Cardano (ADA) price could drop 10%, here’s why.

Amidst this bearish market sentiment, most cryptocurrencies including Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) are experiencing heavy selling pressure. Amidst this market downturn, Cardano (ADA) also looks weak and may face a significant price drop despite millions of tokens being hoarded by whales.

Cardano Whales added 170 million ADA tokens.

According to on-chain analyst firm Sentiment, Cardano Whales with more than 100 million ADA tokens have added more than 170 million tokens between August 27 and August 30, 2024. This huge stockpile before Cardano's much-anticipated Chang hard fork update was initially considered bullish. Attitudes toward the ADA.

Cardano price prediction

However, due to bearish market sentiment on August 30, 2024, ADA experienced a critical break in the uptrend. Since August 5, 2024, the ADA has taken multiple supports for this trend line, and has seen an inverted rally each time. Following this latest crash, there is a high possibility that it could fall by 10% to the $0.305 level.

Currently, ADA is trading below the 200 Exponential Moving Average (EMA) on a daily time frame. However, the Relative Strength Index (RSI) indicates a possible price reversal in the oversold position.

ADA's key liquid standards

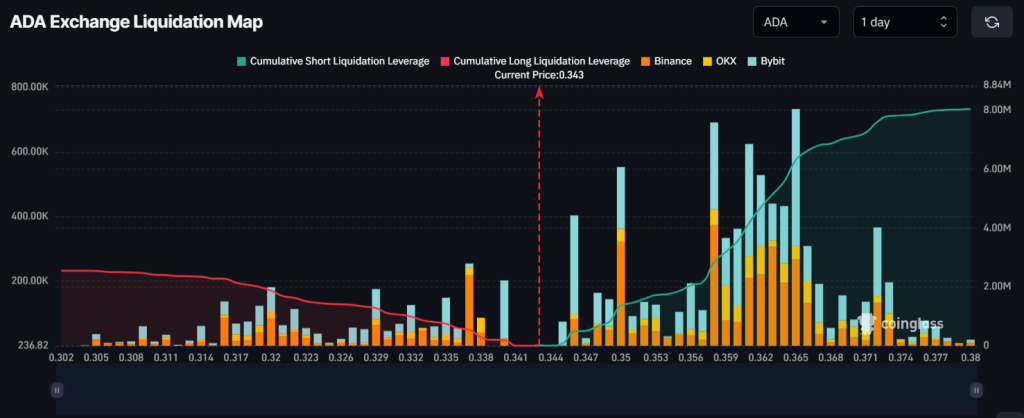

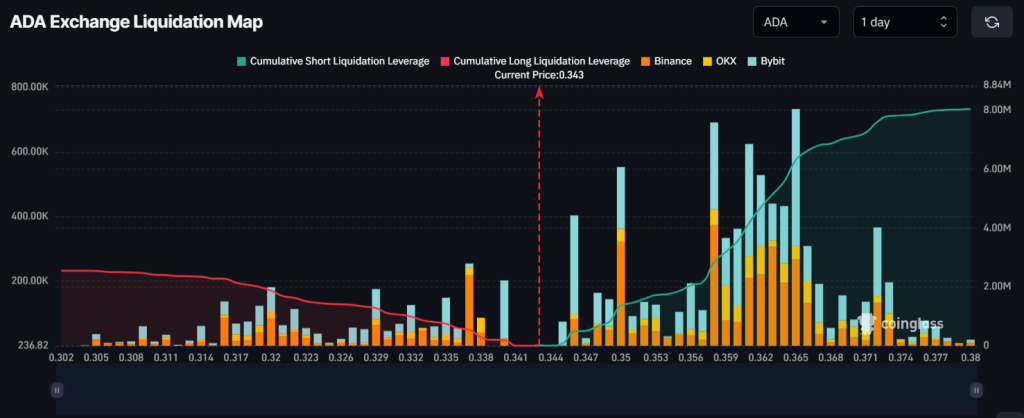

However, ADA short sellers are dominating the asset and draining long positions. According to on-chain analytics firm CoinGlass, the ADA exchange's Liquidity Map indicator has the potential for short sellers to clear millions of long positions.

Currently, the main liquidity levels are on the low side of $0.337 and on the upper side of $0.365, because traders are overextended at these levels.

ADA dominant short sellers

If market sentiment weakens and ADA falls to the $0.337 level, approximately $544,150 worth of long positions will be lost. Conversely, if the sentiment changes and the price rises to the $0.365 level, about $6.31 million worth of short positions will be liquidated.

This relatively long position over the past 24 hours indicates that the bulls are tired and the bears are taking control of the asset.

ADA is currently trading at $0.342 and has experienced a price drop of over 6% in the last 24 hours. Meanwhile, open demand fell by 4 percent over the same period, indicating low interest and fear among traders due to the crash and market sentiment.