Celsius (TIA) price faces uncertainty mainly amid social buzz.

Celestia (TIA) has attracted wide market attention as one of the best performing altcoins in the last seven days, its price has increased by 14.5% to $5.57.

However, on-chain data suggests that despite this recent surge, the modular blockchain project's native token may struggle to maintain its upward momentum.

Because of these reasons, the Celestia Rally is in jeopardy.

One indicator of Celestia's decline is social dominance. Social Dominance measures the volume of conversations about an asset compared to other top 100 cryptocurrencies.

For example, if a project has 30% social dominance, it means that 30% of its social media posts or messages are focused on the top 100 cryptos. A rise in this measure indicates growing market focus, as did the TIA, which hit a weekly high of $6.20 on August 9.

However, now, TIA's social dominance has dropped to 0.07%. If this decline continues, it could cause TIA's price to decline.

Read More: Best Upcoming Airdrops of 2024

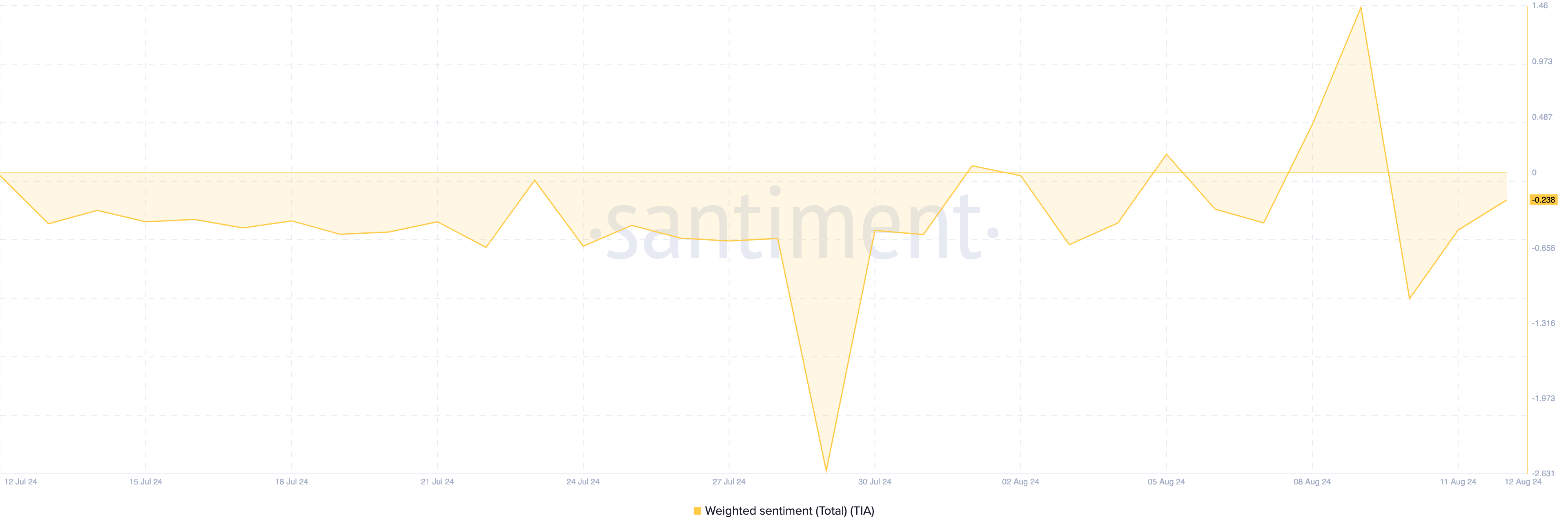

Despite the potential for downside, sentiment around TIA appears to be improving. According to Santiment, TIA's weighted sentiment currently stands at -0.238. This scale measures whether online opinions about cryptocurrency are generally optimistic or pessimistic.

A negative reading indicates more pessimism, while a positive reading indicates a sense of pessimism. Earlier, the reading was -1.069, which shows that the sentiment is still negative, but it has improved.

If weight gain is positive, the need for a TIA may increase. However, as long as the sentiment is negative, the token price may find it difficult to sustain the upward trend.

TIA Price Forecast: Consolidation Ahead?

Technical analysis shows that despite the price increase, TIA price failed to break above the downtrend line. Typically, when the price of a cryptocurrency crosses the trendline, it can be used as a signal for bullish continuation.

However, failure to do so may cause the TIA price to remain below the trend line. Additionally, the Accumulation/Distribution (A/D) indicator indicates that TIA lacks the necessary buying pressure to sustain growth.

The A/D line measures whether there is overbought or overbought in the market. An increase in the indicator indicates an increase in buying pressure, while a decrease indicates more spread. For the TIA, the A/D indicator remained relatively flat, suggesting that the amount of space around the TIA was not particularly high.

Read more: Which are the best Altcoins to invest in August 2024?

If this trend continues, the price of TIA could be consolidated between $4.67 and $5.71. In a very weak scenario, the price could drop to $4.07. Conversely, if demand increases, the TIA price may retest $5.93.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.