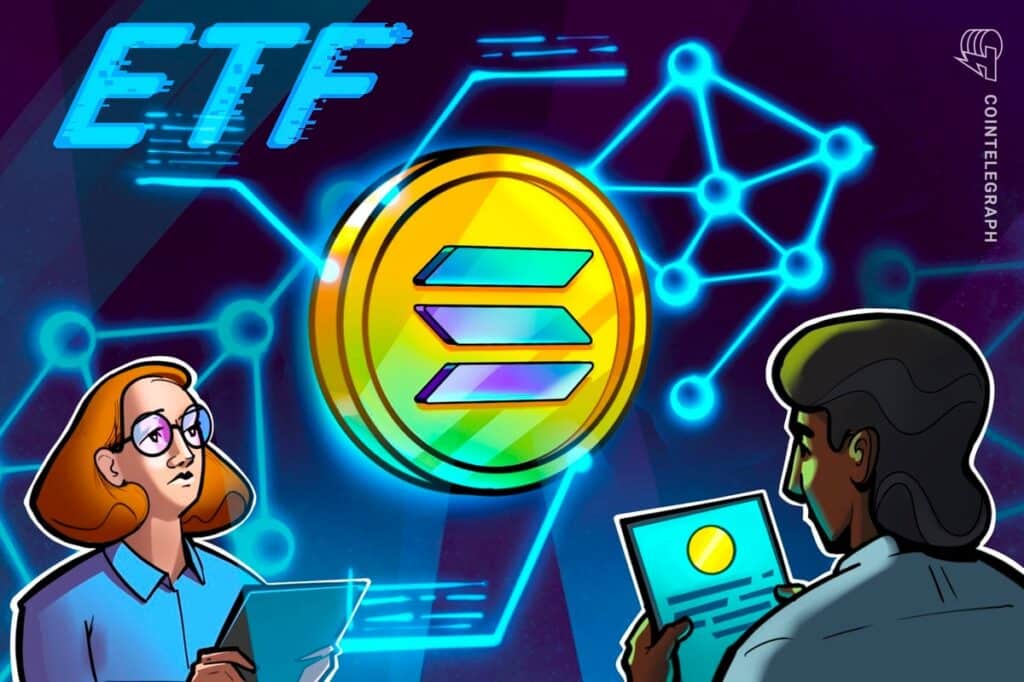

Canary Capital files for Space Solana ETF with the SEC

Crypto asset manager Canary Capital has filed with the US securities regulator for a Solana exchange-traded fund (ETF) – led by VanEck and 21Shares.

The Spot Solana (SOL) ETF tracks the price of SOL through the Chicago Mercantile Exchange CF Solana index — a real-time price reference product, Canary explained in an S-1 filing filed Oct. 30.

Canary's proposed position Solana ETF allows investors to access the Solana market through a conventional brokerage account without the barriers to entry and risks associated with holding SOL directly.

Solana is considered the next cryptocurrency to have an SEC-approved spot ETF, following Bitcoin (BTC) and Ether (ETH) in January and July.

Canary Place Solana ETF's filing with the Securities and Exchange Commission. Source: SEC

Asset managers VanEck and 21Shares were the other two asset managers that filed for the US spot SOL ETF on June 27 and 28.

The Spot SOL ETF is also on Franklin Templeton's radar.

Canary did not say who would be the custodian of the spot SOL ETF, nor did it say what symbol the fund would be listed on.

The firm's latest filing comes after Canary Capital filed S-1s for the spot XRP ETF on Oct. 8 and a week later for the Litecoin ETF on Oct. 15.

Related: Bitcoin ETF Security Threats Rise After FBI Warns About North Korean Hackers

Solana's price rose slightly on the news, but still fell 2.3% to $174.6 on the final day, according to CoinGecko data.

In a post on October 29th, Canary stated that Solana strongly excluded both Ethereum and Binance Chain in terms of active address market share even when accounting for Solana's Layer 2 chains.

Canary was founded by former Steven McClurg, one of the founders of Valkyrie Fund and one of the managing directors of Mike Novogratz's Galaxy Digital.

“Focusing on risk management and adaptability, strategic foresight, we founded Canary to lead actively managed and passive crypto-related offerings for the next iteration,” the company said after launching the Canary HBAR Trust on October 1 – the first trust offering.

Magazine: Bitcoin ETFs make Coinbase a ‘honeypot' for hackers and governments: Trezor CEO