Crypto merchants look at the time of $ 3.3 billion options

More than $ 3.3 billion dollars and eeth-off options will expire over $ 3.3 billion. Data from the expected US CPI (index price information index) and frozen PPI (manufacturer index).

How do the expiration of the expiration of today's expiration benefits?

More than $ 3 billion revenues in the opinions – Sigpato Market Response

The According to Paglot, more than $ 2.76 billion dollars in Bitcoin options for more than $ 2.76 billion options. This space options include 26,543 contracts in the last 25,925.

Clusions are 1.02, which are more submissive than violations by reflecting the character of behavior.

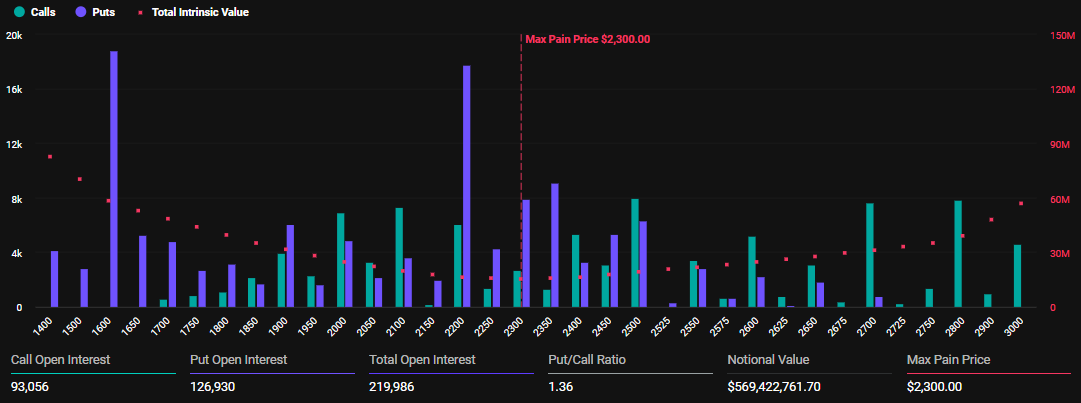

By participating in contractors, 219,989.42.42 million controversy from the last 164,591 contracts from last week. The highest illness of pain is $ 2,300 with a call pillar.

The “highest of pain” in Crypto options is crucial. It encounters the most important financial comfort that would represent the price range.

According to this text, Bitcoin exchange the “ehresh” when $ 2,912 dollars dollars for $ 2,572 for $ 2,572. This means that both digital resources are mainly above the right of the right marketplace.

Specifically, markets to reduce fees, the highest prior to the strike or high pain stop focus.

“B. Ticket is independent …

Griques see the bier over $ 105,000 above $ 105,000 billion have been excessively in the market market. Be careful in preventive strategies that commendation methods of precautions in the market, which you choose to sell precautions rather than a problem.

“Many merchants feel that everyone is running, and when they feel” Greeks, “the Greeks” are working more protective positions.

How does the US CPI and PPI affect the Crepto options market?

In the meantime, these anological options After the price of inflation in April, the small reader showed the small reader from the month of February. 2021. Similarly, the April PPP is fell below 2.5% for 2.5%.

According to analytics, the April information may be kept in this shift while the narrative information changes. Previous Restrics Retail signs of retail signs is pushed to cut the valuable prices for the vipril types and 2% inflation target signals.

“The controversial cavity are returned, markets are not ready for the coming thing.”

This typically are increasingly, such as the risk of risk of risk of risk of risk of risk of accidents such as bitcoin and ethrum. The lower price of inflation affects the market fence and market cool, which stimulates premium option.

However, the CPI and PPI Short-term movements, increased, and ppi short short-term operations of short-term covers CPI and PPI.

Alternative finances may cause choir price activities, but the results are usually temporary. The market is the first day, combination of first efficiency.

Nevertheless, merchants should carefully analyze technical indicators and market emotions before investing this variable.

Teaching

In the following project instructions project policies, Binnibratory is committed to reporting a clear, clear, reporting clear, clearly reported. This news article has a purpose to provide current information. However, depending on this content, readers recommend a specific study before making any decision. Please remember that service terms and conditions, privacy policy and responsibility are updated.