Could Solana (SOL) user adoption drive further price increases?

Solana (SOL) As the number of unique transaction signatories increases, the intrinsic value of the blockchain comes to light. SOL prices have reacted positively in the past two weeks due to the rapid increase in the decentralized exchange (DEX).

Will these indicators keep the SOL price trend high?

Solana's RSI is at healthy levels.

Solana's Relative Strength Index (RSI), steady around 48, indicates limited selling pressure. It is not enough to treat the property as undervalued or to enter the overbought territory. This equilibrium suggests that Solana is at a critical point in the directional price shift.

The RSI is a tool that measures the speed and magnitude of price movement and operates on a scale of zero to 100. In general, a reading above 70 indicates that an asset is overbought and below 30 indicates that it is oversold. Solana's RSI is hovering around the 48 mark, just below the midpoint, indicating a subtle tilt away from a neutral market position.

Such a balanced RSI level can lead to several conditions for Solana. With price stability, it can be a market consolidation as the market appears to be in a holding pattern. Traders and investors monitor the asset closely, waiting for critical signals or triggers that can indicate the direction of the next significant price movement.

However, other indicators point to the second issue, which would be the expectation of a breakout, where the uptrend will continue even if the RSI is above 30.

Read more: 6 Best Platforms to Buy Solana (SOL) in 2024

Solana may soon reach 1 million daily users.

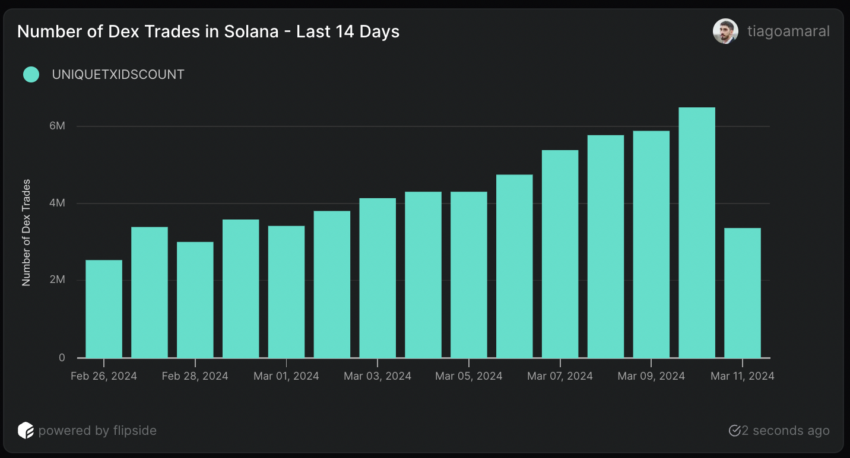

Solana's data on the chain shows us two interesting metrics. The first is the impressive number of DEX transactions, which reached 6.5 million on March 10. This is the largest number of daily DEX transactions on Solana, and since February 26, the number of transactions on decentralized exchanges in the Solana ecosystem has been continuously growing. , always keeping more than 2 million per day. Prior to December 2023, the largest DEX trade daily volume on Solana was 2.2 million.

This shows that users are increasingly engaging with dApps on Solana, making SOL highly leveraged for trading its decentralized exchanges. Therefore, this higher activity and speculation on SOL may affect the price.

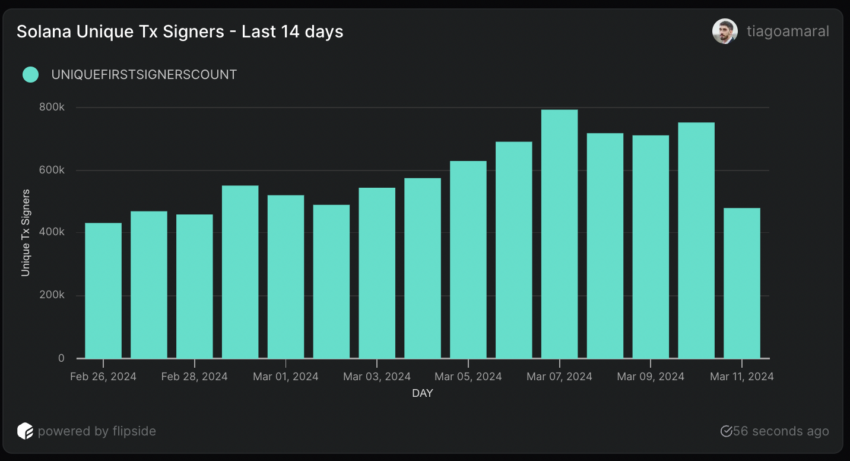

Another on-chain metric to examine is daily unique transaction signers. Simply put, the number of unique users that move through the network each day.

This number has been growing steadily since January 2024. As of February 26, that measure has registered 432,000 users. By March 7, it had grown to nearly 800,000, an 85% increase. That growth in less than a month is remarkable for a chain as large as Solana.

Following that same rate of growth for the following weeks, Solana's daily unique users could reach 1,000,000 in less than 14 days.

SOL price forecast: $200

Solana (SOL) shows a resistance level of $150 and a support level of $148.00. These milestones are identified based on historical price movements where Solana has consistently encountered significant buy or sell resistance.

A break into the $150 resistance mark could bring Solana into a new bullish trend, possibly as high as $200. This upward movement can be fueled by the flow of users joining the Solana network and increasing trading activity on decentralized exchanges (DEXs) connected to the network.

Even after Binance banned Solana withdrawals, this had little impact on the SOL price.

On the flip side, if Solana fails to maintain a foothold above $144, there is a risk that the price could drop to $140. It could pull back further to hit the $138 mark. Close monitoring of these support and resistance levels is crucial, as SOL's recent price direction can provide insights into the crypto market.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

Analyzing the EMA (Exponential Moving Average) cross for 20, 50, 100 and 200 days shows us that the short-term EMAs are crossing above the long-term EMAs, a bullish signal. This indicates that the price of SOL may continue to rise in the next few days.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.