Can this metric stop Ethereum’s (ETH) all-time high?

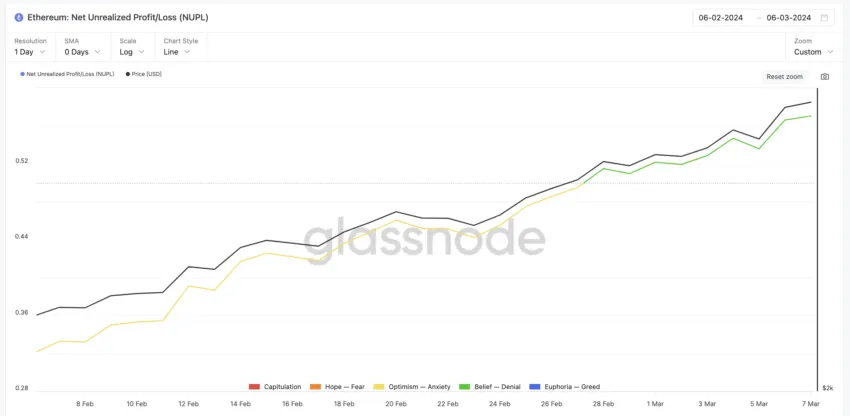

A recent shift in ETH Net Unrealized Profit/Loss (NUPL) into the ‘Belief — Denial' zone shows a critical point. Ethereum's current position at this delicate threshold suggests that while confidence in its long-term value remains strong, there is caution that could lead to market volatility.

Dive into the full analysis to delve deeper into these factors and get a systematic examination of Ethereum's possible future paths.

ETH is the clear winner among the top 10.

In an analysis that focuses on the year-to-date (YTD) growth of the 10 leading cryptocurrencies, excluding stablecoins and memecoins, ETH has shown impressive growth, rising by 67.22% this year. This growth rate allowed it to surpass all of its key competitors, including Bitcoin (BTC), Binance Coin (BNB), Solana (SOL), and Chainlink (LINK).

At the beginning of the year, ETH was valued at $2,352. Since then, it has seen a significant increase, reaching a recent price of $3,946. Despite this impressive growth, ETH's current price remains 18.39% below its all-time high (ATH) of $4,849.03. However, there is a strong possibility that ETH may retest ATH in the near future. This optimism is due in part to Bitcoin (BTC) recently hitting record highs.

However, there is a possibility that the cryptocurrency market may experience some consolidation in the short term. This potential development could happen as investors may decide to liquidate some of their holdings in ETH, which is currently 79% profitable.

Read more: What is the Ethereum Cancun-Deneb (Dencun) update?

The motivation behind such a move could be to expand investments into other cryptocurrencies that have high growth potential, including memecoins.

NUPL will change the status of the indicator

The ETH Net Unrealized Profit/Loss (NUPL) scale has recently moved from the ‘Optimist – Worry' category to the ‘Confidence – Denial' phase. This transition indicates that the majority of holders are now viewing their holdings in a viable light, which strengthens their trust and confidence in ETH. This phenomenon is generally interpreted as a hallmark of a bull market, characterized by investors making investments without closing into an irrational exuberance zone.

The Net Unrealized Gain/Loss (NUPL) metric represents the difference between the relative unrealized gain and relative unrealized loss across all chain addresses. Basically, it shows whether the network as a whole is currently in profit or loss.

However, if the NUPL falls into the ‘Euphoria – Greed' range, it usually indicates that the market is greedy, where most investors are taking profits. Historically, this has often been an indicator of a market high. This can lead to a market correction as more investors decide to take profits.

IOMAP data shows strong support and resistance levels

Ethereum (ETH) is currently benefiting from strong support levels characterized by two key price points: $3,830 and $3,710. These levels act as a critical buffer for cryptocurrency. However, if ETH fails to maintain these support levels, it has the potential to further decline in price. Specifically, it could drop to $3,591. This situation indicates a significant decrease in the market value of ETH.

On the contrary, the asset currently shows a high level of resistance, especially at the price of $ 3,949 and $ 4,064. However, if it manages to break through these resistance levels, there is a chance that the value could go higher, possibly as high as $4,500.

This price point is particularly close to the all-time high (ATH). The optimistic sentiment in the broader market could be affected by such an upward trend. With BTC making new highs recently along with other cryptocurrencies, ETH seems poised to emerge as one of the most valuable beneficiaries of this current market cycle.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

The current indicators show that there may be consolidation in the short term, but the general market trends, such as Ethereum ETH ETH, ETH may reach $ 4,500 and may test a new high in the near future.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action taken by the reader on the information found on our website is at their own risk.