CME surpasses Binance in Bitcoin Futures market share

It finally happened: Chicago Mercantile Exchange (CME) Binance has taken over as the largest Bitcoin futures exchange.

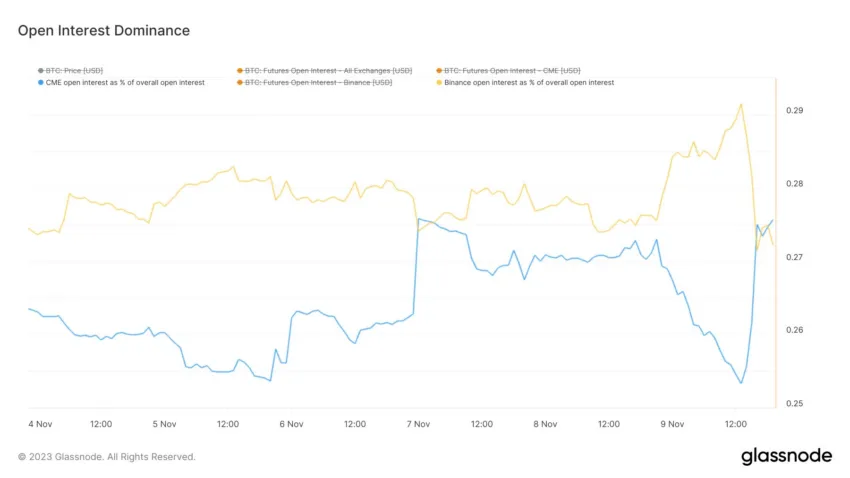

As reflected in open interest (OI), this shift in dominance shows the potential impact on institutional interest in the crypto sector.

The new king of the future of Bitcoin

CME, known for its traditional futures contracts with predetermined expiration dates, now has nearly $4 billion in interest. This equates to a market share of over 24 percent.

In contrast, Binance, which offers both conventional futures and expirations, saw OIA drop to $3.76 billion, a 13 percent drop in the past 24 hours.

Last week, Gabor Gurback, a strategy consultant at VanEck, highlighted the increasing open demand for Bitcoin futures on the CME. he said.

“CME to Overtake Binance as Largest Exchange in Bitcoin Futures Open Interest.”

Read more: 9 Best Crypto Futures Trading Platforms in 2023

Gurbak sees this as an indication that the crypto market is starting to take off, suggesting that physical markets will soon catch up. Crypto analyst Will Clement also commented on this apparent retail-institution statement:

“Bittersweet – soon there will be more costumes here than code clothes.

It forces on Play

However, this transition is not without complications. An X user responded to Gurbak's comment,

“I think the rise of the CME underscores the institutional gravity of Bitcoin's future. However, it is important to monitor the overall health of secondary markets and their potential impact on pricing mechanisms.

The situation occurred when Bitcoin reached an 18-month high of $38,000 before reversing to $36,000. At the same time, Ethereum moved above $2,100 for the first time in seven months. This is mainly due to the news that BlackRock has registered an Ethereum trust in Delaware.

The rise of the CME reflects a broader trend in institutional demand for Bitcoin futures. As the crypto market matures, the volatility of futures exchanges may improve, which may signal a new era of institutional investment in cryptocurrency.

Read More: How to Trade Bitcoin Futures and Options Like a Pro

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify the facts and consult with experts before making any decisions based on this content. It operates without personal beliefs, emotions or biases, providing data-driven content. A human editor carefully reviews, edits, and approves the article for publication to ensure relevance, accuracy, and compliance with BeInCrypto's editorial standards.