Crypto Inflows reached $436 million at the expected Fed price

Digital asset investment products saw inflows of $436 million last week, a turnaround after a series of outflows reached $1.2 billion.

Crypto markets have a lot to look forward to this week as the Federal Open Market Committee (FOMC) decides on the size of the September interest rate cut.

Crypto investment reached 436 million dollars

Bitcoin (BTC) led crypto flows last week, bringing in $436 million last week and reversing the negative flow seen on September 6. In contrast, Ethereum (ETH) continued to experience negative flow, spending $19 million after $98 million. Last week's spending flow was recorded.

The latest CoinShares report predicts a 50 basis point (0.50%) reduction in Bitcoin's positive flow. Regional revenues support this theory, with the US leading the way, accounting for up to $416 million.

In particular, comments from Bill Dudley fueled optimism. The former New York Fed president said on Thursday there was a strong case for a 50 basis point interest rate cut.

“I think there is a strong case for 50,” Dudley said at the Bretton Woods Committee's annual Futures Finance Forum in Singapore.

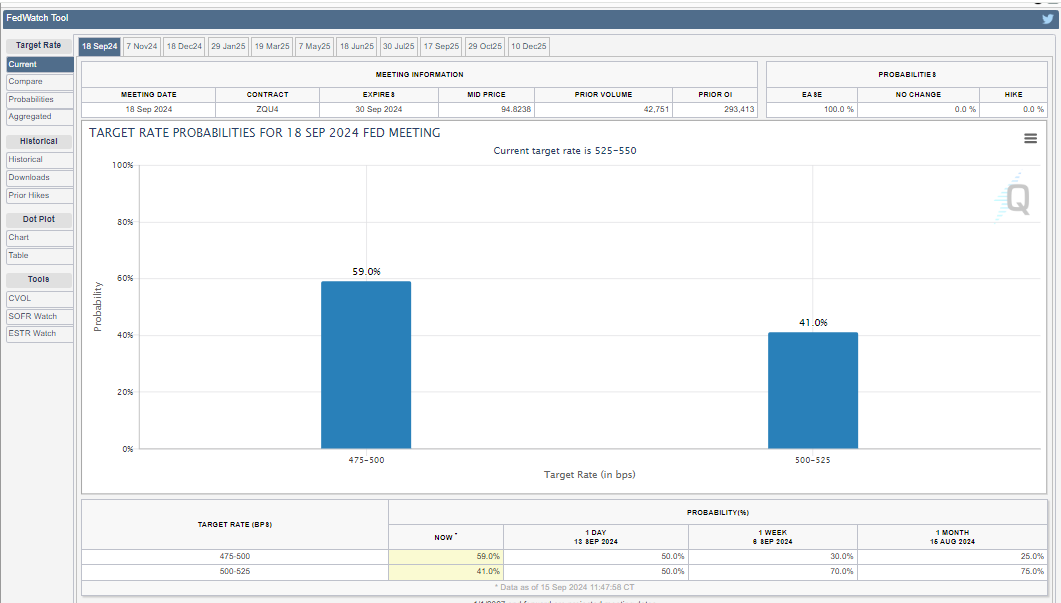

The FOMC's interest rate decision on Wednesday is a key event that crypto markets will be watching closely this week. Traders and investors are preparing for the impact on their portfolios based on the rate cuts chosen by policy makers. Data from the CME FedWatch Tool shows a 59% chance of a 50 bps rate cut, versus a 41% chance of a 25 bps cut.

Read more: How to protect yourself from inflation using cryptocurrency

JPMorgan favors a 50 bps interest rate cut, but whether the cut is 50 or 25 bps, uncertain times await for Bitcoin. A 25 bps cut has already been oversold, while analysts warn that a more severe 50 bps cut would negatively impact Bitcoin.

Regardless of the outcome, markets are eagerly awaiting Wednesday's FOMC decision, which could lead to the first rate cut since early 2020.

The turnover of ETFs is growing.

Meanwhile, CoinShares reported that trading volume in exchange-traded funds (ETFs) remained at $8 billion last week. However, Eric Balchunas data shows that flows into value ETFs are increasing, reaching $11.4 billion over the past 30 days. This represents a significant shift of capital into these financial instruments.

“If we wrap up 30 days, the flow into value ETFs is $11.4B, which is huge. A lot of value ETFs have taken cash, but in the larger BlackRock model portfolio it's turned to EFVs,” Balchunas added.

An ETF expert acknowledged that several value ETFs have benefited from recent cash flows, a large portion of which is BlackRock's model portfolio. Balchunas cited a $5.6 billion inflow in the first two weeks of September, highlighting the growing turn to value ETFs.

He compared this surge to the “Great Head Fake of 2020,” when markets experience an unexpected trend reversal. At the time, growth stocks, particularly in the technology sector, were performing significantly differently than value stocks, surprising many investors.

It is uncertain whether this value rotation will continue to strengthen or face setbacks, especially with the dominance of tech-heavy ETFs such as Invesco NASDAQ Futures (QQQs). Balchunas continues to seek technology-focused investments and questions the longevity of change.

Reflecting the “great head lie” that prompted a reevaluation of traditional strategies and debates about sustainability, the current cycle raises similar questions. It is yet to be determined whether this rotation will endure or face challenges from competing investment themes, but it represents a compelling development for investors to keep a close eye on.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.