Crypto investment flow reached 407 million dollars between US elections

The US economy has been the leading narrative of crypto investment flows for the past several weeks. However, this may be changing as the US election count intensifies.

Inflows into digital asset investment products reached $407 million last week, overshadowing the negative inflows seen in the first week of October.

Crypto investment flows have recovered since early October.

The first week of October saw a sharp decline in cryptocurrency investment flows, registering a negative $147 million and ending the inflow that began on September 9. During this period, investors turned their attention to the broader US economy and multi-asset investments.

However, a new trigger has emerged – the upcoming US presidential election. This evolving narrative is expected to drive crypto investments. Bitcoin capitalized on this shift in sentiment, leading digital asset investment products with $419 million in revenue last week.

“Digital asset investment products saw $407 million inflows as investors' decisions were more influenced by the upcoming US election than monetary policy views,” the report said.

Read more: How to protect yourself from inflation using cryptocurrency

The report concluded that “stronger-than-expected economic data in the first week of October had little effect on slowing the flow.” Crypto investment flows were negative in September, despite the non-farm payrolls, which exceeded economists' forecasts.

The unemployment rate has unexpectedly fallen, compounding ongoing economic surprises. At the same time, Bitcoin's rally and strong earnings show that markets are responding to changes in the political arena.

“The recent US vice-presidential debate and the shift in voting against the Republicans has led to an immediate increase in earnings and prices as it is perceived to be more supportive of digital assets,” the report added.

Crypto investment flows in regional metrics further support the positive outlook, with the US leading the way, registering $406 million in revenues.

US Elections May Drive Crypto Inflows Further.

If CoinShares analysts' predictions hold, crypto investments could see stronger returns in the remaining two weeks of October. With the US elections approaching on November 5, the narrative around crypto is expected to gain more strength as a political topic.

This growing demand could greatly benefit digital asset investment products, as crypto becomes a focal point in the increasingly expensive consumer landscape. The political focus on crypto, combined with market conditions, positions digital assets for growth.

As reported by BeInCryptoof Most American voters Lean towards political leaders who embrace crypto. This is because crypto has become such a non-partisan issue in the US that it is almost split even between the Republican and Democratic parties.

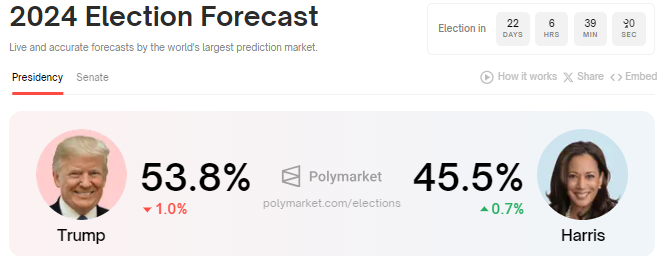

Clear and supportive crypto policies will be a powerful weapon for either candidate Donald Trump or Kamala Harris to squeeze through a narrow path to victory. Polymarket data shows that pollsters support Trump with a nearly 10% margin over Kamala Harris.

Read more: How Blockchain Could Be Used for Voting in 2024?

Bitcoin is benefiting from the shift in sentiment, data from BeInCrypto shows that BTC is up about 5% since the opening of Monday's session, trading at $65,324 at the time of writing.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.