Can Injectable (INJ) Price Breakout Succeed Before Crossing $30?

Injectable (INJ) prices have seen strong growth, but this may not be sustainable due to growing investor uncertainty.

The increasing selling pressure is reflected in the actions of INJ owners, which reduces the chances of recovery.

Injectable holders are moving their holdings.

The price of injection is putting a lot of pressure on the selling volume among investors, which is increasing the flow on the network. Cash flow charting, sitting at two-month lows, is evidence of this.

Chaikin Money Flow (CMF) is a technical analysis indicator that measures the volume-weighted average of accumulation and distribution over a period of time. It helps traders identify the strength of a trend by analyzing the relationship between price movement and trading volume.

An indicator above 0 indicates increasing buying pressure, while a dip below it indicates increasing selling pressure. The INJ is currently witnessing the latter, with the indicator sitting at an April low.

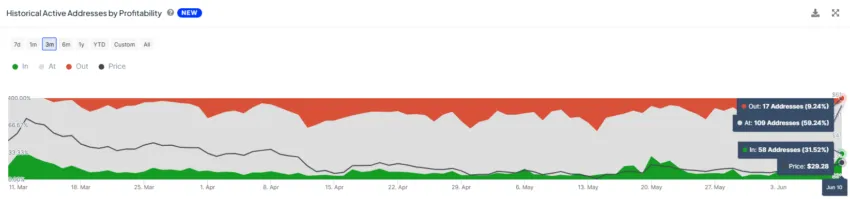

Investors' actions themselves further confirm this flow. When looking at active addresses by profitability, it can be noticed that investors in profit have a high dominance.

The participation of this group hints at the possibility of selling, and their predominance of more than 25% is a sign of sentiment. In the case of INJ, their presence dominates 31% of all active addresses, which makes the case for a bearish result.

Read more: 9 cryptocurrencies that will offer the highest dividend yield in 2024 (APY)

INJ Price Prediction: Breakout May Breakdown

Injector's price, trading at $29.3, is close to the resistance at $30.9, but to breach it, the rally must continue. After the Altcoin recently exited the consolidation between $ 28.0 and $ 21.3, it seems possible.

However, the aforementioned factors suggest a different path for INJ. The gap may fail, and the price of an injection may fall below $28.0, leaving it vulnerable to consolidation.

Read more: Top 9 Web3 projects that are revolutionizing the industry

However, if INJ bounces back from $28.0, where it has already closed above, it could defend the decline. This would allow the altcoin to breach $30.9, undermining the bearish trend.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.