Crypto Market in 2025: What to Expect?

2024 is almost over, and it's been a relatively good year for the ecosystem. But what does 2025 hold for the crypto market?

This is a pressing question that investors may have. In this analysis, BeCrypto discusses insights from prominent analysts about the year ahead. Some predict the bull market will peak, while others urge caution. Here is a list of key indicators and key indicators of the main predictors.

Analyst Expects Bitcoin Rally to Endurance, But First…

For Benjamin Cowen, crypto analyst and founder of IntoTheCryptoverse Bitcoin (BTC) in particular, 2025 could start with a correction. Cowen suggests that this may be because in January, after the last half of the year, Bitcoin showed the same behavior. He advises market participants to be mentally prepared.

“In the last 2 cycles, BTC experienced a post-half-year correction in January. It can be helpful to mentally prepare for that outcome. So it corresponds to January 2025. Cowen wrote on X.

However, this thesis is contrary to the opinion that the price of Bitcoin could reach $120,000 in the first month. BTC is currently trading at $97,970. This year, the cryptocurrency reached a new all-time high of $108,268, which represents a 112% year-to-date (YTD) increase.

Ki Young Joo, CEO of the analysis platform CryptoQuant, opined that the Bitcoin bull market could last until the middle of 2025. Young Ju made this statement in July, suggesting that BTC could attract new capital to extend the crypto market's peak in 2025 until then.

However, in November. Young Ju changed his mind. According to him, if bitcoin prices end 2024 on a strong note, it could set the stage for a 2025 bear market.

“I expected corrections when the BTC futures market indicators were overheated, but we are entering price discovery, and the market is getting hotter. If correction and consolidation occur, the bull run may be extended; however, a strong year-end rally may prepare 2025 for a bear market,” said Young Ju.

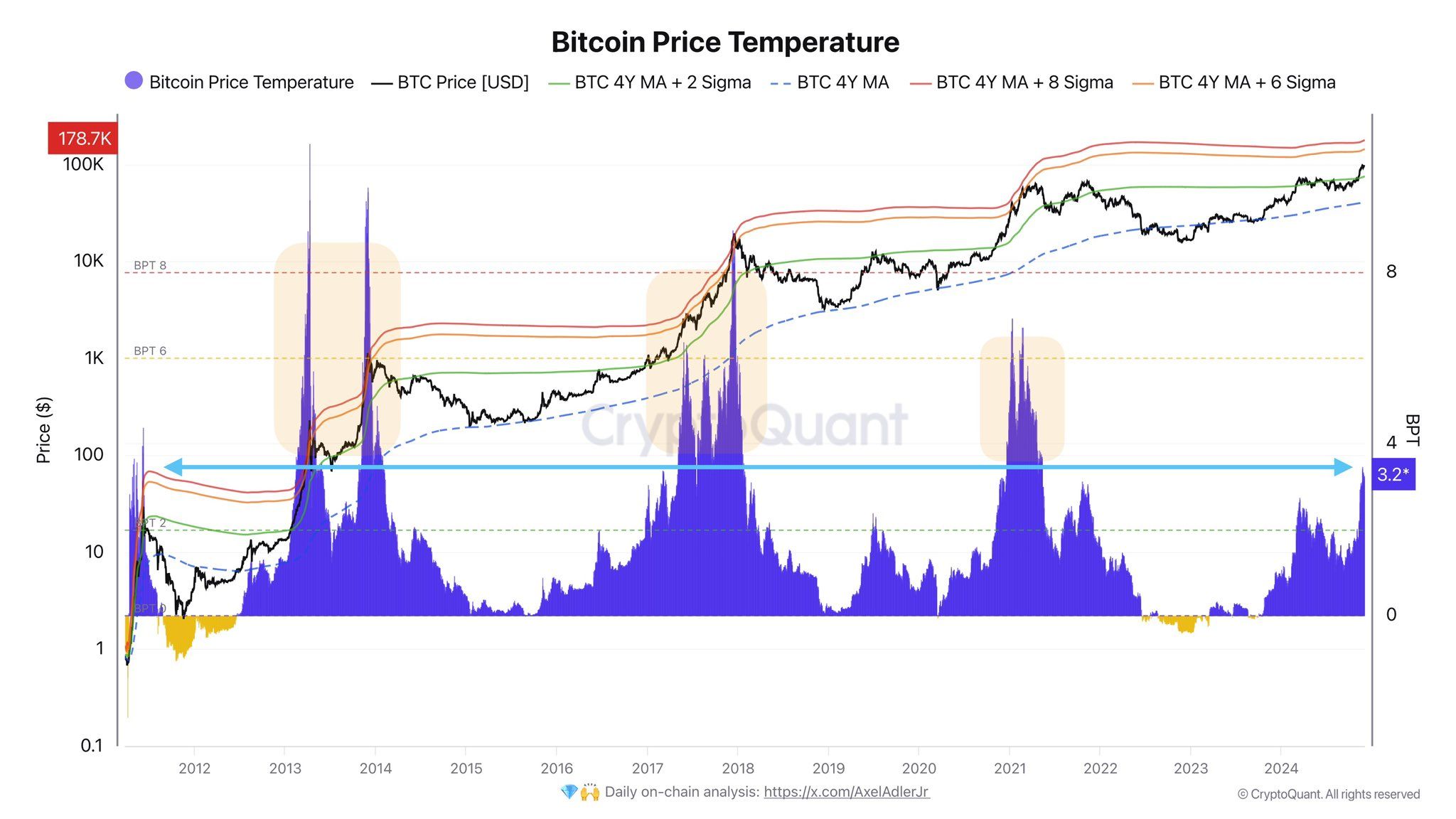

Recently, Axel Adler shared his views on the Bitcoin Price Temperature (BPT), which measures the distance between the current price of Bitcoin and its 4-year moving average.

Typically, Bitcoin reaches the top of its cycle when the BPT reading falls between 6 and 8. On December 7, the Adler Indicator noted that it was at 3.2. However, he mentioned that if the reading rises to 8, it could push the price of Bitcoin to $178,000.

“At the level of 8 BPT, the price can reach $ 178K per BTC. Basically, this serves as a target for 2025, which can be realized if the current demand for the coin in the market continues. Alder mentioned.

Altcoins are not left behind: Solana vs Ethereum rivalry to continue

However, Bitcoin is only one part of the crypto market. Therefore, it is important to look at other assets and the potential macroeconomic outlook for crypto in 2025. New high.

Still, there were some positive signs. For example, BNB and Solana (SOL) have climbed to new highs, while the price of XRP has performed strongly this past quarter. Some relatively new altcoins such as Sui (SUI), Mantra (OM) and Bitget Token (BGB) have also performed impressively.

However, this award would be incomplete without mentioning meme coins that have had a strong hold on the market during this cycle. As a result, experts predict that Mame Coins, AI Coins and Real World Assets (RWA) tokens will continue to perform well in 2025.

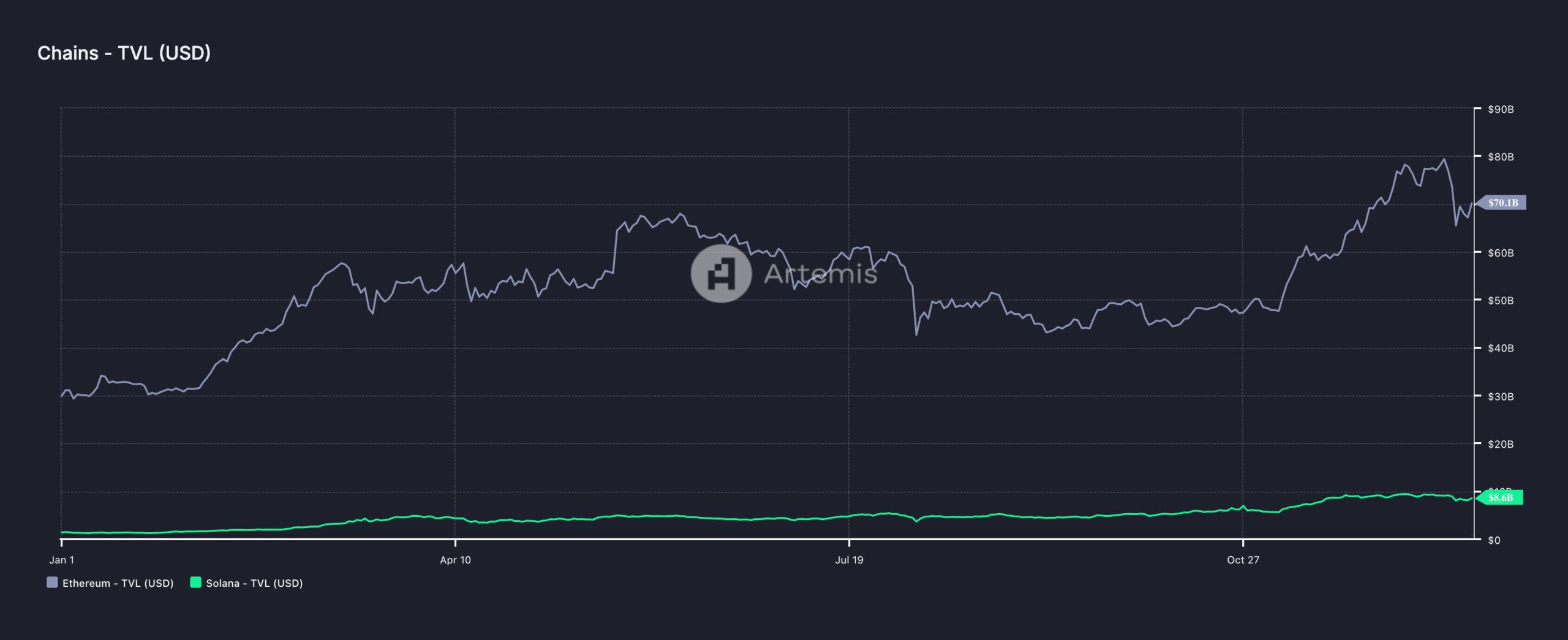

Ethereum (ETH), however, has been a bit disappointing. As a result, digital asset management firm 21Shares says Solana could continue to eat into Ethereum's market share in 2025.

In the report, 21Shares attributed this prediction to the combination of low fees on the Solana blockchain and the acceptance of the PayPal USD (PYUSD) stablecoin. Additionally, he emphasized that this does not mean that SOL will overturn the market price of ETH.

“While we don't expect a full ‘flip', Solana has been the first to outperform and capture more market share than Ethereum through improved UX and infrastructure,” the report said.

Despite this, Ethereum's Total Value Locked (TVL) is higher than Solana. As of this writing, Solana's TVL is $8.60 billion, while Ethereum's is $70.10 billion.

If the forecast comes true, the TVL differential is likely to tighten. As for Solana's ETF application, 21Shares indicated that approval could come in the first three quarters, but could come by the close of 2025 or early next year.

“Solana's expanded role in TradFi is expected to set the stage for traditional financial products such as Solana Futures on the CME or US-domiciled Solana ETFs. While ETF approval may not happen in 2025, the opportunity is expected to increase as we approach the end of the year and into the first half of 2026. 21 Shares added.

What Trump's results and adoption might look like.

From a macroeconomic perspective, the asset manager anticipates that the approval of Bitcoin ETFs will encourage further institutional adoption globally. This sentiment may be related to the election of Donald Trump as the President of the United States.

During the campaign, Trump repeatedly promised that his administration would provide clearer regulations for the crypto sector. His inauguration is scheduled for January 2025, and the resignation of SEC Chairman Gary Gensler will allow the market to gain more freedom.

Outside the US, South Korea is considering lifting its ban on crypto ETFs. If this is successful, it could bring the trading volume to a record high in the Asian region. The UK is not left out either, with speculation that the country will be able to offer crypto exchange-traded notes (ETNs) to retail investors.

According to the above, it seems that in 2025 the crypto market can provide more positive results than what happened this year. Following in El Salvador's footsteps, another country may adopt Bitcoin as a strategic reserve currency.

As of this writing, the only countries capable of achieving that are the US and Javier Millay-led Argentina. If that happens, the price of Bitcoin could reach new highs, and its total market value could increase to more than $5 trillion.

For altcoins, this situation still seems difficult. However, if large amounts of capital flow into these assets, they may appear to be new highs. At the same time, investors may need to be careful. As of 2011 If the market for crypto platforms crashes in 2025, this forecast may be rejected, and the market may fall into a bear phase.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.