Canned assets can be created to a quarter of portfolios until 2030

The first markets of personal markets are visible as the first markets of institutional investments at the end of decades at the end of decades.

The By 2030 1030 Institutions of Institutions 1030 to 24% of State Street Studies were published.

Privacy and private permanent income are viewed as first candidates for the great shocking. These markets are banned with a long time by targeting the main targets to increase and open the liquid.

The investment of investment cancelers are amazing.

Since that certificate, manifestation and numeric intensity, are not relieved for the future of financial speed.

Digital Properts average 7% of portfoliots, it will be placed more than double in three years

It also shows that research shows, many investors have more impact on the operations.

More than half of the technologies that more than half of the junk communications do not view technology that work in Tandem.

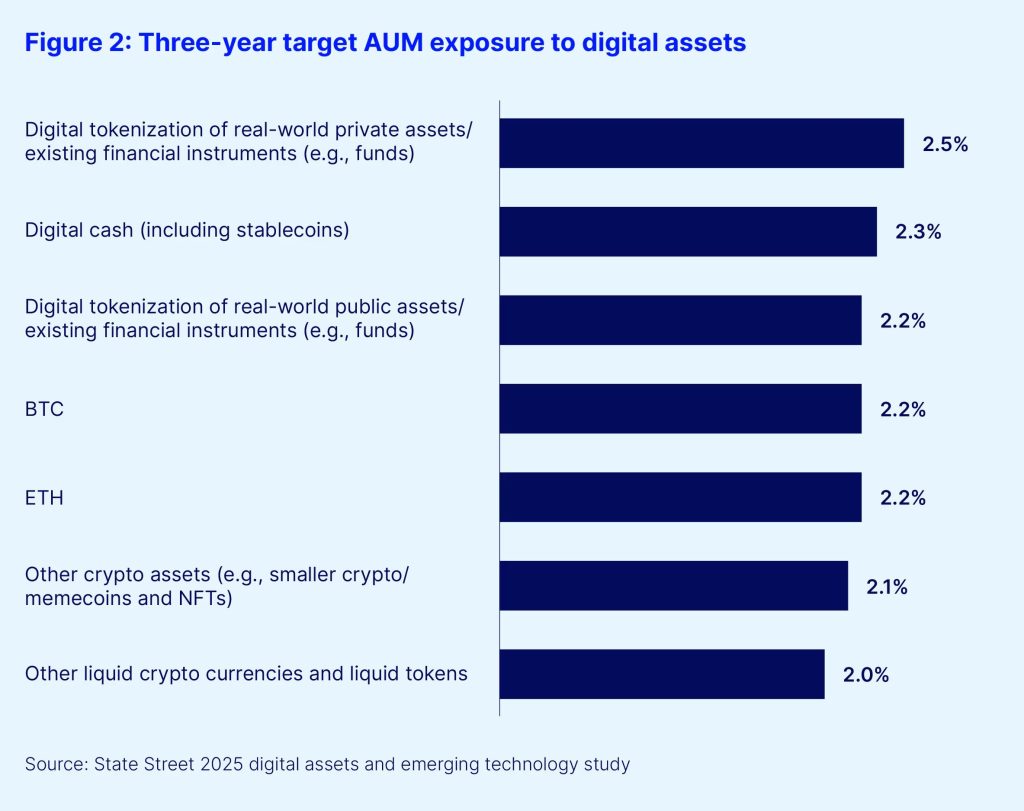

Institutional portfolios contain 7% of the average digital property in digital property, according to the study. This image is expected to increase about 16% within three years. The most common forms are digital money that are configured with permanent earnings listed. On average respondents will contain 1% portfolios in these categories.

Property Managers owners of owners of owners

Property managers have reported high vulnerability from property owners almost every some category. About 2% of the property owners of property owners, 2% of the portfolios, 2% of portfolios catch portfolios. Small administrators admitted that at least 5% in the elemental coin or NFAs that indicate the appearance of a dangerous disaster.

The property of true-world assets is another area where the managers travel. They have reported more vulnerability to recovering public property, provide more personal resources and digital money than property owners.

Still, they are the largest return places in digital portfoliots.

27% of respondents said Brichon is very strong today. A quarter expects the highest performance in three years.

Meanwhile, Eigurative elements were held. 21% of the greatest return generation is now 22% of the time.

On the contrary, 13% of public property is most of the digital returns. Only 10% of personal resources is specified. These figures are often protected in the next three years.

Street Street Modification of State will grow in confidence

State of State, as the state of state indicates that private properties may be first beneficiaries. This period of time can improve the infrastructure and investors of confidence.

Also protect institutions in the decline in the ethnical element of the ten years. This shifter will grow up of the configuration of the configuration rather than scanoral.

The discoveries include weight for the surprise scale of union markets. The owners of the owners of Real Estate and Personal Credit You can expand settlements, cutting outgoing costs, previously investments that are included in private markets.

Pre-guessing pre-assumptions of closing news news