Buy Signal for Cardano (ADA)? The chart shows everything

After a nearly 20% drop in price, the sentiment around Cardano (ADA) has started to shift from a downtrend to an uptrend due to a bullish price action pattern. From July 2024, whenever the price of ADA drops to its current level, it will face buying pressure, resulting in an inverted rally.

ADA's absolute purchase level

According to ADA's daily chart, this is the fourth time in the last four months that the price has reached this support level, which we can consider a buy level.

ADA is currently trading at around $0.333, registering a 2.25% price drop in the last 24 hours. During the same period, the transaction volume rose by 26 percent, reflecting strong participation from traders and investors.

ADA technical analysis and upcoming standards

According to expert technical analysis, ADA looks bullish and is currently at a strong support level of $0.31. This level has been highly supportive for ADA since July 2024. However, it has been observed that when the property reaches this level, it will show a price increase of more than 20%.

Based on the recent price action, there is a strong possibility that ADA will experience a significant price increase of over 20% to reach the $0.40 level in the coming days.

Despite this pessimistic view, the ADA daily chart has also formed a descending triangle pattern. If ADA rises by 20% at this point, this pattern will be broken, and we may witness a significant reversal rally at the $0.45 level.

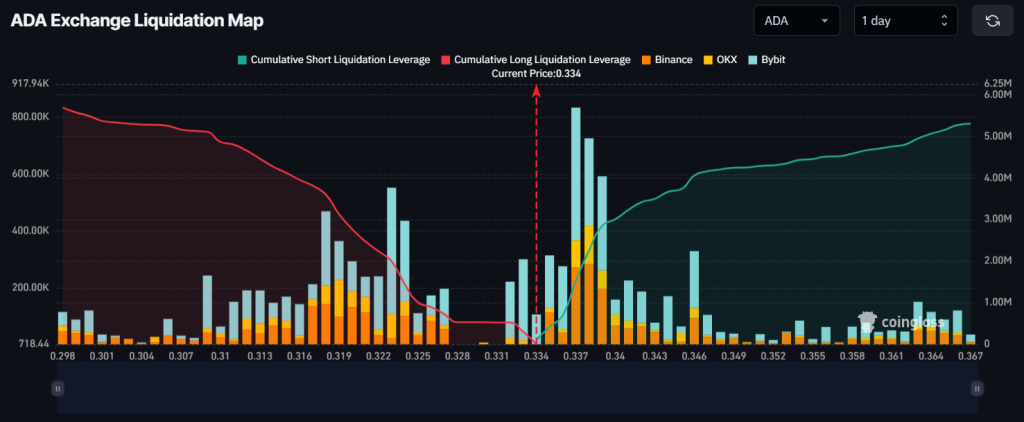

Main fluid levels

Currently, the main liquidity levels are at $0.323 on the lower side and $0.337 on the upper side, traders are overextended at these levels, according to the chain analysis company Coinlas.

If sentiment prevails and the price rises to $0.337, about $1.53 million worth of short positions will be lost. On the contrary, if the sentiment changes and the price drops to the $0.323 level, about $1.99 million long positions will be liquidated.

Combining the liquidity data with technical analysis, bulls currently appear to be dominating the asset, suggesting a potential rally and buying opportunity.