Chainlink (LINK) can fall by 20%, the key steps to be seen

Market sentiment in the cryptocurrency landscape is very weak. Meanwhile, Chainlink (LINK) is turning bullish and is poised for a notable price drop, but is currently at a strong support level.

This negative outlook can be attributed to LINK's recent price action and traders' bets over the past 24 hours.

Chainlink (LINK) technical analysis and upcoming levels

According to professional technical analysis, LINK looks bearish and is about to break the ascending triangle price algorithm on daily time frame. Since early August 2024, LINK has been supported by this trend line, experiencing buying pressure and upward rallies each time.

However, the asset is now in danger of breaking out of this support level due to the negative outlook and bearish sentiment among traders.

Based on the historical price action, if LINK breaks out and closes a daily candle below this critical support level of $10.65, there is a good chance that the asset could decline by 20% to reach the $9 level in the coming days.

Currently, LINK is trading below the 200 moving average (EMA) on the daily time frame, indicating a bearish trend. In trading and investing, traders often use the 200 EMA on a daily chart to determine whether an asset is suitable for shorting or buying.

LINK's Bearish On-Chain Metrics

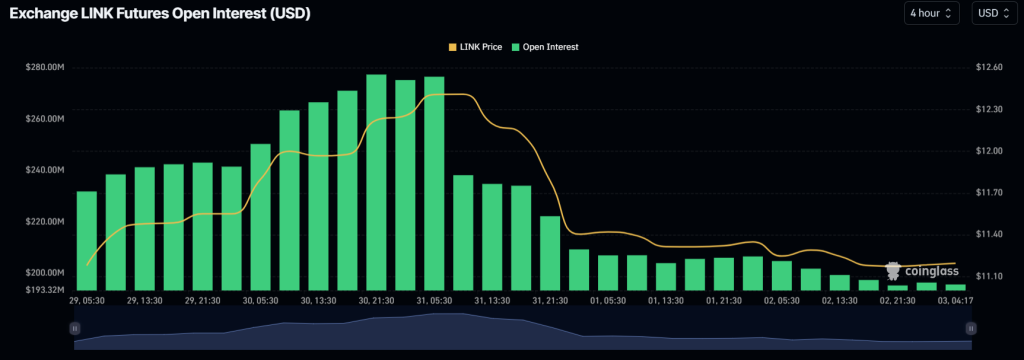

LINK's negative outlook is further supported by chain parameters. According to on-chain analytics firm Coinglass, LINK's long/short ratio currently stands at 0.94, indicating bearish sentiment among traders. In addition, open demand has decreased by 4.5% in the last 24 hours and jumped by 1.5% in the last four hours.

This decrease in open demand for LINK indicates a decrease in demand among investors and traders.

Current price momentum

At press time, LINK is trading at around $11.20 and has experienced a 1.1% drop in price over the past 24 hours. During the same period, the trading volume decreased by 34%, which resulted in a decrease in the participation of traders due to the widespread decline in the price of the crypto market.