Could Starknet (STRK) Mainnet Upgrade Trigger Bullying Reversal?

Ethereum layer-2 network Starknet (STRK) has struggled since its launch in February. This issue is one of the reasons why STRK holders only get 8% profit.

Despite the slowdown, cryptocurrency holders seem to have decided to test the waters by refraining from selling. Meanwhile, this analysis on the chain shows more.

Starknet hopes to regain its lost wealth

A few days ago, Starknet announced the successful launch of parallel execution and block packaging improvements on Testnet. The update, which is slated for gas bill reductions and two-second verification times, will go live on Mainnet on August 28.

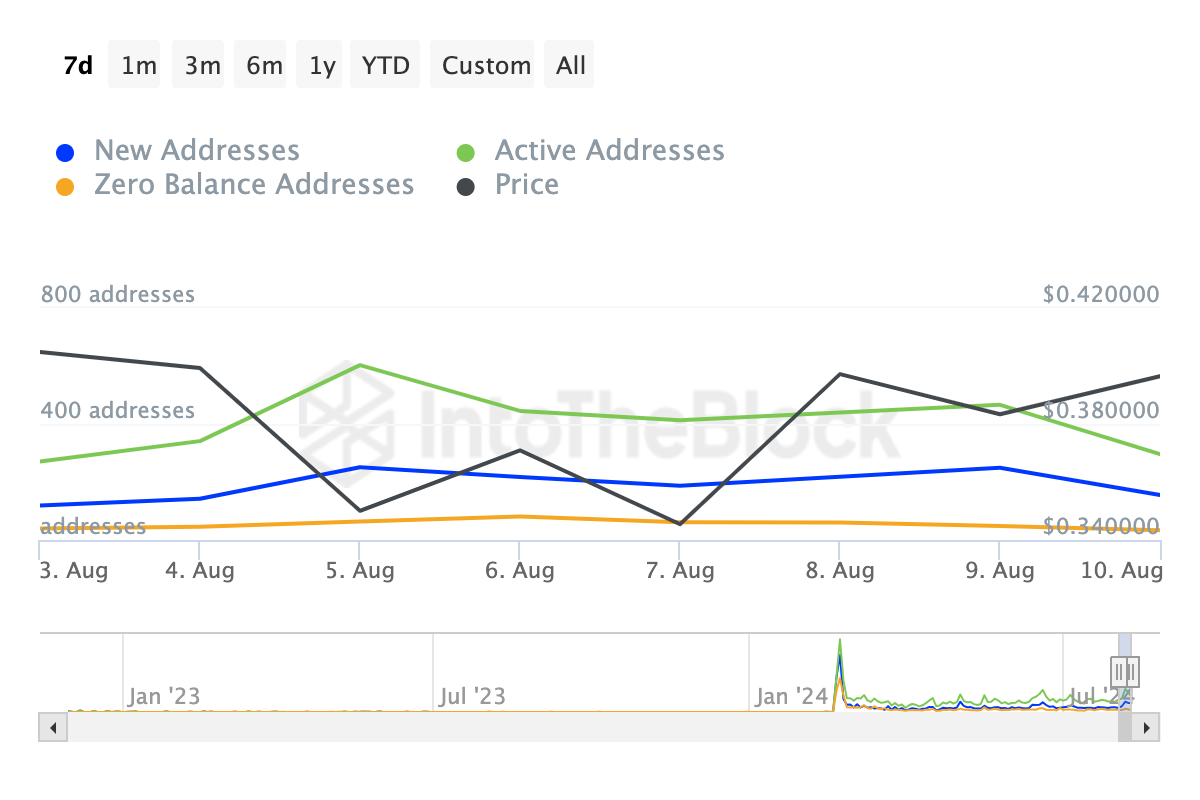

Following Testnet's announcement, IntoTheBlock data shows that the number of addresses holding STRK has increased between the last 30 days and the last 365 days.

While the reason for this is uncertain, the increase clearly indicates that holders remain optimistic about the token's future potential. Similarly, it indicates that they are not ready to give up on losses, regardless of the failure.

Read more: Deep Dive into Starkware, Starknet and StarkX

This decision can be called surprising considering the controversies in which Starknett was involved. For example, early adopters of the project were not satisfied with the airdrop distribution in February.

In addition, the project experienced a significant decline in user engagement, and recently the CEO resigned. Interestingly, on-chain data has seen significant improvements in network activity.

In particular, new contacts, which refer to the number of participants who completed their first successful transaction, increased by 30.25% in the past week.

Similarly, active addresses, a metric that measures the number of senders and receivers on the blockchain, also jumped. If it continues, the increase in these figures is a great sign for StarNet and its native brand.

STRK Price Forecast: The token is looking at the upper resistance

At press time, STRK is trading at $0.39, making it one of the top 100 gainers in the last 24 hours. Based on the daily chart, the cryptocurrency formed a descending triangle between June 5 and August 3.

A descending triangle is a bearish chart pattern characterized by a series of lower highs (LH) and a resistance level in the winter. Earlier, STRK broke below this range, suggesting that the downtrend may continue.

But as of this writing, the cryptocurrency looks poised to break out of the pattern. Money Flow Index (MFI) reading of 16.20 indicates that it is in a price discovery mode.

In addition to measuring buy and sell volume, MFI also assesses whether a cryptocurrency is overbought or oversold. Prices at 80.00 and above are overbought, while those at 20.00 and below indicate overbought.

Read more: ZkEVMs Explained: Boosting Ethereum Scalability

STRK is oversold under this rule, and a significant bullish reversal could be on the cards. Therefore, if the buying pressure increases, the token price may come to the upside resistance at $0.62 in the short term.

In addition, the successful completion of the parallel execution and blockchain update on the Mainnet, coupled with strong demand, may push the price to $0.94. However, if confidence declines among holders, selling pressure could come, and the price could drop to $0.34.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.