Crypto investment flow reached 2.2 billion dollars on the prospect of the US election

Crypto investment surged to $2.2 billion last week, the highest since July 2023. Experts say that this development is increasing the optimism that Republicans can win in the upcoming US elections.

This change in political expectations boosted investor confidence and market value.

Crypto Inflows at Multi-Month Highs Amid US Election Buzz

Digital asset investment flows reached 2.2 billion last week after a positive inflow of $407 million was recorded for the week ending October 11. This represents a five-fold week-on-week growth, with Bitcoin seeing the largest revenue at $2.13 billion.

Positive flows to Ethereum reached 57.5 million dollars. Meanwhile, multi-asset earnings snapped a 17-week streak of outflows to record outflows of $5.3 million.

Just over a week ago, CoinShares analysts were reporting growing interest in the upcoming US election, given that the US led the charge with a total of $2.3 billion in revenue.

“We believe this renewed optimism is fueled by growing expectations that the Republicans will win the upcoming US election, as they are generally seen as more supportive of digital assets. This has resulted in positive price momentum,” reads a paragraph in the report.

Read more: How Blockchain Could Be Used for Voting in 2024?

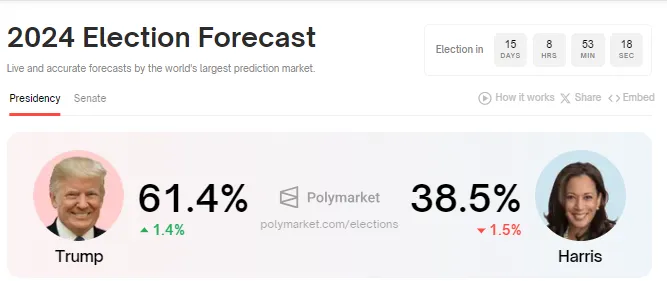

According to CoinShares researchers, this shows the growing demand for crypto investments in the country. It comes with just 15 days to go as counting continues for the US election. According to Polymarket, pro-crypto candidate Donald Trump is ahead with Kamala Harris by a margin of 22.9 percentage points.

When the Republican candidate is considered to be in favor of the cryptocurrency sector, the general impression is that the Donald's victory will lead to more crypto-friendly regulations.

As BeinCrypto reports, the Republican presidential candidate beyond Gary Gensler plans to reform US crypto regulations. This will further fuel market growth amid the belief that the party may introduce policies beneficial to the cryptocurrency industry.

As the countdown continues, investor interest in crypto is growing. The report showed a 30% increase in transaction volume for digital asset investment products last week. The increase in trading activity coupled with rising asset values has brought total assets under management (AUM) in the digital asset space to nearly $100 billion.

If the current momentum continues, the market may soon surpass this milestone. Crypto investment flow may increase this week compared to last week.

“A positive regulatory environment could open the floodgates for institutional investment. If the US sees a change in leadership that supports crypto innovation, it could lead to clear guidelines for crypto businesses, a potential green light for ETFs, and institutional confidence, which could drive new capital into crypto markets,” wrote the analyst. X (formerly Twitter).

Read more: How to buy Bitcoin (BTC) and everything you need to know

Meanwhile, Bitcoin is trading at $68,210 as of this writing, and is holding the psychological level of $70,000, according to data from BeinCrypto.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.