Cryptocurrency movement creates rapid market renaissance

Bitcoin (BTC), Ethereum (ETH) and the broader crypto market recovered following Monday's market crash.

After entering the $49,000 level on August 5, Bitcoin is now trading at $57,375. Similarly, Ethereum fell to $2,100 on the same day and then regained its footing at $2,519.

Brutal sentiments persist despite macroeconomic risks.

According to data from Santiment, the public has played a major role in the crypto rebounding over the past 30 hours. Analysts attribute this rapid recovery to large investors, commonly referred to as Welsh, who are actively accumulating these crypto assets.

Read more: Who will have the most Bitcoins in 2024?

On-chain data from CryptoQuant shows that over 404,000 bitcoins have been moved to permanent keeper addresses in the past 30 days. CryptoQuant CEO Ki Young Joo said this is “clearly piling up.” Ki has seen 40,000 bitcoins flow into US exchange-traded funds (ETFs) over the past 30 days.

“New whales are being stocked,” he said.

Key also pointed to a lack of major sales activity by “old whales,” specifically referring to large investors who have been in charge for more than three years. He pointed out that these whalers used to sell their catch to new whalers between March and June.

Despite the bullish sentiment, Key acknowledged the macroeconomic risks that could lead to a forced sell-off. He cited large deposits like those at Jump Trading as an example. Moreover, some of the indicators on the chain are borderline, even if they turn into a mess.

Amid growing concern about the future of the crypto market due to the recent crash, Ki remains optimistic. He believes the bull market is still strong.

“If the market doesn't recover in two weeks, I will reconsider. I follow the smart money, so if I'm wrong, the new whales are either wrong or they've underestimated the macro environment,” he said.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

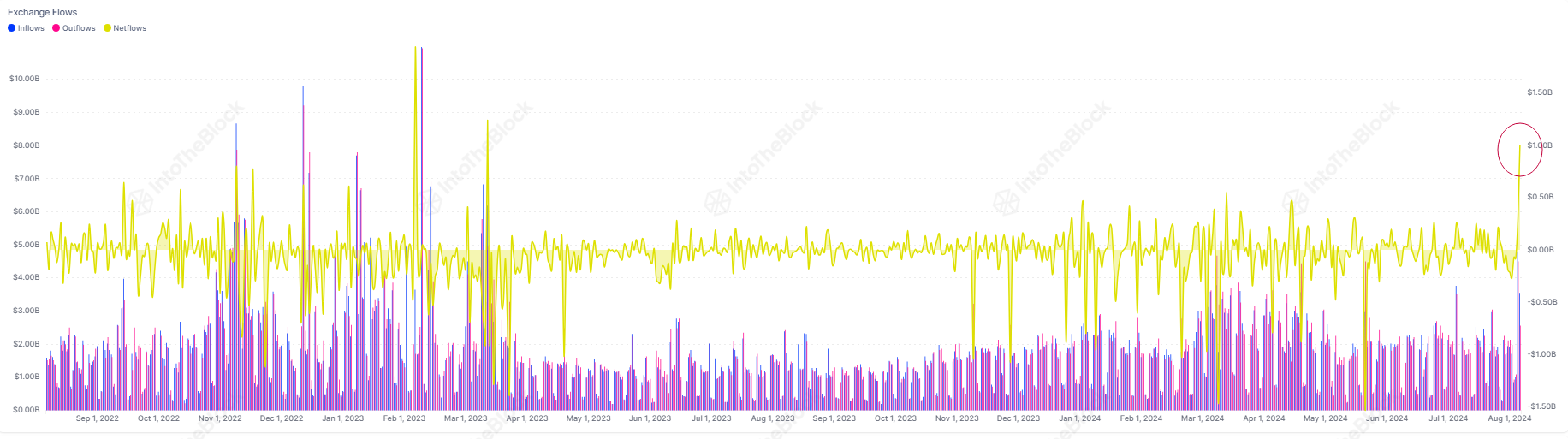

Juan Pellicer, Senior Researcher at IntoTheBlock, said that what caught BeInCrypto's attention was the stablecoin's entry into the currency. Yesterday, it reached $0.99 billion, the highest since April 2023. This net income shows that investors are typically putting stable coins into buying properties.

A recent report by CoinGecko further reinforces these beliefs. He stated that the collapse of the crypto market during Covid-19 is still five times worse than the recent sell-off.

“In the last ten years, the worst global crypto market correction was -39.6% on March 13, 2020 due to the risk of Covid-19. […] In comparison, the largest crypto market selloff this year to date was significantly lower -8.4%, which took place on March 20, 2024,” the report reads.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.