Chainlink (LINK) Price Under Threat: Will Holders Intervene?

Chainlink (LINK) price is falling, but the trend is currently weak. This allowed investors to stop the ongoing decline.

On the other hand, the altcoin is seeing some bearish developments that could wipe out some of the recent gains.

Chainlink's price is finding support among bonds.

Chainlink's price has corrected over 14% over the past four days to trade at $18.56. Despite this, the altcoin has strengthened itself in the $21.69 and $17.56 range, testing the latter as support in the near future.

Looking at the on-chain metrics performance, it looks like this consolidation will continue, as the cryptocurrency also recognizes backups from LINK holders. Most active addresses actively transacting on the network include bullish investors.

According to Profitability Active Addresses, we see that 7% of active investors are at a loss. The remaining 57% are in the money i.e. neither profit nor loss and the remaining 35% are profit investors.

Since most participating addresses are loss-proof, they keep selling, preventing excessive drawdowns.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

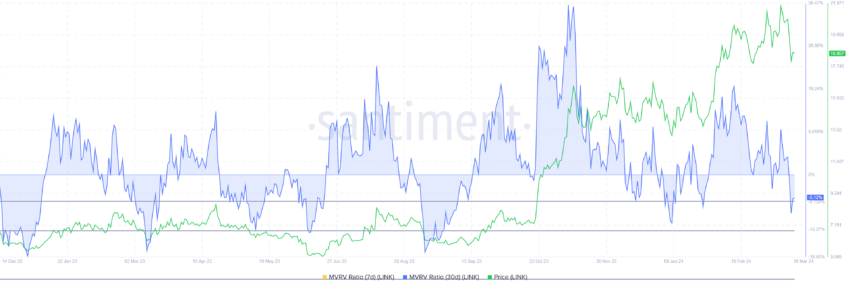

Secondly, the market value to real value (MVRV) ratio also indicates bullishness. The MVRV ratio evaluates the investor's profit or loss. The 30-day MVRV for Chainlink is -5.2% indicating that recent investors have lost money.

Additionally, historical data shows that an MVRV of -5% to -12% often precedes market rallies, the so-called “opportunity zone” to accumulate.

Therefore, LINK is currently very good to stock and may attract investors to it.

LINK PRICE FORECAST: Death's cross looms over investors' heads

Given the above factors, Chainlink may have one shot at pushing back the price and ending the bearish rally. This helps LINK not only break the 50-day Exponential Moving Average (EMA), but also take $19 as a support level.

However, it should be noted that the altcoin is seeing a death cross on the 4-hour chart. A death cross occurs when the 50-day EMA crosses below the 200-day EMA, indicating that an asset's price has declined.

Read more: How to buy Chainlink (LINK) and everything you need to know

If this bullishness prevails, Chainlink's price could drop to $17.56, a loss that would invalidate the bullish thesis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.