By April 2024, the Bitcoin Hash Rate will fall by 20%, JPMorgan suggests

JPMorgan released a report predicting a 20% drop in the Bitcoin Network Hash Rate following the Bitcoin halving in April 2024.

“We estimate that 80 EH/s (or 20% of the network hashrate) could be removed in the next half (April 24) as less useful hardware is retired,” the report said.

An expected significant drop in Bitcoin's hash rate

According to the research report, the Bitcoin mining industry is in a “critical period” until the Bitcoin halving in April 2024.

The Bitcoin halving happens every four years, which involves the halving of Bitcoin miners' rewards. It aims to tackle inflation and the fourth halving will be in April 2024.

Subsequently, the four-year block award opportunity will reach approximately $20 billion. This forecast is based on the current price of Bitcoin. However, he emphasizes that it is down about 72 percent from two years ago:

“For context, this figure reached about $73 billion on April 21, and fluctuated between $14 billion and $25 billion last year.”

At the time of publication, the value of Bitcoin is $26,778.

JPMorgan lists several Bitcoin mining firms but named Bitcoin mining firm CleanSpark as its top pick.

“Our top pick, we believe CLSK offers the best balance, growth potential, energy costs and relative value.”

However, despite the investment firm Marathon Digital being the largest operator, it has the highest energy costs and lowest margins.

Bitcoin mining estimates before the decline

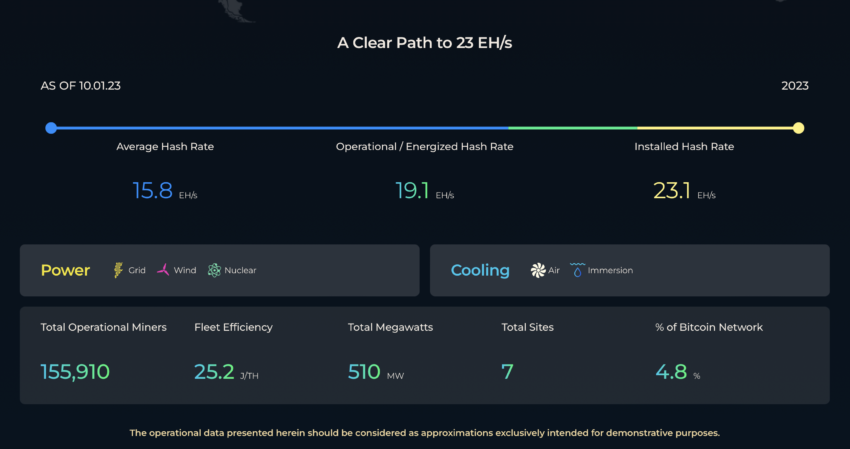

Marathon Digital provides a summary of operations on its website, noting that the figures are rough estimates. However, the company claims that it currently has around 155,910 miners worldwide.

Meanwhile, Riot Platforms believes it has fairly low energy costs and liquidity.

Conversely, BeInCrypto recently reported that four-year cycles may not correlate with Bitcoin halvings as commonly assumed.

Referring to a recent online comment, ‘Pleditor', a Bitcoin enthusiast, questions the widespread speculation.

“Bitcoin's four-year cycles are also random and have nothing to do with halvings.”

Nevertheless, the upcoming halving has created excitement among Bitcoin mining companies.

In the year On August 16, BeenCrypto reported that Bitcoin infrastructure company Blockstream is acquiring Bitcoin miners with the expectation that the assets will appreciate in value after April 2024.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content.