Crypto market trends key

Cryptocurrency markets are closely watching several key US macroeconomic events this month, which could have a significant impact on portfolios. Federal interest rate announcements in particular will be a key publication in September.

Positive economic data often influences investor sentiment in the crypto space. When traditional markets strengthen, investors become more confident about the overall economy, and vice versa. This can affect risk appetite and ultimately interest in alternative assets such as cryptocurrencies

US economic events to be seen in September

Bitcoin (BTC) slipped above the $60,000 psychological level, continuing its sluggish performance despite positive triggers. As growing institutional adoption, a more accommodative regulatory environment and expected Federal Reserve (Fed) rate cuts have done little to boost BTC's value.

Bitcoin is currently more than 20% above its most recent high of nearly $73,500 five months ago. As the new month begins, crypto market participants are closely watching key events, especially as historical data suggests that September is typically a period of Bitcoin's worst performance.

Read more: How to buy Bitcoin (BTC) and everything you need to know

Non-farm payrolls, unemployment rates

Investors will be keeping a close eye on the upcoming US Non-Farm Payrolls (NFP) report, which will include key data on job creation and the unemployment rate. The July report showed weaker-than-expected job growth, with 114,000 jobs added, beating the average forecast for August of 162,000.

If the NFP figures for August are strong and the unemployment rate is lower, it could indicate a stronger economy, which could influence investors positively towards cryptocurrencies. Such employment-related reports can significantly affect market sentiment, risk appetite and the overall economic outlook, indirectly affecting Bitcoin and the broader crypto market.

Ahead of the NFP report, data from the Job Openings and Labor Turnover Survey (JOLTS) released Wednesday will provide insights into the health of the labor market. The median forecast of 8.1 million job openings in July was down slightly from 8.18 million, likely pointing to a growing economy, increased consumer spending and wage growth.

Additionally, ADP's National Employment Report due Thursday will provide a snapshot of private sector employment. July's ADP report exceeded the previous estimate of 122,000 jobs, indicating strong job creation and economic growth.

Donald Trump's debate on Kamala Harris

On September 10, the Republican and Democratic presidential candidates for the upcoming November election, Donald Trump and Kamala Harris, will participate in the debate. With cryptocurrencies and digital assets key issues in the campaign, this event could create volatility in Bitcoin and the broader cryptocurrency markets.

Both parties have shown interest in crypto, with Harris reportedly warming to pro-crypto policies.

“One of the things you need is stable rules, rules of the road… Focus on cutting unnecessary bureaucracy and unnecessary regulatory red tape… New technologies protect consumers and create a stable business environment with consistent and clear rules the way,” Bloomberg reported, citing Brian Nelson, a senior adviser to Vice President Harris' campaign. .

On the Republican side, Trump's team is working to position America as the crypto capital of the world. With both candidates looking to connect with the crypto community, the debate is expected to be intense, especially given Trump's fighting style and Harris' background as a prosecutor.

US CPI

The US Consumer Price Index (CPI) for August, scheduled for release on September 11, will be one of the key economic indicators of the month. This data measures the rate of inflation by tracking price changes in consumer goods and services. In July, CPI inflation reached 2.9%, slightly lower than the 3% recorded in June, according to the US Bureau of Labor Statistics (BLS).

With the Federal Reserve targeting an inflation rate of 2%, August CPI data will be critical in determining whether inflation continues to slow. If the CPI falls below 2.9%, it indicates that inflation is moving in the right direction, which may reduce the pressure on the Fed to maintain high interest rates.

Ahead of the CPI release, the September 6 talks between New York Fed President John C. Williams and Fed Governor Christopher Waller will be closely watched. Both indicated a possible shift to looser monetary policy as inflation has already shown signs of easing and the labor market is stable. If their upcoming speech reflects their belief that the bullish trend is continuing, it could be huge for the cryptocurrency market.

American PPI

The day after CPI data is released, the U.S. Bureau of Labor Statistics publishes the U.S. Producer Price Index (PPI) inflation rate. In July, the PPI eased significantly more than expected, giving relief to both stocks and Bitcoin.

Notably, US PPI inflation fell to 2.2% year-on-year (yoy) in July, below expectations of 2.3% and down from a revised 2.7% in the previous session. Similarly, core PPI inflation, which excludes food and energy prices, eased to 2.4% in July, down from 2.7% and significantly lower than the previous 3.0%.

If the August PPI data to be released on September 12 shows a slowdown in inflation, it could boost appetite among investors, favoring assets such as Bitcoin and other cryptocurrencies.

Interest rate paid

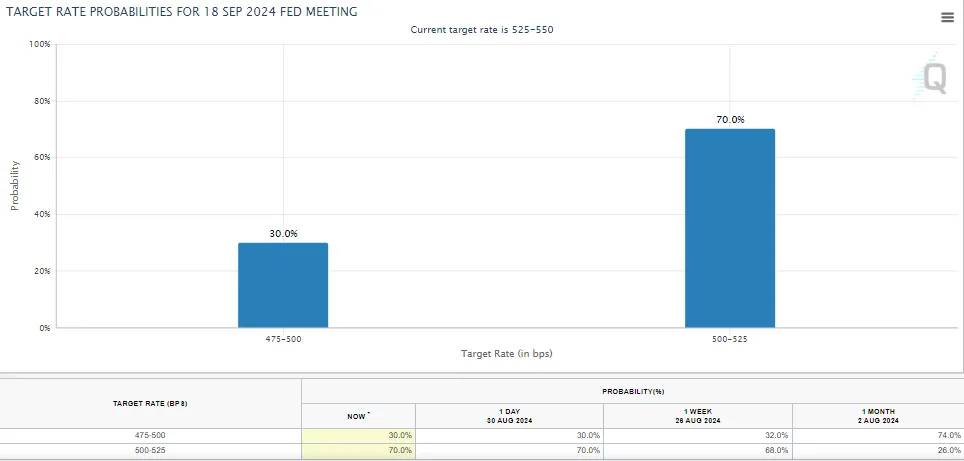

Another key event this month is the Federal Reserve's interest rate decision on September 18. In the previous meeting, the Federal Open Market Committee (FOMC) decided not to change interest rates, policymakers voted unanimously to keep the overnight lending rate between 5.25. % and 5.50%

However, at a recent meeting, Fed Chairman Jerome Powell increased his confidence that inflation is on a sustained path toward the Fed's 2% target.

“The time has come for policy reform. The direction of travel is clear, and the timing and speed of the deceleration will depend on earnings data, the improved outlook and the balance of risks,” Powell said.

Read more: How to protect yourself from inflation using cryptocurrency

This suggests that the Fed is at the end of its accommodative hiking cycle, according to the latest economic data. Market participants will closely watch the upcoming decision, because it can have a wide impact on financial markets, including cryptocurrencies.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.