Crypto investment products see initial earnings in more than a month.

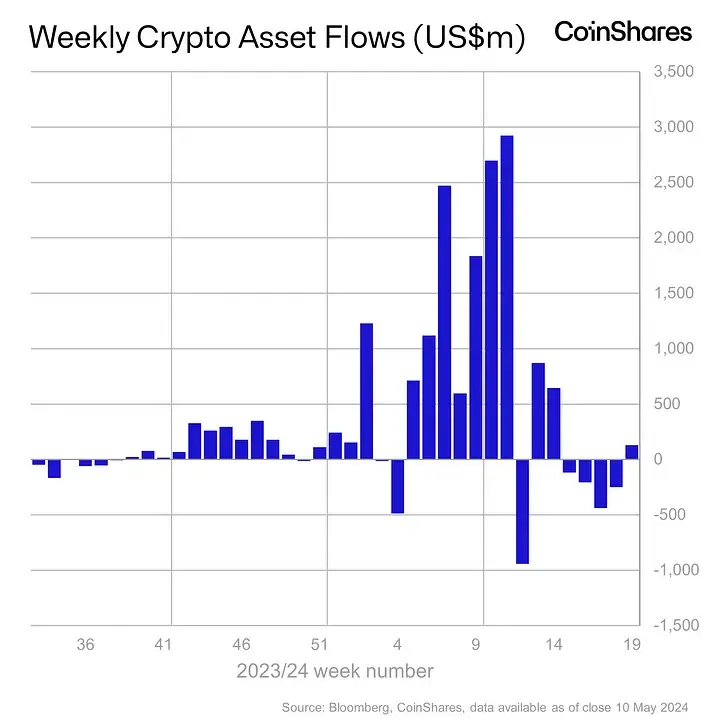

Digital assets investment products saw $130 million in revenue, the first in four weeks.

Bitcoin remains above $62,000 and saw $144 million in revenue last week.

As Bitcoin shows new resistance above $62,000, the latest market data shows that digital asset investment products fell in last week for the first time in over a month.

On Monday, digital asset manager CoinShares published its weekly report on crypto investment products.

The list shows that the industry saw an inflow of $130 million in the week ending May 10. It's the first time the gauge has read positive since the first week of April — a four-week streak.

Bitcoin in particular saw inflows of $144 million, while short-Bitcoin ETPs recorded outflows of $5.1 million.

Most of the $135 million in revenue was seen in the US. Hong Kong saw $19 million in revenue. Elsewhere, Canada and Germany recorded withdrawals of $20 million and $15 million, respectively.

ETP rates remain low.

As the week looked at overall revenue flow, CoinShares head of research James Butterfill wrote on the company's blog that ETP volumes continued to decline.

For example, while the market saw $8 billion in ETP volume last week, it averaged $17 billion in April.

“These volumes highlight that ETP investors are becoming less active in the crypto ecosystem, representing 22% on global trusted exchanges compared to 31% last month,” Butterfill explained.