Cardano (ADA) price forecast for January 12

ADA, the native token of the Cardano blockchain, is set for higher momentum after breaking out of a high price action pattern on the daily timeframe. The overall market is recovering following a prolonged price decline in the cryptocurrency market, which triggered a large rally in ADA and confirmed the breakout.

Cardano (ADA) price action and upcoming levels

According to expert technical analysis, ADA has created a head and shoulders price pattern on the hourly time frame. In a recent price recovery, it broke out of the pattern and closed an hourly candle above it.

This bullish pattern is often taken as a buy signal by traders and investors, as it typically supports bullish sentiment. Based on historical price trends, if ADA holds above the $0.95 mark, it could rise by 25%, reaching the $1.24 level in the coming days.

In the hourly timeframe, this reversal momentum has broken above the 200 exponential moving average (EMA), indicating that ADA has turned bullish in the short term.

Metrics bullish feeling on the chain

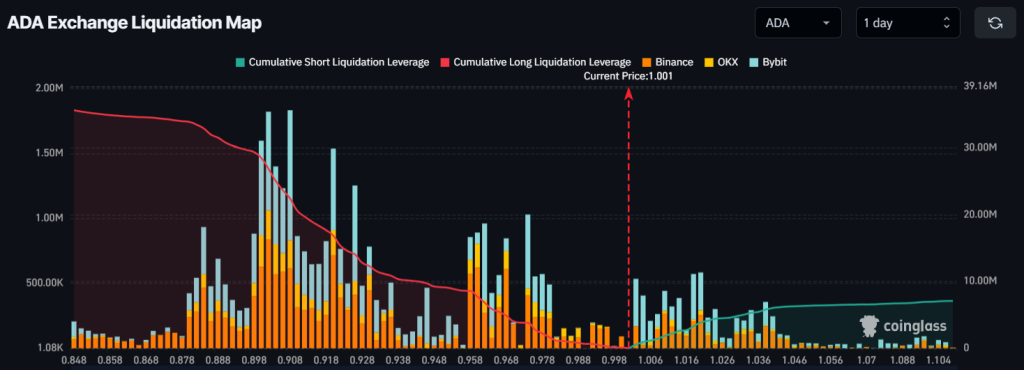

Observing this high price action, traders on Binance have built strong long positions, according to the chain analysis firm Coinglass.

79% of ADA traders are long.

Currently, the long/short ratio of Binance ADAUSDT stands at 3.75, which indicates strong bullish sentiment among traders. Additional data shows that 78.96% of top traders currently hold long positions, while 21.04% hold short positions.

However, traders seem to be constantly building new positions, resulting in open interest increasing by 9.89% in the last 24 hours.

ADA trader over-levels

Currently, traders are oversold at $0.908, while bulls have built long positions worth $22.40 million. Meanwhile, short sellers appear to be overextended at the $1.02 mark, with short positions at $3.87 million.

This liquidity data indicates that traders are very bullish, which may explain the large bets on long positions.

Current price momentum

Currently, ADA is trading around $0.999 and has gained over 7.5% in the last 24 hours. Despite the change in sentiment and volatility in the market, ADA's trading volume fell by 44%, indicating low participation by traders and investors.