Crypto Liquidity Hits $314 Million, What’s Next for the Market?

The world's largest cryptocurrency (BTC) experienced a sell-off after the US stock market closed, resulting in a price drop of more than 6%. The decline began when bankrupt crypto lender Celsius paid off nearly $2.5 billion to 251,000 creditors.

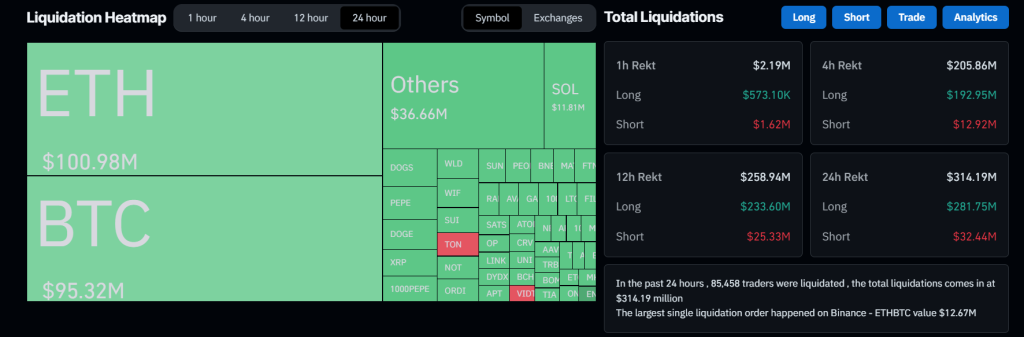

Crypto Liquidations reached $313 million

Amidst this selling pressure, major cryptocurrencies including Ethereum (ETH), Solana (SOL) and Dogecoin (DOGE) experienced record lows similar to the August 5, 2024 market crash.

According to data from on-chain analytics firm CoinGlass, more than 85,500 traders have been withdrawn in the past 24 hours. Meanwhile, the total liquidation registered by the company reached 314.19 million dollars. The single largest liquidity order occurred on Binance ETHBTC, valued at $12.67 million.

According to the data, the main liquidity came from long bets as bulls liquidated more than $282.05 million worth of long positions. This suggests that the bulls were expecting an inverted rally, but it didn't turn out the way they expected.

Meanwhile, short sellers burned $31.70 million worth of short positions during the same period.

Bitcoin price prediction

As of now, BTC is trading near the $59,200 level and has experienced a price drop of over 6% in the last 24 hours. Meanwhile, the transaction volume increased by 36 percent.

According to expert technical analysis, BTC looks bearish and there is a high probability of going down significantly. Following the fall in price, BTC saw a breakdown in key uptrends. If the daily candle closes below the trend, there is a high possibility that BTC may fall to the $54,000 level or even lower.

Will BTC crash again?

Although 251,000 creditors have received payment, there are still 121,000 creditors who may soon receive cash, which could create more selling pressure. To date, Celsius has disbursed $2.57 billion, which is 36 percent of its total disbursements. This implies that if all creditors receive their payments, the market may experience further declines.