Can Ethereum Price Break $3,300? Here’s what should happen

For the first time since September 27, Ethereum has crossed the $2,700 mark and is showing strong signs of maintaining its upward momentum. Ten days ago, ETH dropped below $2,400, sparking speculation that the cryptocurrency may struggle to break even again.

However, over the past seven days, ETH has crossed key resistance levels. In this on-chain analysis, BeCrypto shows how this upward momentum can drive its value higher.

Ethereum sees reduced selling pressure

One indicator that fuels this forecast is the Ethereum exchange Net Flow, which shows the amount of coins moving in and out. According to CryptoQuant, market participants have taken the exchange of 29,378 ETH as of this writing.

In terms of spot trading, higher values typically indicate increased selling pressure. However, with nearly $80 million removed, it suggests that ETH may not face significant selling pressure in the near term.

On the derivatives side, the decline points to lower volatility, indicating that traders with open positions are less likely to be exposed to liquidity. Taken together, this current situation could be significant for the price of Ethereum.

Read more: Ethereum ETF explained: what it is and how it works

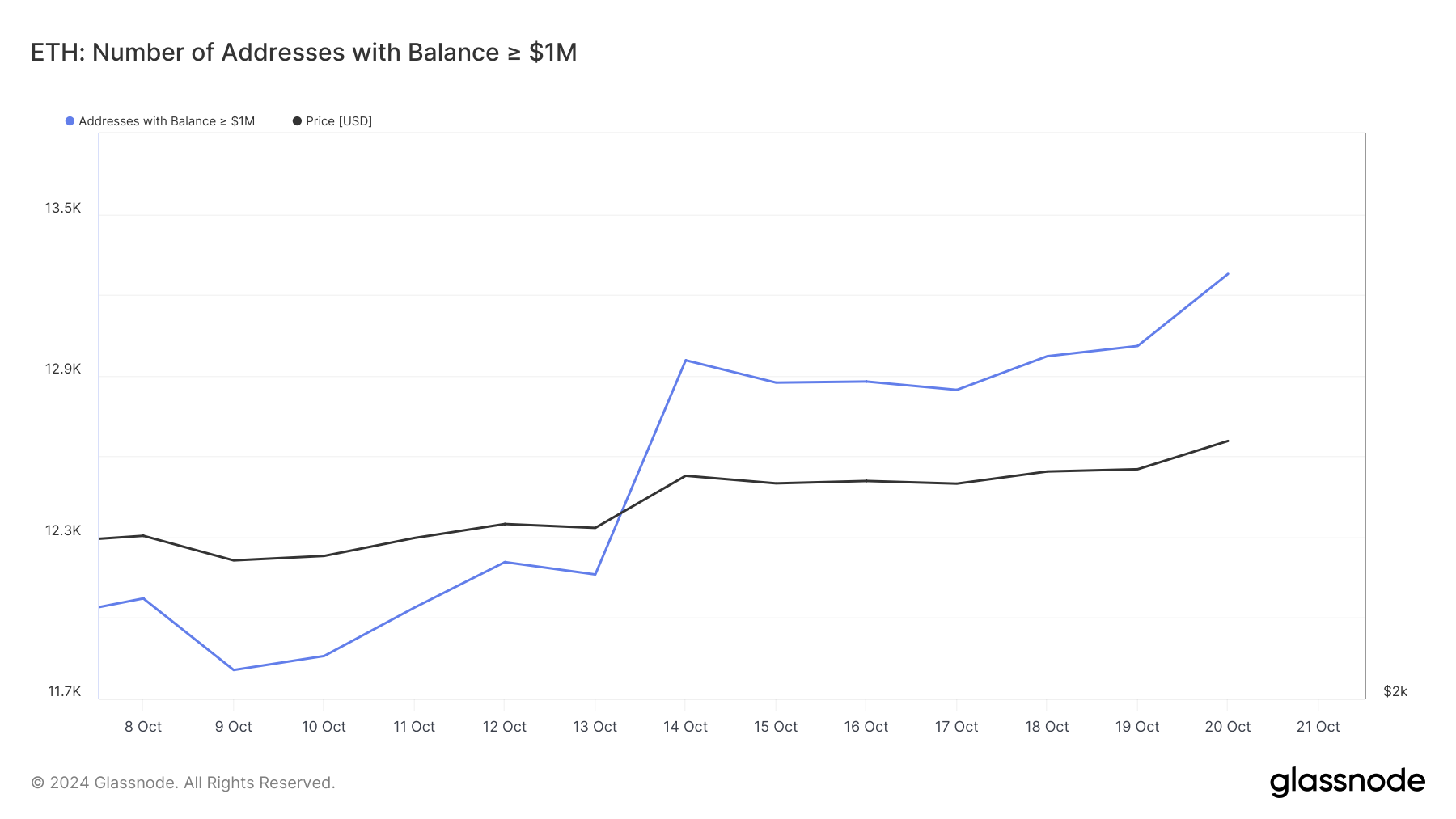

Another metric that supports the bullish view is the number of addresses holding $1 million or more worth of ETH. When this metric is raised, it indicates that HODLers are hoarding more coins, reflecting bullish behavior. On the contrary, the decline shows that long-term holders are cashing out, particularly bearish sentiment.

Based on Glassnode data, the number of addresses holding ETH worth $1 million and above has increased, suggesting that the price of Ethereum will not go into another decline.

Michael van de Pop, a crypto analyst and founder of MN Consultancy, shares a similar view. However, Van de Popp noted in the post that ETH has a chance to rise above $2,770 and above $3,000.

“Ethereum may finally be flipped. It is very good to break the critical resistance at $2,770. If that happens, the next target is $3,200, the analyst emphasized.

ETH Price Prediction: Bulls should defend $2,689 support

Looking at the daily chart, it shows that the price of Ethereum has broken out of the balanced triangle. For context, a symmetrical triangle is a chart pattern defined by two converging trends that connect successive peaks and troughs.

Usually, when the price of the asset breaks below the triangle, the value of the asset declines further. For ETH, it is the other way around, suggesting that the value may continue to rise. But for this to happen, the bulls need to defend the $2.689 support

Beyond that, buying pressure needs to increase so that the price can rise above the $2,989 resistance. If that is the case, the price of ETH may rise to $3,316.

Read more: How to buy Ethereum (ETH) and everything you need to know

However, this thesis may be null and void if ETH falls below the mentioned support line. In that case, the price could drop to $2,471.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.