CMCCC Global Raises $100 Million in Blockchain Fund Focused on Asian Startups

Asia-based blockchain venture capital (VC) firm CMCC Global has announced the launch of the Titan Fund, a $100 million investment to support blockchain startups in the region.

In the year Founded in 2016, CMCC Global is one of the first Asian VC firms to focus exclusively on the blockchain ecosystem.

As stated on the official X (formerly Twitter) page, the organization stated that the fund's initial focus area is Hong Kong before expanding to other Asian hubs and by extension the world.

However, CMCCC Global is not the only investor in the Titan Fund.

According to an update shared with South China Morning Post (SCMP) by co-founder Martin Baumann, Winklevoss Capital, owner of the Gemini Winklevoss Twins and Animoka brands, are also major contributors to the blockchain fund.

Investors such as Block.one, Pacific Century Group, Jebsen Capital and 30 others are key players in the Titan Fund.

While shedding light on the next steps, Bauman stated that the Blockchain Fund will initially offer equity investments in blockchain infrastructure companies, consumer applications and crypto-financial services.

CMCC Global has been a key player in the crypto VC landscape for many years.

The investment firm has strong ties with Hong Kong-based crypto company Animoka Brands. He recently participated in a $20 million investment round in Mokaverse, a newly-discovered non-vulnerable token (NFT) ecosystem.

The VC firm participated in a pre-seed funding round for Web3-based services firm Terminal 3 in August 2023.

When asked how much of the $100 million would be deployed in Hong Kong, Bauman said the number was not yet set in stone.

Instead, the strong relationship with the Asian region made him start the new fund instead of elsewhere.

Despite being an Asia-first VC firm, CMCCC Global continues to expand its global footprint. The company now operates in North America and Europe.

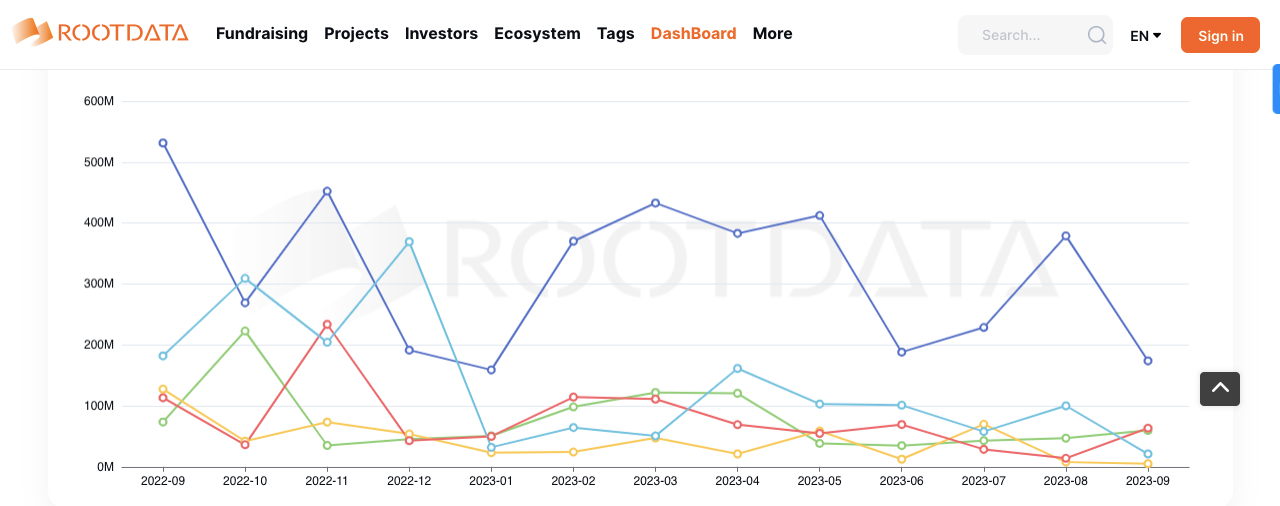

VC funding has dropped by 70%

Globally, the amount of capital invested in crypto-facing businesses has dropped significantly.

According to a dashboard created by RootData, the amount of investment flowing into the crypto space has dropped by 70% over a 365-day roadmap.

Providing context, RootData reports that VC funding has fallen from $1.8 billion in 149 rounds in June 2022 to $520 million in just 83 projects in June 2023.

According to the latest data, 166 investment rounds of $1.69 billion have been made in the last 90 days. However, this figure represents a decrease of 10.2% compared to last year.

Declining interest in the cryptocurrency sector cannot be attributed to a lack of innovation. Rather, it stemmed from a climate of strict regulation of the startup industry and subsequent market collapse.

Although many governments around the world are taking precautions, the Hong Kong government took a different approach by revising its position in October 2022.

Following this change, the number of crypto businesses facing opposition in their home countries is increasing.