CoinFLEX Lenders Respond to OPNX Shutdown: ‘Leaving a Path of Destruction’

10 months ago Benito Santiago

“From CoinFLEX to 3AC and things like that, we say in Germany Verstung, they have left a trail of destruction behind them,” said a certified CoinFLEX lender.

The creditor contacted Decrypt and provided evidence of their claim against CoinFLEX, but requested anonymity due to ongoing legal matters.

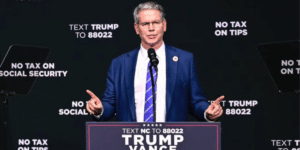

The Open Exchange, or OPNX, led by CEO Mark Lam and founded by crypto hedge fund Three Arrows Capital co-founders Su Zhu and Kyle Davis, announced last week that it was shutting down. That sparked a storm of litigation among CoinFLEX board members and creditors.

CoinFLEX was the previous work of Lamb, Zhu and Davis. When it controversially changed to OPNX, creditors say they had no power over the new company.

Those who participated in the previous work are watching the OPNX news with interest. Already, Zhu and Davis have moved to OX.Fun, a gamified crypto derivatives platform, as consultants. It uses Ox, the same native token as OPNX.

“As an advisor to OX.Fun, I'm excited to see what the team is building with $OX.” “Mark is not involved in OX.Fun in any capacity,” Davis told Decrypt.

He did not respond to questions about whether CoinFLEX funds were used to create OPNX, whether CoinFLEX's creditors and board members were excluded from the rebranding, or whether the group of creditors left a “trail of destruction” behind them.

But then, there are ongoing legal claims against OPNX from the new CoinFLEX board.

Meanwhile, OPNX investors are following the 3AC co-founder's OX token to memecoin – with the full support of Zhu and Davies.

“They think it's the greatest joy in the world,” said the unnamed CoinFLEX lender. “However, OX.Fun is just the reincarnation of OPNX.”

Calling themselves “the herd,” CoinFLEX lenders follow 3AC's co-founders faithfully and ignore their storied history as investors move on to their next venture.

“I feel sorry for those people,” said the unnamed CoinFLEX lender. “I think it's about education, too. Because when I ask people on forums, who do you do business with? They don't know. Someone told me they don't believe in hard work. Maybe some of these people should be. They should be punished.”

$OX are depositing in droves to @OXFUNHQ before the ship sets sail on Thursday pic.twitter.com/i9sbSx9FsB

— Kyle (3/AC) (@KyleLDavies) February 4, 2024

Table of Contents

ToggleCoinFLEX left behind

Despite a new name change, and the absence of the evicted sheep a few months ago, the CoinFLEX company still exists.

What's left is a bunch of frustrated and confused individuals who believe the law was violated in the process, said Kirill Gurov, CoinFLEX board member and Kraken Ventures partner.

“People who commit crimes should go to prison and my opinion is that these people are committing crimes,” Gurov told Decrypt. “Mark moved from Dubai to Hong Kong after Vara's conviction. He left HK and as far as I know he hasn't been back since before we were appointed. In fact, he admitted in an email that he had a personal threat to come back. When he comes back and tries to seek personal compensation and additional financial support from creditors, this is not the behavior of honest people.

As a result, the new board has ongoing legal actions that “will not change at all” due to the recent OPNX news, Gorov said. Instead, the news is “proof” of their claims against the group.

“It's okay to create new companies,” he said. But using corporate games to perpetuate chaos is a very different matter and we hope the authorities pay attention.

The current CoinFLEX board's initial plan was to “revive the company”, but then they had to shift their focus to “solving the mess left behind”.

However, the unnamed lender says the relationship with the new board was worse than the previous one.

“The lending team is also very large, so we cannot discuss a legal strategy with 1,000 people and still maintain an edge.” Gurov told Decrypt, “We want to do better with updates and we're working towards it, but Mark refuses to hand over CoinFLEX assets like the website and so on. We hope to eventually bring it back and use it as a proper information portal soon.”

Confirmed creditors' main concern was that they received no official correspondence, only “a post in a small Telegram group”. But Gurov said this was due to Lam not providing creditors' emails, “not having a very good staff” and prioritizing cleanup.

What happened in the past

Prior to OPNX, Mark Lam founded CoinFLEX in 2019. By 2022, the project was struggling. So Lam looked to Zhu and Davis for help. At the time, they saw their crypto hedge fund Three Arrows Capital (3AC) collapse and go bankrupt.

CoinFLEX later stopped withdrawing funds. The company said this was due to investor Roger Weir not having a “written margin agreement”. He vehemently denies the claim. This resulted in a restructuring of the company which was approved by the Seychelles Court.

The unnamed CoinFLEX lender claims to have lost “low five figures” during this period.

Soon after, CoinFLEX changed to OPNX. But this “rebrand” drove out the CoinFLEX board and creditors, who had no power in the new exchange.

“Turns out there was never a rebrand.” Gurov told Decrypt. “Coinflex's assets were transferred or used by OPNX, a completely separate company, without any oversight.”

Again: Another detail Davis was asked about but declined to comment on.

Meanwhile, CoinFLEX's board and creditors believe Lamb and 3AC's co-founders used CoinFLEX funds to cover 3AC's legal fees, hiring for OPNX and paying for a photo shoot in Dubai.

https://x.com/CoinFLEXreal/status/1717496736501887177?s=20

OPNX, Mark Lamb and Su Zhou did not immediately respond to Decrypt's request for comment. This article will be updated if you respond. Kyle Davis declined to comment other than OX.Fun.

Edited by Stacy Elliott.

Stay on top of crypto news, get daily updates in your inbox.