Data Companies Sell Crypto to Save Their Stocks: Is This Sustainable?

Highlighting the high net worth asset value (NVNV) crisis among DGJG asset managers, FFNSL. It will sell for $32.7 million in ENTERUS.

The sale will cost more than $42.7 billion in ethical competition and more than $42.7 billion across the entire sector. This forced sell-off is due to a wave of over-inflated exposures in corporate treasury stocks as they struggle below the value of their asset-date stocks.

Sponsored Sponsored

Treasury companies sell assets until the stock is broken

In 2007, 10,922 extensions were sold in FG Nextus to support the 2007 million dollar share. The company will use some of the value of the video held after the issue of the stock from SAVA with additional AV. The FG Nexus, which went up to $11.9 million on Wednesday, was funded by $11.9 million, a fiscal year of $11,005, and $37 million in funding.

8% of the above represents $3.45. Shares reached $3.94 per share in mid-November. However, this method is approximately 10 million dollars in debt and a 21% compensation reserve compared to the September level.

FG NEXUuss is one of the many digital asset companies looking for Crypto sales. At the end of October, Enthzila announced the sale of $ 40 million in the United States to facilitate the stock houses. The company said that since October 24, there are about 1200,000 companies starting from about $1200,000 and about 1200,000 after about $1200,000.

One of the starting companies is the price that covers the price of sippino containers (MNAVES is a value below 1.0), they realize the hidden prices. The most effective way to do this is through the stock buybabborbbork, but it is necessary to realize the money by looking for money. If the company does not have enough cash reserves, it must sell the fuel for cash.

MetPlationnet, a data company that stores Bitcoin, fell to 0.99, down to 0.9, before recovering to 1.03. The shares doubled from June, sector-wide tension. Mixing fixed components with Crypto exposure, the pressure of current market conditions is already influencing.

Sponsored Sponsored

Structures that adjust market pressure

Data companies accumulated $22.6 billion in Q3 alone, out of $42.7 billion in CRUPPode. This expansion is positive, with positive feedback loops and rising prices, which were set at more than $126,000 in October. However, subsequent benchmarks have exposed weaknesses in the capital structures built and access to the capital market.

Treasury companies only account for 0.83% of the total CRUSPPTO market capitalization. Their containers, however, ensure their impact during take-off. Prices are sold at the time of sale of convertible notes, put offers, put offers and permanent preferred equity.

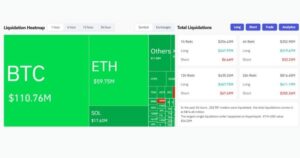

Market liquidity as asset prices have declined significantly. Bitcoin's order book depth fell from $20 million to $14 million in 1% bonds. Analysts estimate that the sales of the treasury company will be between $4 billion and $6 billion.

Systematic risks such as buying installations

The lack of confidence and reduced capital deployment led to corporate crypto purchases. They are now selling fixed demands that were once fixed demands. Even for companies with heavyweight balance sheets, the risk of appearing between CRUCPTON prices and fair values is myspcoin's “stock stock number 60% KMCPPPP.”

Small treasury companies, especially those that hold less liquid assets, will increase the stress. Many of the tablets were exposed to Solana, and many organizations were focused on property damage. Add to the broad sector exposures of limited detail and thin business volumes in variable amortization.

Retail investors have already contributed to the liquidation of institutional investors to reduce market demand. In the year In November, more than $4 billion in market costs and volatility adjusted for market-maker activity. These conditions are similar to market crashes that have occurred in other asset classes, such as the 2008 mortgage payments.

This drug crisis will lead to long-term stimulation of digital asset treasury models. Elderly emergency management and regulatory oversight may be necessary if the broader market is faced. The ability of the crypto holdies to sustain the forced liquidations after the weeks ahead will determine whether the sector survives their slump or a dominant recovery.