Can Solana (SOL) Price Recover Amid Declining Institutional Interest?

The price of Solana (SOL) continued to rise as the rest of the market fell until the rally came to an abrupt halt this week.

The corrections that occurred in the last two days have had a negative impact on the altcoin, but the reason behind it is more serious.

Is Solana losing institutional favor?

Solana's price has fallen over the past two days, erasing nearly 16% of the altcoin's recent gains. Interestingly, this correction came at the same time as the CoinShares weekly report was released.

According to the report, it can be seen that the interest of institutional investors is at a high level last year. However, most of the inflows were directed to Bitcoin, which indicated $2.89 billion inflows for the week ending March 15.

What they differ is the exit. Ethereum and Solana emerged as the two worst performing assets during the week in question. The former recorded a cost of $13.9 million, while SOL saw $2.7 million leave the property. However, this did not affect Solana's month-to-day flows, which are still the highest among other altcoins, including Ethereum.

With $23.8 million flowing in since the beginning of March, Solana has topped Ethereum by $13 million. This shows that despite the bear week, SOL still supports the institution, which makes the recent correction a false spot.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

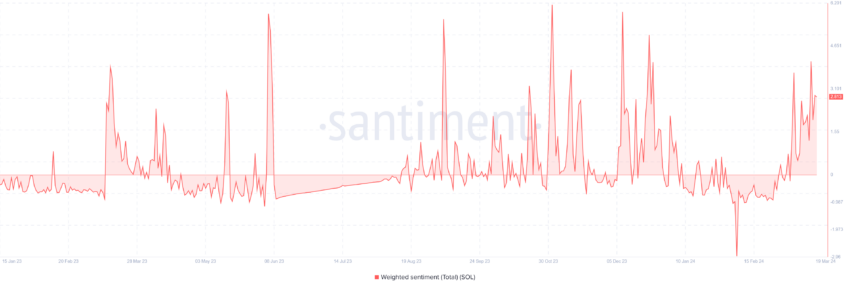

Moreover, the decline in prices did not affect the optimism of the investors. Solana owners are still bullish, the highest since December 2023. This indicates that SOL investors still expect more bullishness.

SOL Price Prediction: This is where Altcoin will end up.

Solana price is already testing the $168 level as support and will not fall through it. This level shows the confluence of the 50-day exponential moving average (EMA), making it a critical support surface.

If the bullishness continues, SOL could pull back to find support at $183, which will recover about half of the corrections recorded in the last 48 hours.

Read More: 13 Best Solana (SOL) Wallets to Consider in March 2024

However, if the critical support floor is lost, it can be reduced to $150. Missing this would invalidate Bullish's thesis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.