Crypto reached $3.13 billion in revenue

Crypto investment inflows hit a record-breaking weekly inflow of $3.12 billion last week. This increase brings year-to-date inflows to $37 billion, reflecting Bitcoin's growing dominance and renewed interest in digital asset investment products.

It comes as Bitcoin (BTC) continues to show potential for new record highs, with the highest price now standing at $99,588 on Binance.

Bitcoin dominates among record high levels of Crypto Inflows.

Bitcoin led the pack last week with $3.078 billion in revenue, its biggest performance to date. Although the current price has reached the highest level, the increase in demand has been extended to short-Bitcoin investment products, which have recorded a weekly income of 10 million dollars. Notably, these short-Bitcoin revenues reached $58 million per month – the highest since August 2022.

The latest inflow of $3.12 billion is a significant increase from previous weeks, continuing a strong upward trend. For context, the week before saw $2.2 billion in gains, fueled by the Republican campaign and Federal Reserve dovishness.

It brought in $1.98 billion after the election a week ago. These consistent income streams demonstrate the market's resilience and growing confidence among investors despite widespread economic uncertainty.

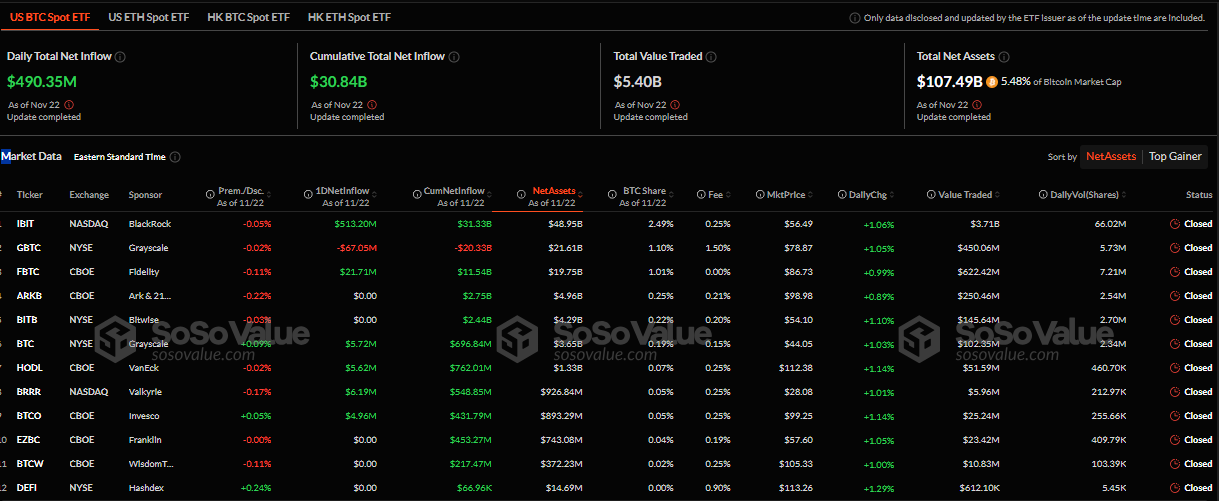

However, the adoption of Bitcoin ETFs (Exchange Traded Funds), which are attracting significant institutional interest, is fueling Bitcoin's growth. According to data from SoSoValue, the combined net income of Bitcoin ETFs in 2016 was By the time markets closed on Friday, November 22, it had reached $30.84 billion.

With all eyes on MSTR, ETFs have quietly picked up more than 10x the amount of BTC buried last week. Pac-Man mode is on,” said Erik Balchunas, ETF analyst at Bloomberg Intelligence.

Amid growing optimism, Balchunas recently noted that US spot ETFs satoshi are 98% of the world's largest holdings of BTC. Similarly, analysts predict that Bitcoin's upward trajectory may extend to $115,000 this holiday season. Whale activity and long-term carriers cashing in on the current rally will strengthen the bullishness.

MicroStrategy's Michael Saylor, a vocal Bitcoin advocate, hinted at expanding the firm's Bitcoin holdings, further strengthening institutional confidence in the asset.

Solana (SOL) has emerged as a strong contender among altcoins, recording a $16 million revenue stream last week. This far surpasses Ethereum's $2.8 million. However, on a year-to-date basis, Solana still trails Ethereum, which remains the dominant altcoin with the highest gross revenue.

Solana's recent success can be attributed to increasing optimism surrounding Solana-based ETFs. From VanEck, 21Shares and Bitwise, among others, investor confidence in the Solana ecosystem has increased.

These ETFs are expected to expand Solana's technology to retail and institutional investors pending SEC (Securities and Exchange Commission) approvals.

As Bitcoin and the broader crypto markets continue to rise, optimism is tempered with caution. Market watchers like CryptoQuant caution against over-exuberance, warning of a possible price correction after bitcoin's recent rally. Other skeptics, including Cyber Capital's Justin Bones, have raised concerns about cryptocurrency's vulnerability to liquidity risks.

On the one hand, analysts predict continued growth led by ETFs, institutional adoption and strong market sentiment. On the other hand, overleveraged positions and warnings of liquidity risks suggest that a pullback could follow this severe phase. How long is this progress? They will depend on regulatory developments, market sentiment and macroeconomic conditions..

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.