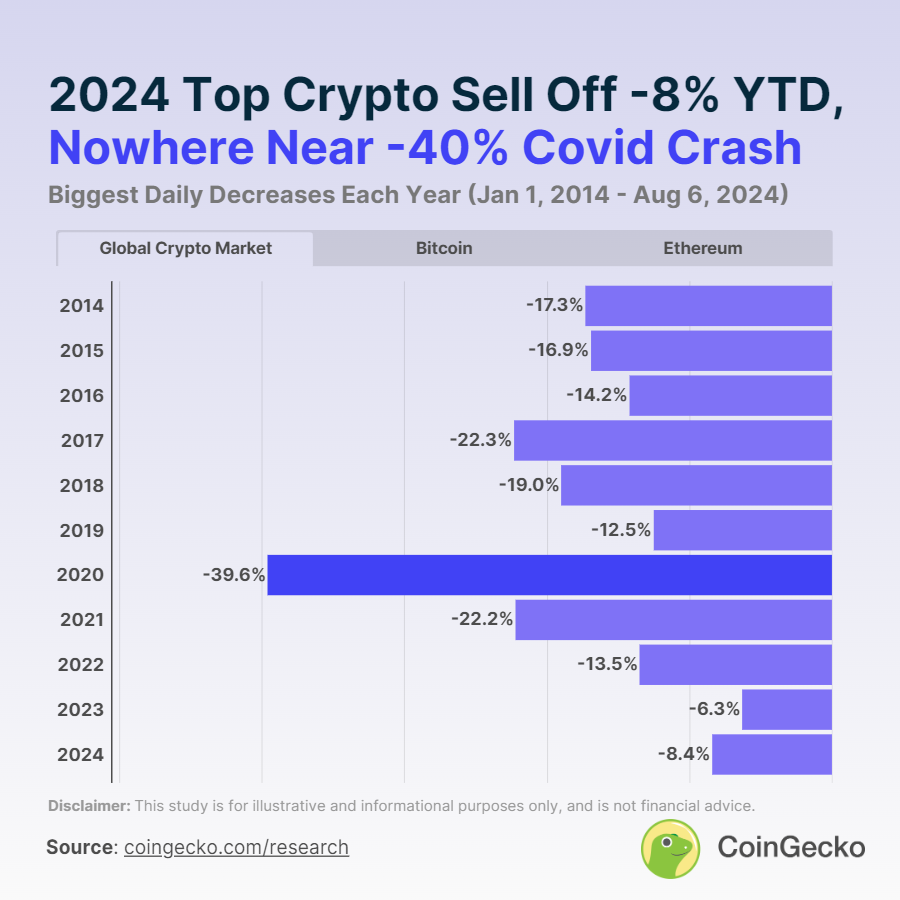

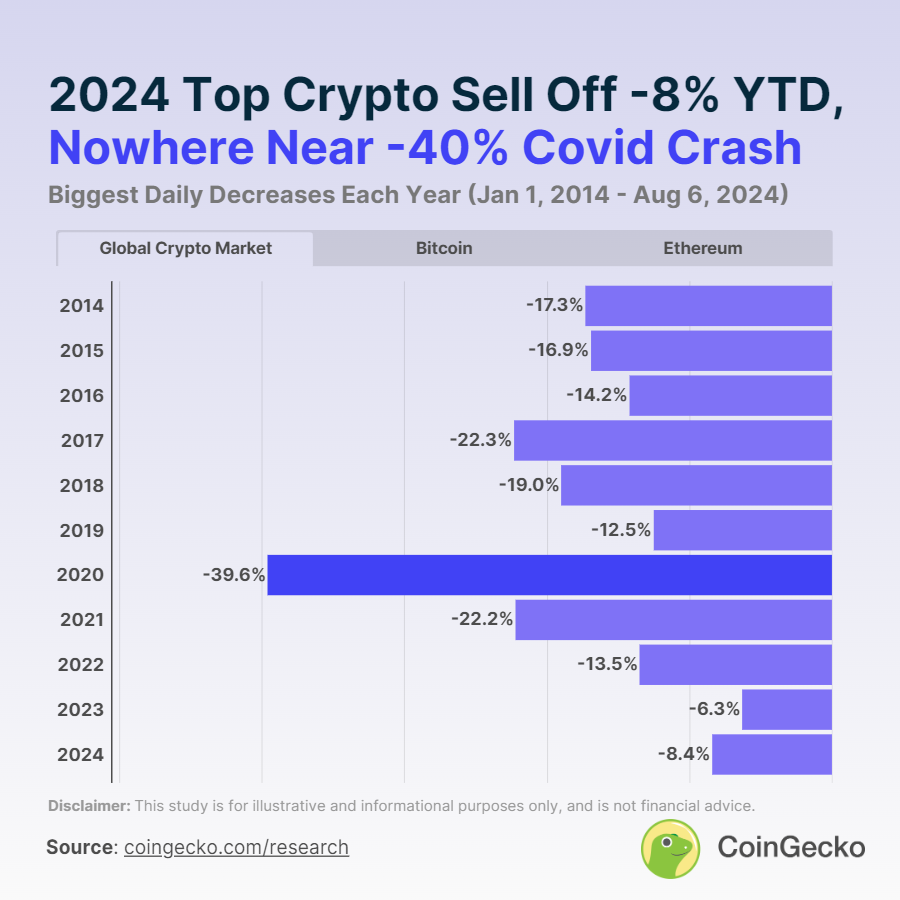

Crypto’s Recent Returns Are Five Times Softer Than Covid Crash: CoinGecko

Key receivers

The biggest crypto market selloff in 2024 was -8.4%, which is significantly lower than the -39.6% risk of covid-19. Crypto hasn't recorded a single day market correction since the FTX crash in November 2022.

Share this article

Despite Bitcoin (BTC)'s recent 29% drop in two weeks, the crypto market's 2019 It showed resilience in 2024, with no significant corrections compared to historical declines. According to CoinGecko, this year's biggest selloff was a relatively mild -8.4% on March 20, 2024.

In contrast, the worst crypto market correction in the last decade was caused by the Covid-19 crisis on March 13, 2020. The total crypto market capitalization fell -39.6% day-on-day, from $223.74 billion to $135.14 billion, the report highlighted. .

Bitcoin experienced the largest price correction of -35.2% on the same day, with Ethereum showing the second largest decline at -43.1%.

In the year Since the fall of FTX in November 2022, the crypto market has not recorded a single day of correction. Over the past ten years, the longest crypto corrections have lasted at most two consecutive days, and only three times.

In the year Since 2014, the global crypto market has experienced a 62-day market correction, representing only 1.6% of this period, while the average crypto market correction is 13%.

Specifically, 2023 saw a zero-day correction for the entire crypto market, Bitcoin and Ethereum. Although the global crypto market and Bitcoin avoided corrections in 2024, Ethereum experienced two days of price corrections this year: -10.1% on March 20 and -10% on August 6, 2024.

Share this article