Could Ethereum Wells Raise ETH Price This Month?

Ethereum (ETH) whales are at it again, but this time, they are not selling the cryptocurrency like they did for some parts of the year. Instead, on-chain data shows ETH reserves are growing, with retail investor interest growing.

What does this mean for ETH? BeInCrypto shows all the details, analyzing the developments and their impact on the price of Ethereum.

Ethereum retail investors, the big wigs are buying.

In the year On November 29, Ethereum's large proprietary net flow stood at 28,680 ETH, but today it has risen to 80,130 ETH. Netflow measures the difference between accumulated coins and those sold by whales.

A positive network flow indicates whales are buying more tokens than they are selling, which is typically a sign of bullishness. In contrast, a negative net flow indicates selling, often due to weak price action.

According to the latest data, Ethereum whales accumulated approximately 51,450 ETH in two days – about $ 188 million. If this buying trend continues at similar volumes, the price of ETH could push above $3,700.

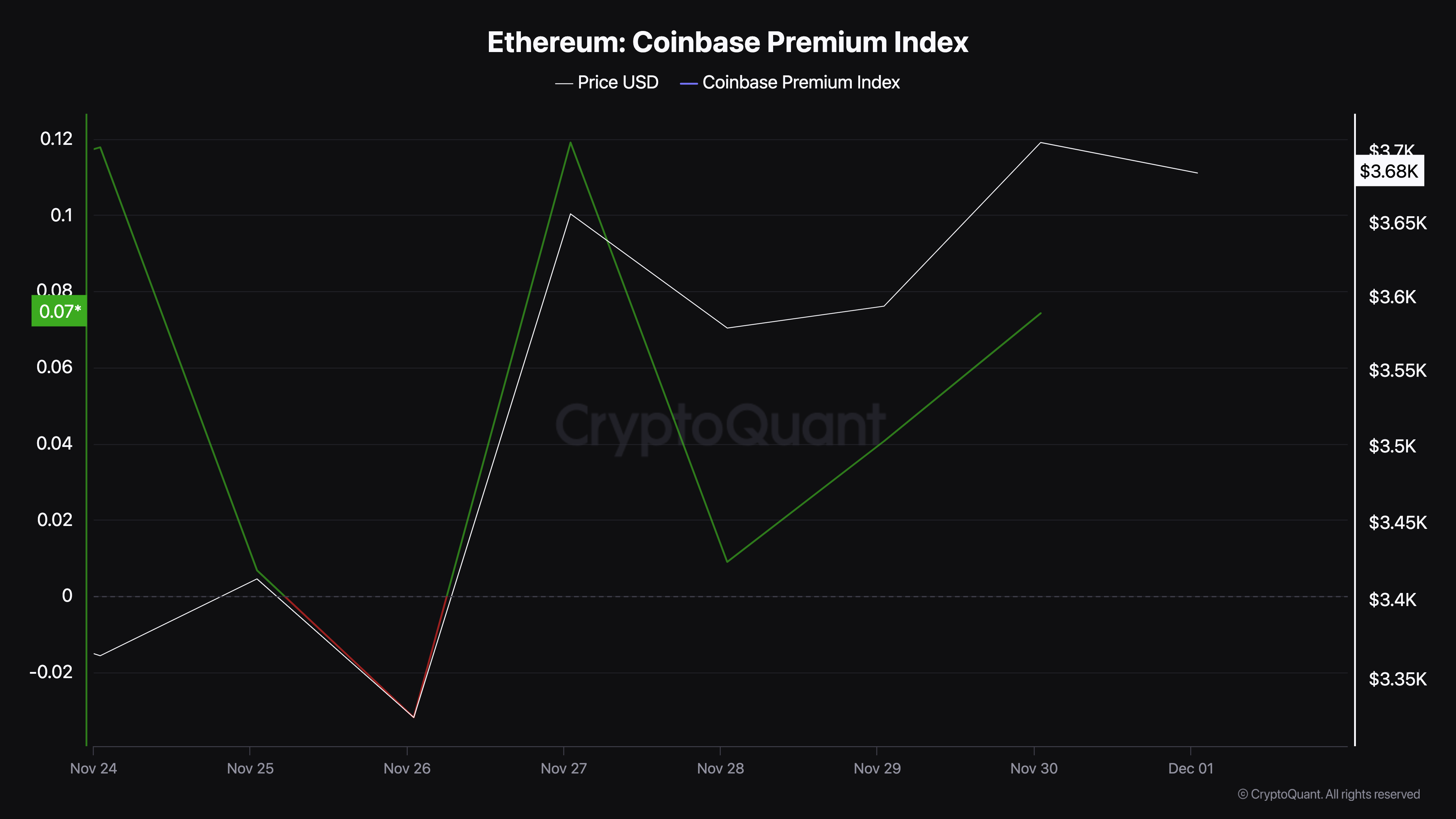

In addition to whales, CryptoQuant data shows that the Coinbase Premium directory has increased. The index measures the difference between the ETH/USD Coinbase price and the Binance price.

A negative reading indicates selling pressure from US investors in particular. On the contrary, a positive index indicates an increase in buying pressure – the current trend for ETH.

If U.S. investors continue to hoard ETH, this growing demand could cause the cryptocurrency's price to skyrocket, as noted earlier.

ETH Price Prediction: Strong Support, High Price

Based on the daily chart, the Parabolic Stop and Reversal (SAR) indicator is below the ETH price. Parabolic SAR is a technical indicator used to determine the price direction of an asset.

When the dotted line of the indicator is above the price, it indicates resistance. As such, the property in question finds it challenging to climb. However, in the case of Ethereum, the indicator is below the price, which suggests that the cryptocurrency has strong support to maintain its growth.

BeinCrypto also saw the formation of a bull flag, which suggests that buyers have blindsided sellers. Considering this position, the price of ETH can rise to $4,000.

However, it is important to mention that Ethereum whales may have a role in this prediction. If these key stakeholders continue to thrive, ETH may hit the aforementioned target.

On the other hand, if the whales stop buying, this prediction may be invalidated. In that case, Ethereum could drop to $3,425.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.