Charles Hoskinson warned that CBDCs could disrupt financial freedom

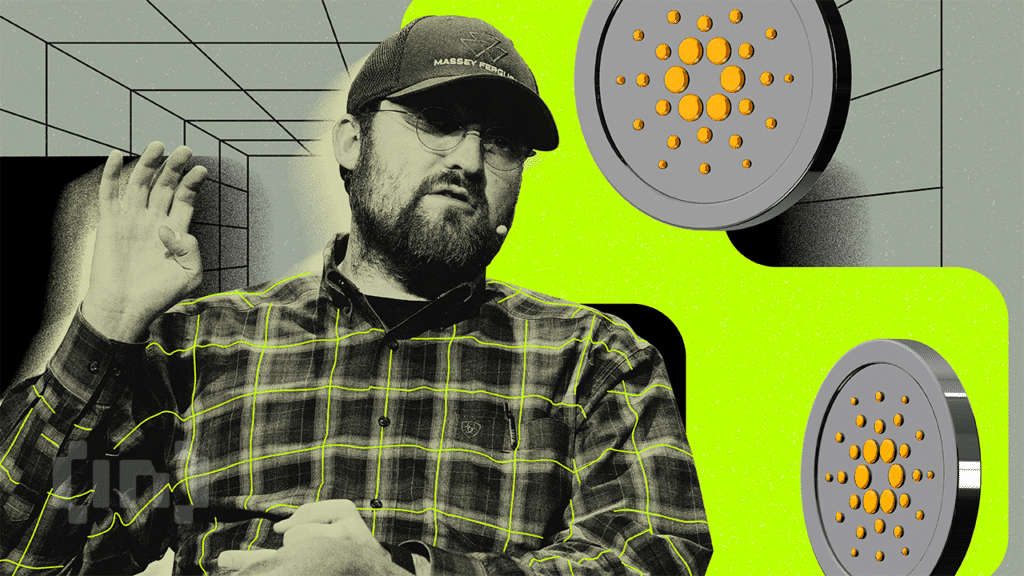

Cardano blockchain founder Charles Hoskinson spoke on Central Bank Digital Currencies (CBDCs) while explaining the basic concept behind crypto.

Hoskinson made this statement on May 11 while expressing his views on the upcoming US presidential election on social media.

Hoskinson explains why Crypto is important

According to Hoskinson, the fundamental concept of cryptocurrency is to establish new social contracts. He explained that these terms make governments, corporations and other authorities accountable to the people. He urged the industry to focus on promoting this objective instead of engaging in arbitrary debates on taxes and regulations.

Hoskinson warns that those who oppose the spread of crypto may unwittingly support the concentration of power among the few. He warned that if the crypto industry fails to seize the opportunity, CBDCs may be the only viable option.

Thus, these CBCs may exacerbate financial surveillance and citizen control, threatening user privacy and autonomy. Hoskinson went on to say that governments could use CBDCs to control data flows and disrupt social mobility.

“Crypto gives us our voice, our financial freedom and our common humanity. Any politician who wants to rob us of that is dangerous,” Hoskinson said.

Read more: How to buy Cardano (ADA) and everything you need to know

The Cardano founder's views on CBCCs echo concerns shared by privacy advocates that they could become a tool for widespread government surveillance and economic exploitation. Renowned author Robert Kiyosaki, best known for “Rich Dad Poor Dad,” recently warned of central banks' use of CBCCs to violate individual privacy.

“Caution please. Banking crisis worsens. Threat of war increases. Central banks push CBDC, Central Bank digital currency, to spy on us. I'm buying more bitcoins and silver coins,” Kiyosaki said.

Despite such concerns, proponents argue that CBDCs will improve transaction efficiency and strengthen fraud prevention in digital transactions. Deutsche Bundesbank President Joachim Nagel highlighted the urgent need for central banks to re-evaluate their business models and rapidly adopt CBDCs.

CBCC is a blockchain-based government-issued currency. It enables faster settlement of fiat currency transactions for central banks, retail banks and consumers compared to traditional banking infrastructure.

In particular, the largest number of nations and financial institutions—134 in total, accounting for 98% of global GDP—are considering CBDC implementation, with a significant increase from 35 nations in May 2020. CBC exploration, including development, pilot programs or launch events.

Read More: Digital Rupee (e-Rupee): A Comprehensive Guide to CBCC India

“Of the Group of 20 (G20) countries, 19 are now at the advanced stage of CBDC development. Eleven of these countries are in the pilot stage. This includes Brazil, Japan, India, Australia, South Korea, South Africa, Russia and Turkey,” according to the Atlantic Council. He wrote.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.