Can the Shiba Inu (SHIB) hold the interest of prospective traders?

The Shiba Inu (SHIB) derivatives market has seen a decline in activity over the past few weeks. This is reflected in the open demand for futures, which is at its lowest level since February 14.

This decline is due to the fall in the value of Mem Coin. At the time of writing, SHIB is trading at $0.000014, the price level it reached at the end of March 1.

Shiba Inu traders should avoid betting on the coin's future price movements

According to Coinglass, SHIB's future open interest is $26 million. It has been down consistently since July 19, which is down 51% over the past 16 days.

An asset's futures open interest refers to the total number of outstanding futures contracts. When it declines, it indicates a decrease in market activity and demand for the property. It is generally interpreted as a bearish signal which indicates that traders are losing confidence in the future value of the asset.

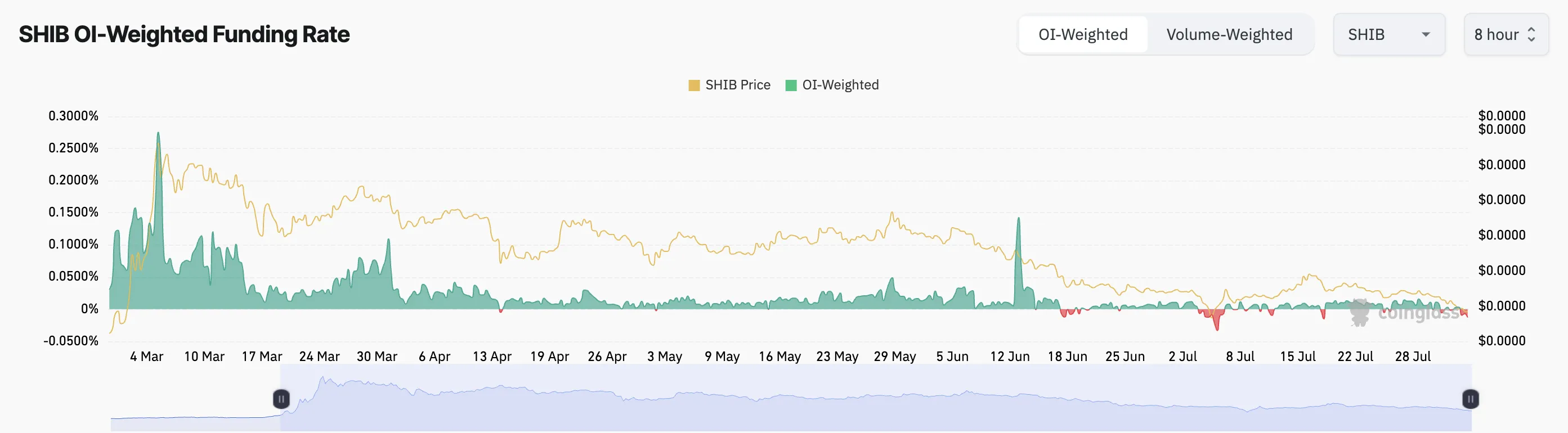

However, SHIB's primarily positive funding on cryptocurrency exchanges suggests that this may not be true for MemCoin.

For context, since hitting a year-to-date high of $0.000035 on March 6, SHIB's price has maintained a downtrend. However, the weighted funding rate has remained predominantly positive since then, highlighting the continued demand for long positions among futures traders.

Read more: Shiba Inu — Beginner's Guide

Cash-out prices are a technique used in perpetual futures contracts to ensure that the contract price of an asset is close to the spot price. When they are positive, it means that more traders are buying the asset and waiting for a price rally than those who are buying and hoping for a fall, which is a bullish sign.

SHIB Price Forecast: Is Recovery Underway?

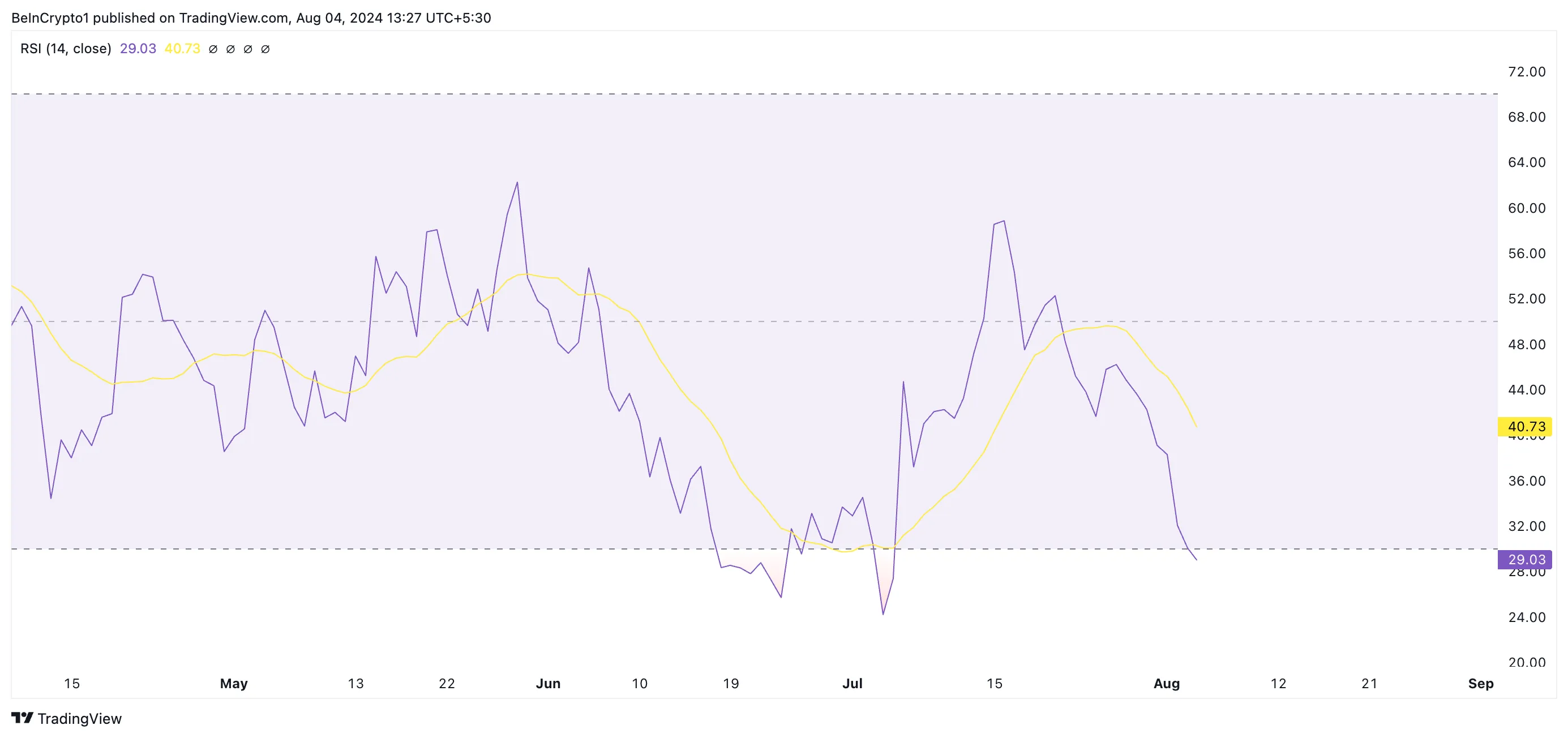

SHIB's Relative Strength Index (RSI), evaluated on a daily chart, suggests a possible price rebound. At press time, the price of the indicator is 29.03.

Asset RSI indicator measures oversold and overbought market conditions. At 29.03, SHIB's RSI suggests that MemCoin may be oversold and an upward correction is likely.

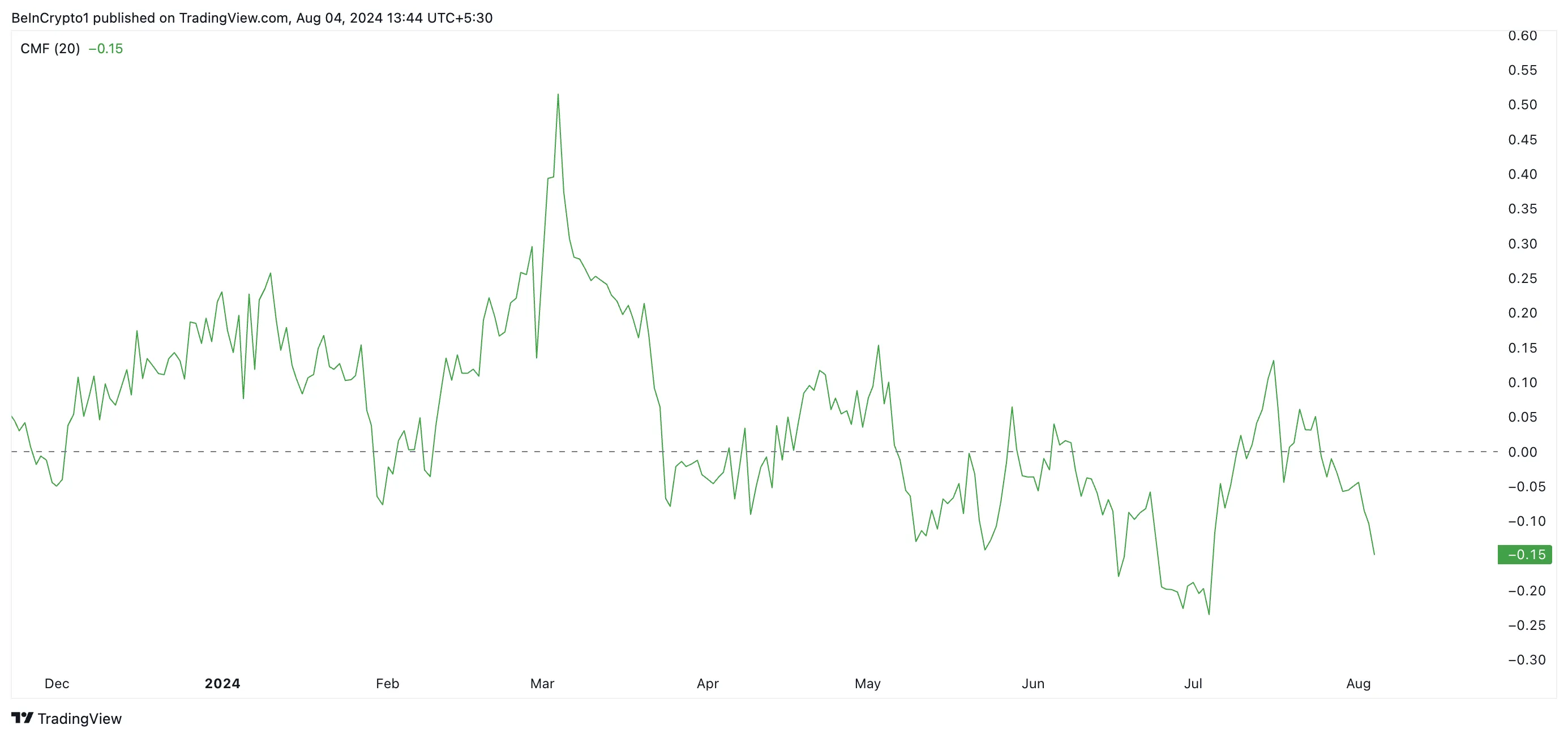

However, readings from other indicators suggest that a rebound may not be in the offing. For example, SHIB's price drop has come along with the decline of Chaikin Money Flow (CMF). At the time of publication, SHIB's CMF is at -0.15 below zero and in a downward trend.

This indicator tracks the flow of money into and out of the asset. A CMF value below zero is a sign of market weakness.

A falling price coupled with a low and negative CMF indicates a strong bearish trend. A falling CMF indicates that more money is flowing out of the asset, reinforcing the bearish trend and making it clear that selling pressure is outweighing buying pressure.

If this trend continues, SHIB price will drop to $0.000012. It was last sold at this price level on July 5th.

Read More: 12 Best Shiba Inu (SHIB) Wallets in 2024

However, if the market trend changes And instead of it, a lot of liquid will start flowing into the SHIB, it can witness a rally; Pushing the price to $0.000020.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.