Can Ethereum (ETH) defy 82% odds to reach ATH?

The chances of Ethereum (ETH) reaching a new all-time high (ATH) in 2024 have been speculated on Polymarket for some time. Most traders who invest their money in the world's largest prediction market feel that their chances are low.

ETH price is $2,549 at press time, which represents a 17.75% decline over the past 30 days. This on-chain analysis examines whether bets on altcoins are worth it.

The odds are heavily stacked against Ethereum.

According to data from Polymarket, 3% of traders believe that the price of ETH will reach ATH before the end of this third quarter.

However, 18%, with bets worth $201,429, suggest that the cryptocurrency will peak between October and December 2024.

Finally, traders placed an astonishing $477,498 in bets that Ethereum would be worth less than ATH by the end of the year. This group represents 81% of traders who put their money where their mouth is.

Read more: How to invest in Ethereum ETFs?

A few months ago, market participants were confident that the price of ETH would trade higher than its peak in 2021. One reason may be the feeling that the cryptocurrency will follow in the footsteps of Bitcoin (BTC) post-ETF validation.

However, that was not the case. For example, when BTC ran to a new ATH in March, US investors hoarded a ton of the coin despite the massive institutional outflows.

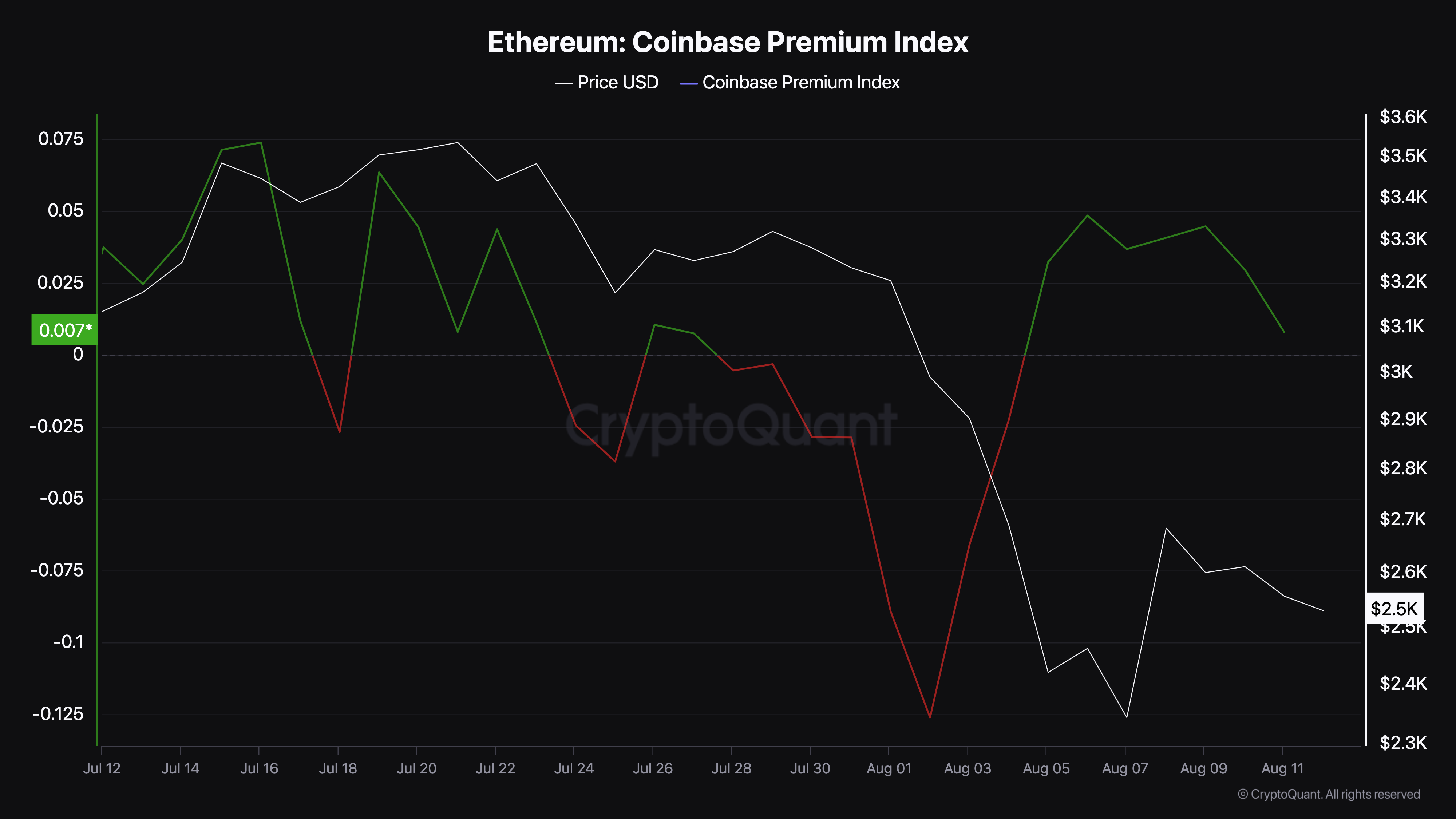

According to CryptoQuant, the Coinbase Premium Index increased between August 3rd and 6th.

Lower values indicate otherwise. As of this writing, the Coinbase Premium Index has declined from that height. This indicates that buying power on the exchange is not close to the maximum level.

In addition, Solana (SOL) price hitting a new ATH on ETH may be linked to bets. If it continues, this could hurt the price of ETH and its chances of reaching an all-time high in 2024.

ETH price prediction: $5,000 is possible, but not in 2024.

In addition to the possibility of altcoin reaching a new ATH, investors want to know if the crypto has reached the end of the cycle. To assess this possibility, BeInCrypto examines the Pi Cycle Top Indicator.

This indicator uses the relationship between the 111-day moving average (green) and the 365-day moving average (purple) to determine whether the price has reached a market high. Historically, when the long EMA crosses above the short EMA, the price is near the top.

As you can see below, the crossing happened around September. In November, the price of Ethereum reached $4,891 and soon began to turn downwards.

At the time of the press conference, the crossover did not occur, indicating that the price of ETH may increase before the top of the cycle. From the looks of things, the price of the cryptocurrency may not reach $8,000 or $10,000 as predicted by some corners.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Based on this indicator, Ethereum can reach a high of $5,367 in the next 350 days. On a shorter 111-day time frame, ETH price could rise to $3,295. If the price stays at this level, Ethereum may not surpass its previous all-time high in 2024.

However, the cryptocurrency market is very dynamic, and conditions can change quickly. Increased investor interest and buying pressure could devalue this forecast, increasing the possibility of ETH reaching new highs.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.