Canned assets can be hit by $ 2033

For the last time you arrived: April 7, 2025 14:39 H.

Why the keys

Key Controls

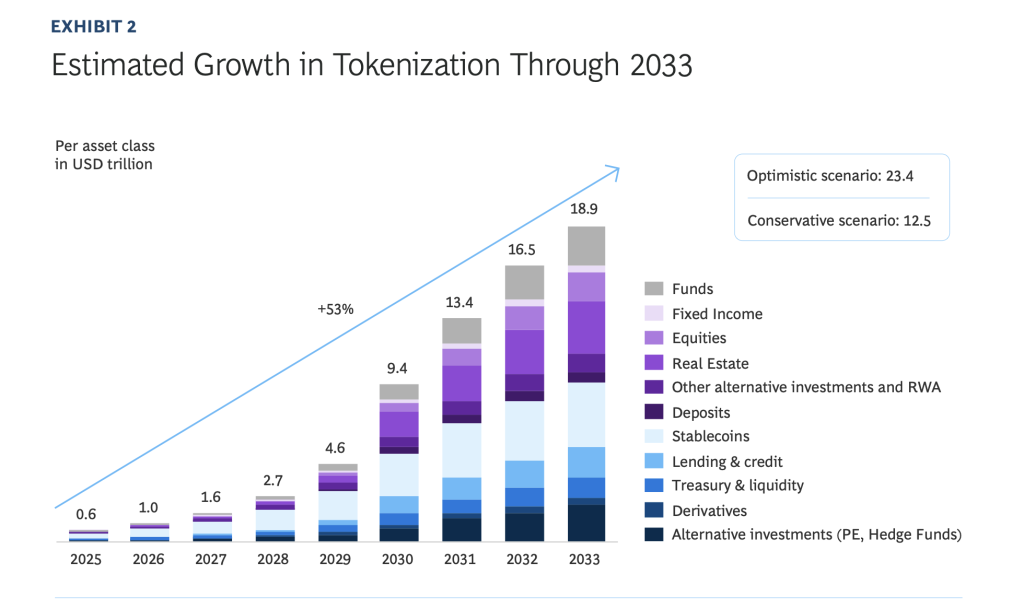

Combined properties of real-life properties recognize that $ 0.6 trillion dollars about 18.9 trillion dollars.

The report was one cooperation between Ripple and Boston consultation team (BCG).

This skirt shows the basic change of international cash infrastructure.

Being progressive transparency, adult technology and institutional speed.

The Ripperier reported on April 7, the Ripperier reported has been cut out of $ 0.6 trillion for $ 183, 170 trillion to 183 trillion.

This growth shows 53% annual growth rate and the financial resources are a new time not to work in color digital instruments, not the variable and programs that move on genital mutilation.

The report held in cooperation with Burenon Advisory Team (BCC) lists the three-level evolution of the three-level evaluation.

The financial industry is experiencing low vulnerability, and the institutional institution stirred known financial equipment such as money market and bonds.

The second chapter of the technology is expected to see more complex property, including personal credit and real estate, including personal credit and real estate.

The popular technology will complete the transfer transformation of the transformation of the technology and non-financial products. This pressure is underway through step transparency, technology infrastructure and institutional investments.

In Blockrock, Loyalty and Japanese Production

Key players in the financial sector have already drawn this shift. Major institutions such as Blackrock, Loyalty, and Jipamgan began to make a modified improvement.

Tibor Meree, director of the manufacturing and program officials, the organizations of the individuals, and the professional authorities and program authorities and program authorities, the owners of the individuals, the owners of the individuals, the owners of the individual's property, ownership of the individuals, the owners of the individuals, the owners of the individuals, the owners of the individuals, the owners of the individuals, the owners of the individuals, the owners of the individuals, the ownership of the individuals, the owners of the individuals, the owners of the individuals, the owners of the individuals, the owners of the individuals, the owners of the individuals, the owners of the individual

Contraction transparency is crucial to the European Union, the EU, in many Arab Emilies and Switzerland, is crucial.

Similar progress is protected by fitting institutional speed in the United Nations.

With the growth of contact, the sophisticated stone layer of stones, and in front of strategic investments and strategic investments and strategic investments, strategic investments are creating a “result of equitable.”

This result of installation of institutional offerings and investment is a confidence cycle.

Marcus Information, the Ripplex President of the Ripplex President is read in Bockeinin to fully integrate the Greek economy.

This combinations for streaming processes, reliability and open new income streams.

Construction of certificates and the owner of the owner of the inquirement of the intersection of the owners of the ownership of the international capital markets are expected to destroy an international capital markets access.

But the trip is not a challenge without it. The centered cancel and control of control

However, industrial stakeholders are collecting these obstacles in common standards and infrastructure to overcome these obstacles.

Popularity no longer an approximate concept

Berhartery Caroffinner, Hagar, Notes, Advertisements No more in BCG, notes, advertisements no more, the cornerstone stone about international financial support.

It makes clear that the RIPPER report institutions will be completely free of full operations.

Pre-guessing pre-assumptions of closing news news