Crypto Wells held $227 million in the middle of the Bitcoin market

Recent market activity shows that crypto whales are rapidly buying Bitcoin (BTC), hinting at a possible market recovery. This week, Spot On Chain highlighted notable transactions including the largest withdrawal by cryptowell—36LMb.

This investor moved 999.999 BTC, worth about $55.09 million, from Binance, with Bitcoin valued at $55,114 each.

Crypto Wells buys $227 million in bitcoins

The move is part of a larger trend in the past week where the crypto currency, worth more than $227.7 million, has moved above 4,014 BTC. Notable withdrawals from Binance included several key players:

Crypto whale 1KuPi spent 1,110 BTC worth $64.8 million on September 2nd and September 5th. Crypto whale bc1qg moved 1,381 BTC between September 2nd and 6th valued at $78.25 million. Hot wallet – 39xG8, released 100 BTC on September 5 6. whale bc1qd transferred 433 BTC worth $23.93 million between September 5th and 9th.

Read more: A comprehensive guide to tracking smart money in the Crypto market

These moves coincided with an 11% drop in the price of Bitcoin last week, following an increase in outflows from US Bitcoin-exchange traded funds (ETFs). This marked the longest period of daily outflows since they were listed earlier this year. Investors dumped about $1.2 billion into Bitcoin ETFs in the eight days ending Sept. 6.

Last week, Bitcoin fell to around $52,550. Therefore, the dip offers a suitable opportunity to buy whales. Historically, buying at such lows often precedes a market recovery.

Brian Quinlivan, lead analyst at Sentiment, said: “Since that big August crash, we've had the biggest spike in negative keywords since last month…it became the last time to buy.”

Bitcoin is currently up 4% from last week's lows, now hovering around $55,000.

In light of the recovery, some investors, including BitMEX's former CEO Arthur Hayes, have closed their short positions on Bitcoin. Hayes gained 3 percent. His decision followed comments from US Treasury Secretary Janet Yellen, who pointed to controlling risks to the labor market.

“Bad Gurl Yellen is watching; if the markets go down any further, she'll certainly print more money and bring about the collapse,” Hayes joked.

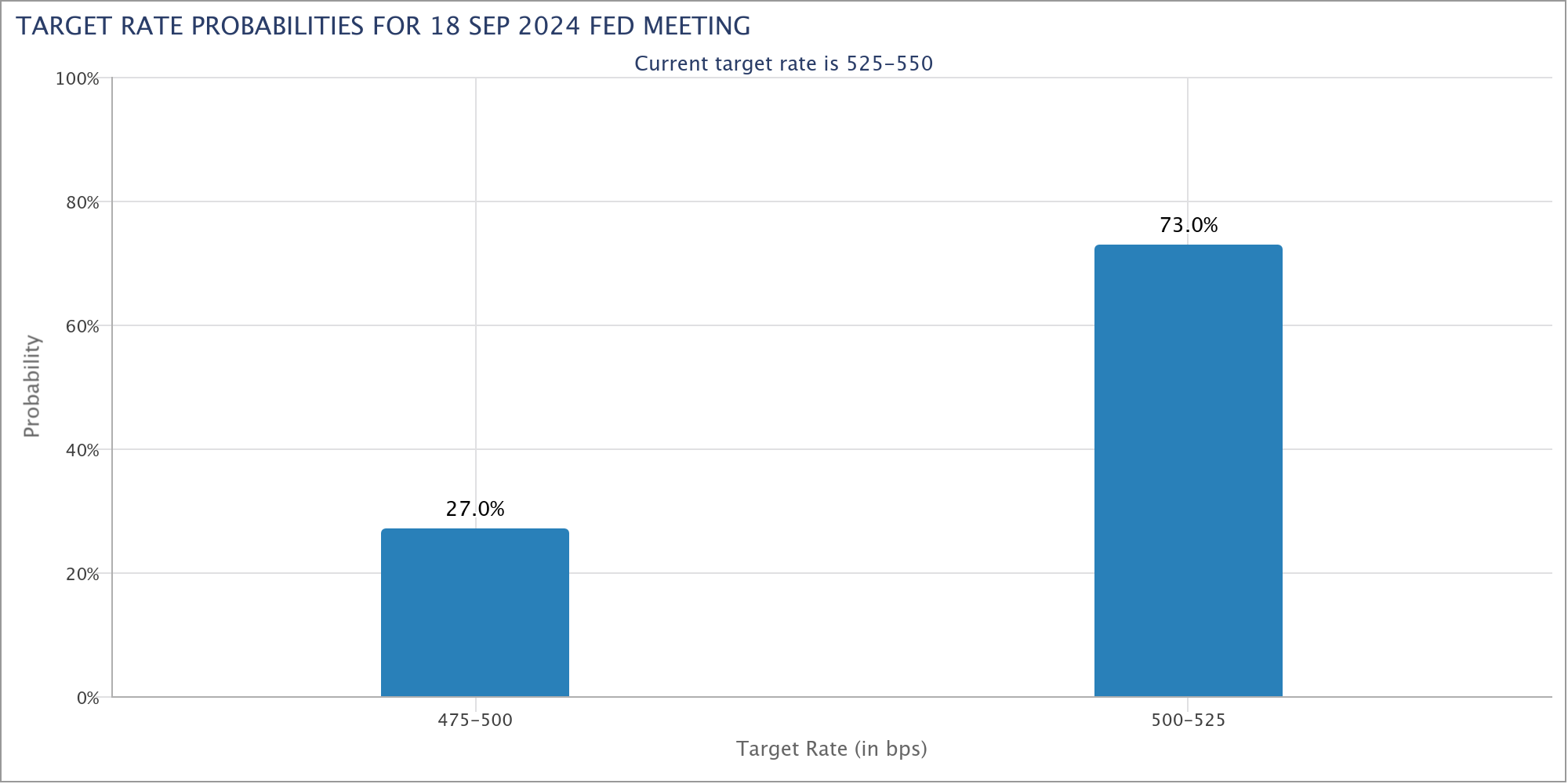

Economic indicators have influenced market sentiment. U.S. nonfarm payrolls data showed the economy added just 142,000 jobs in August, below expectations of 164,000. This underperformance has led analysts to expect a 50 basis point rate cut by the Federal Reserve in September.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

“We expect the Fed to cut by 50 basis points to stay ahead of the curve, as it would be too slow to cut monetary policy by 25 basis points to prevent too much damage of late,” said Marcus Thielen from 10X Research.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.