Could Bitcoin (BTC) trigger a bullish price recovery?

Bitcoin (BTC) price is expecting a rally, which will help the cryptocurrency recover from its recent losses. Institutions are key to this, but retail investors are gaining prominence in the market.

This will give BTC the necessary impetus to break out of its current slump.

He sees an increase in the demand for Bitcoin

Bitcoin's price is largely dependent on institutions in the current bull run, and the market is seeing similar results. Last Friday, Greyscale Bitcoin Trust (GBTC) recorded its first ever inflow of $63 million.

The spot launch of Bitcoin Exchange Traded Funds (ETFs) has been a major catalyst for the bull run. This shows euphoria in the market with the net unrealized profit/loss indicator currently above 0.5.

Because halving is aggressive, demand increases following a reduction in rewards. In the last bull cycle of 2020-2021, this Euphoria was achieved eight months after it was halved. On the other hand, this time, the same was halved 6 months ago.

So, while ETFs are driving demand consistently, the recovery is likely to accelerate.

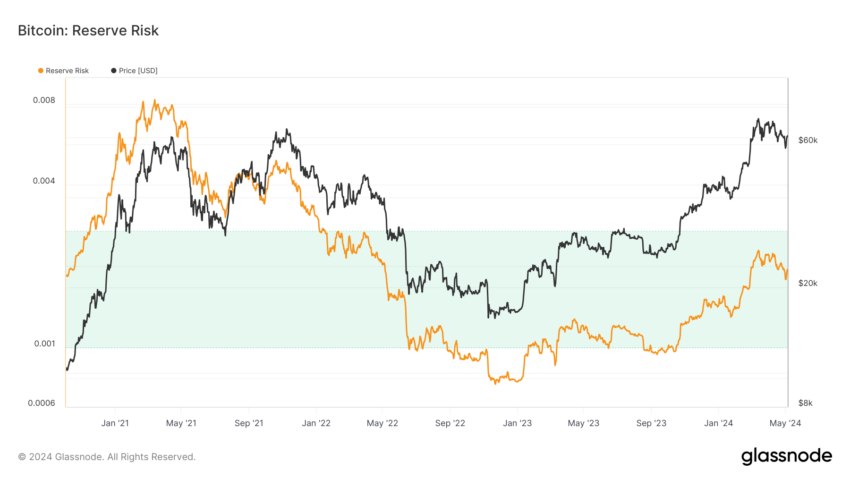

But this interest is not limited to institutions, as retail investors can jump on the bandwagon. This is because the reserve risk indicator is currently in the positive green zone.

This indicator is a measure of the general confidence shown by investors. Combined with its low price, BTC offers an attractive risk-reward ratio for investing. Therefore, if BTC holders see the potential for profit, they will move into stocks, prompting a recovery.

Read more: Half a story of Bitcoin: Everything you need to know

BTC Price Prediction: Breakout Expected

At the time of writing, bitcoin prices are testing the upper limit of the flag at $64,140 the cryptocurrency has been stuck on since March. This bearish continuation pattern shows the potential of a 45% rally, setting the target at $92,505.

However, realistically, the target is breaching its current all-time high of $73,000. This happens if $65,000 is maintained as a support floor and BTC breaks out of the pattern.

Read more: What Happened in the Last Half of Bitcoin? Predictions for 2024

On the other hand, if the breach fails, the price of Bitcoin could drop to $61,000. A loss of this support will cause BTC to test the flag's lower trend line, which could hit $56,600 to invalidate the bullish thesis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.