Coinbase shares will break $300 for the first time since 2021.

The crypto exchange is one of the big winners of the United States elections on November 5.

362 General views

1 Total shares

News

The cryptocurrency exchange Coinbase Inc. (COIN) rose more than 20% on November 11, when the stock crossed $300 for the first time since 2021.

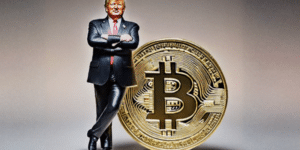

US crypto stocks are making big gains after Donald Trump won the presidential election, as many believe his victory will be good for the industry, according to Cointelegraph research.

Michael Miller, an equity analyst at Morningstar Inc., said, “As the company struggles with SEC regulatory pressure, we see Coinbase benefiting from the election results.” 7 research note.

“With the incoming Donald Trump administration expected to be more favorable to the cryptocurrency industry, the company's stock trading will face less regulatory pressure,” Miller said.

“A less direct, more permissive approach to cryptocurrency will give cryptocurrency prices a tailwind.”

Source: Google Finance

“Crypto has the full support of the winning presidential candidate,” Coinbase CEO Brian Armstrong said in an article on the X forum on November 6.

“The country has completely rejected the work of Senators Warren and Gary Gensler, who have spent years trying to kill our industry illegally,” Armstrong said.[t]The next Congress will be the most pro-Crito Congress ever.

On October 30, Coinbase reported revenue of $1.2 billion and a profit of $75 million in the third quarter of 2024.

Coinbase is focused on “some of the building blocks now in place to help bring a billion users onchain,” according to an Oct. 30 shareholder letter.

“In Q3, we made significant progress advancing some of these building blocks — specifically integrating stablecoins into our product suite and scaling the Base network,” the letter said, referring to Coinbase's Layer 2 scaling network.

Another cryptocurrency trading firm, Galaxy Digital, had its biggest trading day of the year on Nov. 5 as Trump's victory boosted interest in crypto.

“[O]UR Franchise was doing the whole hog — trading with counterparts in the U.S. and abroad, lending, origination desk,” Galaxy CEO Michael Novogratz told Bloomberg.

“It really felt like a vindication of everything we've been working toward,” Novogratz said.

Magazine: How Chinese traders and miners are getting around China's crypto ban