Can Polkadot (DOT) price climb to $12?

Polkadot's price is heavily influenced by the positive interest it has received from institutional investors. The altcoin seems to be heading for a previously failed high.

However, he may face a number of objections along the way, which may overpower the current bullishness.

Polkadot is bigger than Solana and Cardano

Polkadot's price has recovered 12 percent this week, with a portion of that credit going to institutions with retail investors. Their interest in DOT increased in the week ending March 23, so they chose this altcoin over the likes of Solana and Cardano.

Polkadot hit $5 million in revenue, not much but still positive. On the other hand, SOL and ADA both saw spending of $5.6 million and $3.7 million, respectively. This shows that institutions have opted for DOT this week, pushing the price up.

Read More: Polkadot (DOT) Price Prediction 2024/2025/2030

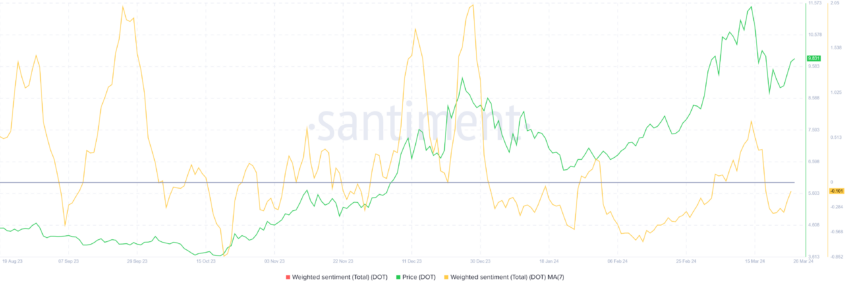

Similarly, retail investors are also showing a return to bullish sentiment following the recovery. This is critical for the price of Polkadot because optimism is the culprit that drives the altcoin up.

DOT Price Forecast: Will Investors See $12 Again?

The breakout signals suggest that the price of Polkadot is definitely on the road to recovery and will continue to rise. Over the past few weeks, the altcoin can be seen forming a rounded bottom pattern. This suggests a potential reversal pattern of 31%, setting the target price at $12.

While the DOT failed to meet this target during the previous bull run, it has one shot at breaking the resistance levels marked at $10 and $11 this time.

Read more: What is Polkadot (DOT)?

This environmental barrier may act as a barrier to Polkadot's rise, and if it fails to breach these resistances, it may fall back to the $9.2 support floor. Missing this level would undermine the bullish thesis, causing it to drop to $8.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.