Can the price of Ripple (XRP) recover from the recent decline?

The price of Ripple (XRP) has decreased by 11.09% in the last 30 days, and current indicators suggest further caution. The Relative Strength Index (RSI) is at 38.93, indicating a bearish trend but not yet indicating oversold conditions.

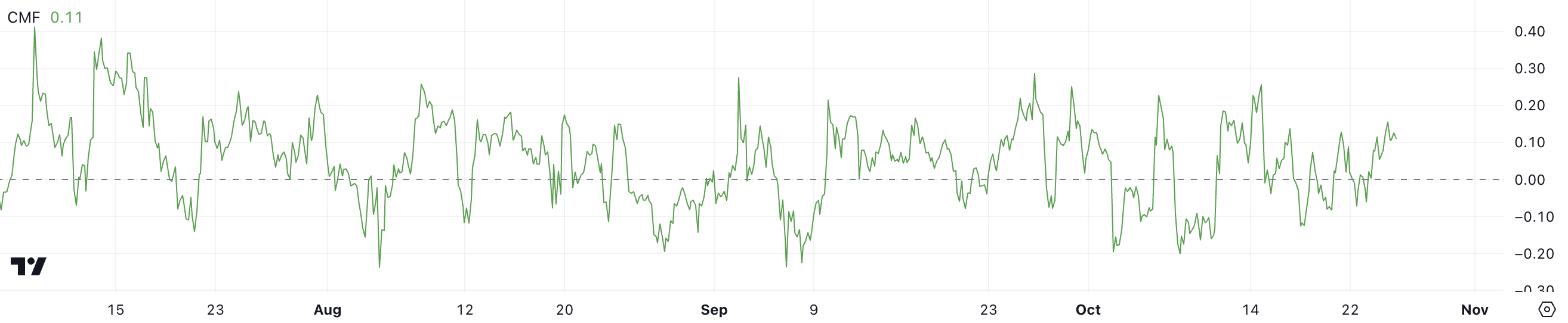

This means that XRP's correction may still have room to continue before finding strong support. Additionally, while the Chaikin Money Flow (CMF) was positive at 0.11, this did not translate into price growth, indicating that confidence in XRP is still weak.

XRP RSI is still far from oversold.

XRP's RSI is currently at 38.93, indicating that the asset is in a downtrend but not yet oversold. Although this level has not yet peaked, it suggests that selling pressure is still present.

The Relative Strength Index (RSI) is a momentum indicator used to measure the speed and volatility of price movements. It ranges from 0 to 100, with values above 70 indicating overbought conditions and values below 30 indicating an asset is oversold.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

With the RSI hovering above the oversold threshold, it suggests that there may be room for further downward movement in XRP price before buyers enter.

Ripple CMF is positive, but this may not be enough.

XRP's Chaikin Money Flow (CMF) is currently at 0.11, indicating some positive buying pressure. However, a positive CMF reading does not always mean the market is bullish. Although in the positive zone, this price alone does not provide enough confidence for a clear uptrend.

Chaikin Money Flow (CMF) is an indicator that measures the buying and selling pressure of an asset, with a difference between -1 and 1. When the CMF is positive, it indicates that buying pressure is greater than selling pressure. In recent months, even when XRP's CMF has turned positive, it hasn't seen a consistent rise in price.

CMF readings have been particularly positive over the past few weeks, but XRP prices have failed to rally. This suggests that holders may still have strong faith in XRP, and a higher CMF value may be needed to trigger a significant price increase.

Ripple Price Prediction: A 23% Correction Possible Soon?

XRP price is currently trading below all EMA lines, suggesting a bearish sentiment. The EMA lines are sliding down, with the short-term EMAs sitting below the long-term, further confirming the downtrend.

This alignment indicates that the selling pressure is dominant, and there is not yet much impetus for a strong upward move.

Read more: XRP ETF explained: what it is and how it works

Key resistance levels are marked at $0.56 and $0.61. For a momentum reversal, XRP needs to break above these resistance zones to regain positive momentum. If XRP wins its legal battle with the SEC, or if its ETF is approved, a breakthrough could be seen.

On the downside, support levels at $0.43 and $0.40 provide a safety net if the price continues to decline. This means that there may be a 23% correction in the price of XRP.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.