Can Solana prices return to annual highs?

Solana (SOL) price hit a new annual high of $68.20 on November 16 but has since declined.

The price is now trading slightly below the critical resistance area at $62.50. Will it rise or fall?

Solana closes five consecutive bullish candles.

The price of SOL has been on a strong upward trend since early October. At that time, SOL confirmed its descent and resistance trendline as support (green icon).

SOL rose from the $27 and $50 resistance position during the upward movement. Last week Solana prices hit a new annual high of $68.20. This was the highest price since April 2022.

With RSI as a momentum indicator, traders can determine whether the market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have the advantage if the RSI reading is above 50 and the trend is up, but if the reading is below 50, the opposite is true.

RSI is rising and above 50, both positive signs. While the indicator is overbought, it has not produced any bearish divergence yet. Also, the current value of 80 is much lower than the maximum of 99.

Read more: 9 Best AI Crypto Trading Bots to Maximize Your Profits

What are the analysts saying?

Cryptocurrency analysts at X are positive about the future trend. Blutz Capital uses Elliott Wave Theory to determine if the price will increase quickly.

Technical analysts use the Elliott Wave theory to determine the direction of the trend by studying recurring long-term price patterns and the psychology of investors.

Cryptogodjohn and RectCapital have similar bullish views, though both use horizontal price levels to achieve it. All three traders believe SOL prices will rise to new annual highs.

Read more: 9 Best Crypto Indicator Accounts for Trading

SOL Price Prediction: Reset or Continue?

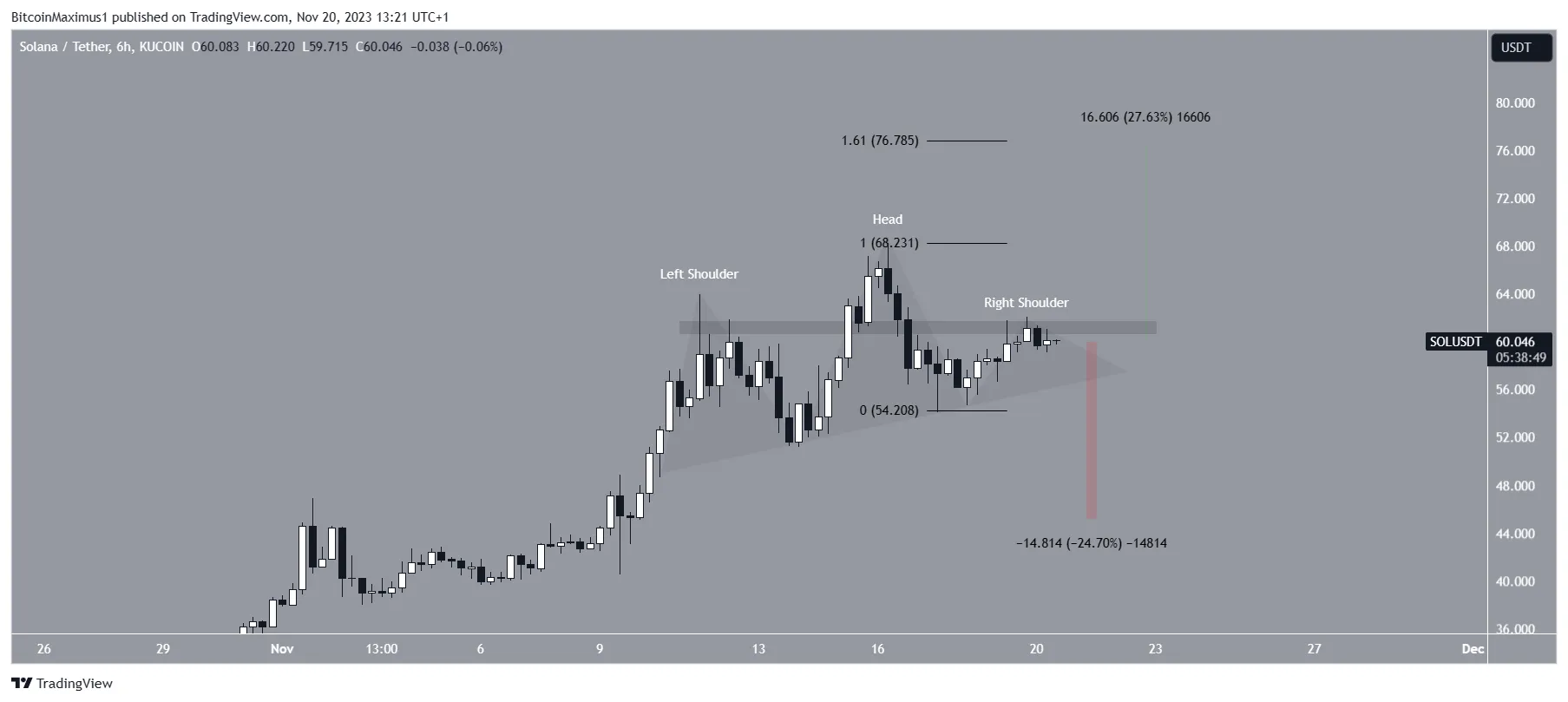

While the weekly time frame is overstated, the six-hour indicates that an initial trend may be forming before the altcoin eventually starts to climb higher.

The reason for this comes from the six hour price action. The price action shows that SOL broke above the $62.50 resistance area before reconfirmation.

The price movement of SOL looks like a Head and Shoulders (H&S) which is considered as a bearish pattern. However, the feasibility of this design has yet to be proven.

Read more: What is Solana (SOL)?

The bearish pattern is confirmed only if the SOL price breaks above the $60 level. A 25% decline is expected to close support at $45.

On the other hand, a retracement of the $62.50 area will devalue the H&S pattern, adding at least 25% to the next resistance at $76.80.

Therefore, the future SOL price forecast depends on the reaction of the $62.50 resistance area. If the price is rejected or reclaimed, the position may be reduced or increased by 25%, depending on whether a rejection or reclaim occurs.

Click here for BeInCrypto's latest crypto market analysis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.