Can Zcash (ZEC) Proposed Stake Proof Fuel Drive More Profits?

The price of Zcash (ZEC) rebounded last week, hitting a new high on Monday before pulling back recently. On the said date, Privacy Coin reached $45.45.

This price marks not only ZEC's highest level this year, but also its highest level since March 2023.

Zcash plans to confirm stock movement, reduce supply

Zcash (ZEC) is up nearly 45% over the past 30 days, making it one of the top performing altcoins in early August. On July 15, ZEC traded at $28.54, but has since seen significant growth.

According to BeCrypto, this increase is not driven solely by buying pressure or general market demand. The key reason behind the increase is speculation surrounding Zcash's transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). ZEC was traditionally based on a PoW algorithm similar to Bitcoin (BTC).

However, on August 10, project founder Zoko Wilcox hinted at a move to PoS. Wilcox notes that the creation of new ZEC through PoW has contributed to price pressures over the years, a recent trend that is starting to change.

Wilcox, in a statement via Medium, stated that the move to PoS will reduce the pressure on ZEC's value by planning to reduce the creation of new coins. Explaining how PoS can positively impact the value of cryptocurrency, the founder shared this:

“It allows people to hold shares of ZEC, thereby increasing the demand for ZEC. By locking up ZEC held in shares, it reduces the supply of ZEC.”

Backing up the founder's concerns about increased supply, data from Masari shows that Zikash's new production has reached up to 157,000 coins. On July 1, this figure was below 70,000, indicating a significant increase in the circulation of coins.

Read more: How to buy the first Zcash

It should be noted that the transition to proof-of-stake will only be partial if implemented. Once completed, a portion of ZEC's supply will be dumped, reducing new production and putting significant pressure on prices.

ZEC Price Prediction: Another Peak Is Near.

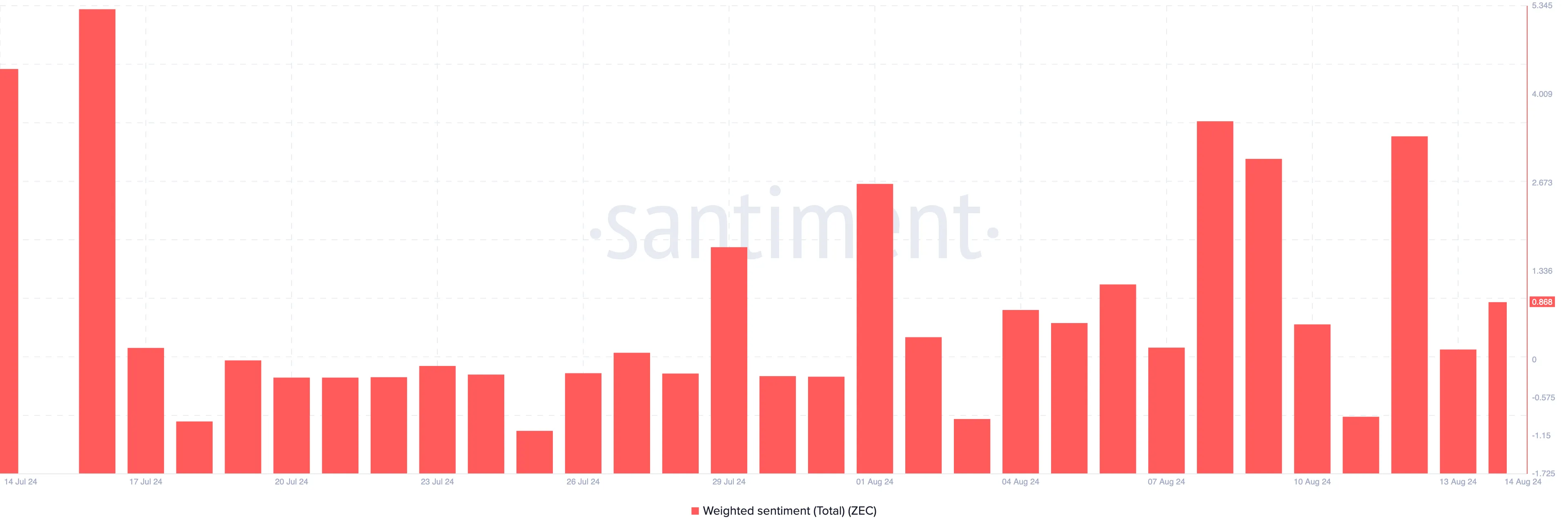

From a chain perspective, Sentiment data shows that sentiment around ZEC has increased. This scale uses social dimension to measure awareness around a project in the market.

If the heaviness reading is positive, most comments are positive. However, a negative rating indicates that most of the conversation is tilted toward the bearish end. For ZEC, the reading first fell on August 13.

However, at the time of the press conference, it has improved, suggesting that market participants are confident in Zcash's short-term price performance. If this continues, the demand for ZEC is likely to increase as well as its value.

On the technical side, the daily chart shows that ZEC price is forming a lower high (LH) since July. This pattern shows strong support as the price rises.

Additionally, the Exponential Moving Average (EMA) provides additional insight into the ZEC trend. EMA is a technical indicator used to measure trend direction. When the short EMA is placed above the long EMA, it indicates a bullish trend, while the opposite indicates a bearish trend.

On July 14, the 20-day EMA (blue) crossed above the 50-day EMA (yellow), forming a golden cross. This pattern often confirms a bullish outlook, reinforcing ZEC's upward momentum.

Read More: Zcash (ZEC) Price Prediction 2024/2025/2030

The short EMA continues to move above the long term, indicating potential for further gains. If this trend continues, the price of ZEC may reach $46 in a short period of time.

However, a bearish crossover could derail this view. If profit taking intensifies, ZEC price may drop to $36.74.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.