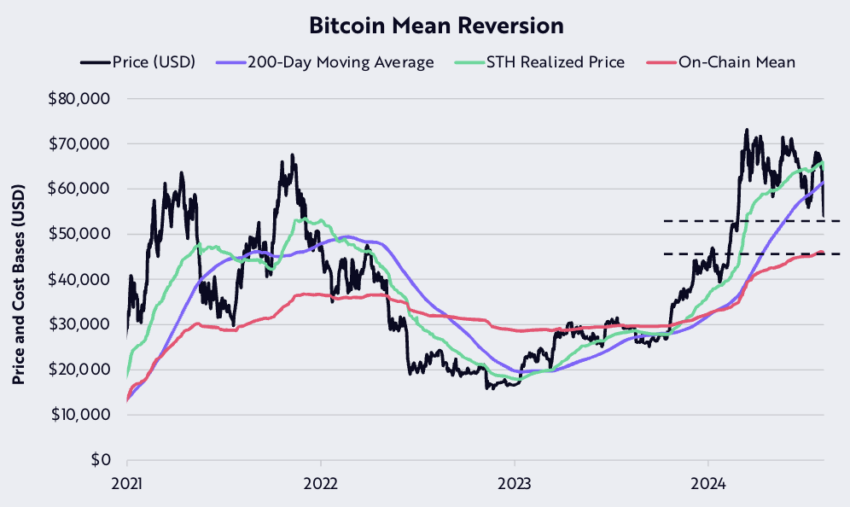

Crypto Wells buys between the $46,000 target

The price of Bitcoin (BTC) appears to be in danger as major stakeholders, often known as crypto-wells, have halted their buying activity.

This buying halt has raised concerns about Bitcoin futures, especially as technical patterns show a winning trend. Historically, such trends have been associated with periods of prolonged downtrends or consolidation.

Crypto Wells Bitcoin is back

According to Loonchain's latest data, institutions have pulled back from Bitcoin purchases, coinciding with a 1.44% decline in the price of Bitcoin over the past 24 hours. Bitcoin is currently trading around $58,300, down more than $61,900 from last Monday's high.

The recent price drop below $60,000 seems to have affected institutional demand for Bitcoin.

“Institutions seem to have temporarily stopped buying, and the price of BTC is down 4.5% today! We noticed institutions accepting USDT from the Tether Treasury and transferring it to the exchange 2 days ago,” said Lookonchain.

In addition, the stablecoin's holdings in Tether's treasury decreased, and $1.3 billion was traded after the August 5 crypto market crash, indicating a reduction in buying pressure and a more cautious approach from investors.

Amidst these concerns, trading veteran Peter Brandt suggests that Bitcoin may be witnessing a bullish to bearish trend. The analyst sees a “death cross” on the weekly chart between the 8 and 19 simple moving averages (SMA).

Although this is not always a reliable predictor of future prices, it indicates the beginning of a decline.

Interestingly, David Poole, Research Associate at ARK Invest, has provided insights into Bitcoin's critical support levels during a price correction.

“Bitcoin's most important price supports are at $52,000 and $46,000, the latter confirmed by the chain average is the red line on the chart,” Puell explained.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

In conclusion, Bitcoin's current technical conditions, with a pause in institutional buying and the emergence of a death cross, suggest a cautious outlook in the short term. With critical support levels identified and market sentiment leaning towards risk, the coming weeks will be crucial in determining whether Bitcoin can stabilize or if further declines are on the horizon.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.