Do we need this many Layer 1 Blockchains? Shocking truth

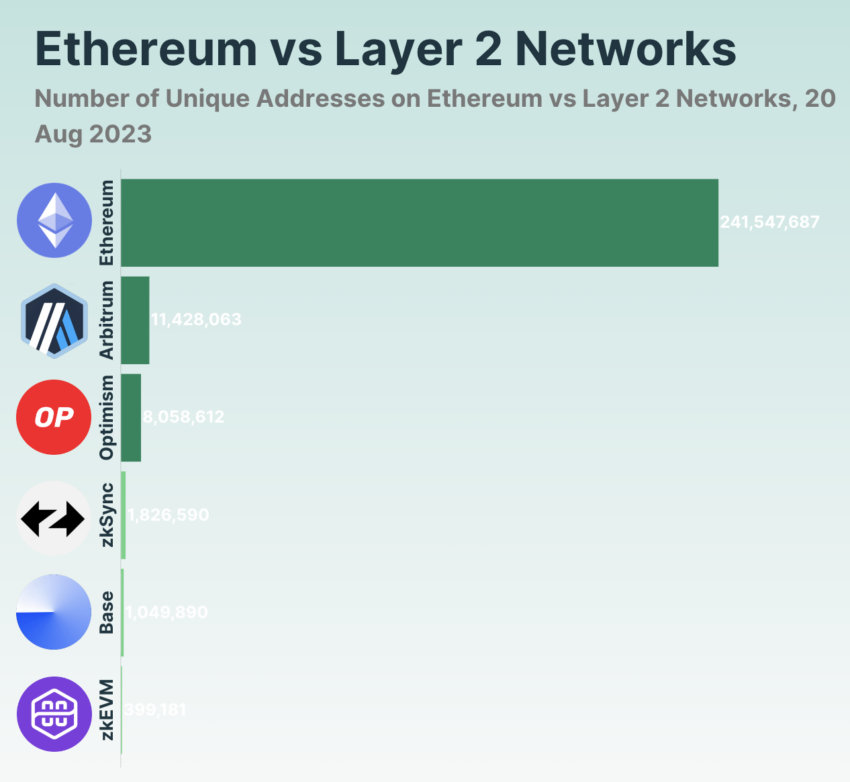

The cryptocurrency industry has seen an explosion of Layer 1 (L1) solutions, each offering unique promises of scalability, decentralization, and improved user experience. Yet, although L1 platforms are higher, many of the same challenges persist. With the growing popularity of Layer 2 (L2) solutions that address these scalability concerns, questions are raised about the value of continuously launching new L1 blockchains.

To solve this problem, BeenCrypto spoke to three key blockchain developers—Jack O'Holler from Scale Labs, Charles Wein from Galxe, and Matt Katz from Caldera—to solve this problem. Their insights highlight the industry's struggle with expansion, the rise of L2 solutions, and intense competition between both new and established L1 platforms.

Layer 1 Glutathione: Solving or Exacerbating Problems?

L1 blockchains form the basis of decentralized networks, generating decentralized applications (dApps) and protocols. Ethereum, Bitcoin and a few L1 chains dominate the market. Still, new competitors emerge regularly, hoping to solve blockchain's most persistent challenges.

However, the influx of new L1 blockchains raises an important question: do we need more or are we overcomplicating the ecosystem without making real improvements?

Skale Labs co-founder Jack O'Holler credits L1's market cap. Arguably, while many L1 projects are emerging, only a few are gaining meaningful traction.

“The Layer 1 market is crowded from a narrative and new token perspective, but very small-scale chains are executing in terms of market traction,” O'Holleran said.

O'Holler points to metrics from CoinGecko, where most of the developer and user momentum is consolidating around the top 10 blockchains. Even when a new L1 offers a new solution, O'Holleran emphasizes that it's not enough to guarantee success.

“Right now, there's a fight for new chains to gain a foothold in the developer market. Weather systems are gaining user traction but struggling to capture market share with net new applications,” O'Holleran told Beincritpo.

The competition in the L1 space has intensified, new projects must be much better than the existing ones to make an impact. O'Holleran believes we are at a point where only the strongest L1s will survive.

Case for new L1 Blockchains

However, not everyone agrees that the market is oversaturated. Charles Wein, founder of Galax and Gravity, sees the proliferation of new L1 chains as a sign of innovation. His company recently launched its own L1 solution, Gravity, to address the scalability issues in the platform.

“The Layer 1 space has exploded, many new blockchains have entered the market,” Wayne said. According to him, these new L1 blockchains are not redundant but bring scalability and specialization to the fore.

“Old blockchains struggle with congestion and high fees, while the new L1s offer better transaction and transaction costs,” Wayne added.

Some of these new L1s will incorporate advanced technologies such as zero-knowledge credentials (ZKPs) to enhance privacy and security, Wayne said. His view reflects the growing need for niche or specialized L1 chains that cater to specific industry needs.

Gravity, for example, focuses on cross-chain interoperability, providing an omnichain infrastructure that general-purpose blockchains like Ethereum may not adequately address. For him, the introduction of new L1s makes the development ecosystem more agile and responsive to real-world challenges.

Layer 2 Solutions: Future Scalability?

As the debate about the need for new L1 blockchains continues, L2 solutions have become a popular alternative. L2 solutions aim to improve scalability by building on top of existing L1 chains, alleviating the need for a completely new blockchain infrastructure.

Matt Katz, founder and CEO of Caldera, supports L2's solutions. The company's “bundle-as-a-service” platform helps developers quickly create blockchains for Ethereum L2.

“Ultimately, the difference between L1 and L2 mainly involves implementation details and affects the overall architecture of the blockchain,” Katz told BinCrypto.

He believes that while L1s provide the foundation, L2 solutions offer more flexibility to developers without having to build an entirely new blockchain. Katz highlighted the implementation problems that many new L1 blockchains face.

“L1 blockchains, in contrast to L2 solutions, do not have native, built-in bridges to Ethereum. This absence exacerbates the issue of liquidity fragmentation, creating significant misunderstandings when managing assets.”

Read more: Layer 1 vs. Layer 2: What's the Difference?

On the contrary, L2 solutions use built-in bridges that are compatible with the security model of the chain, which makes them more efficient and reliable. Despite his support for L2 development, Katz acknowledges that the influx of new L1s could damage the ecosystem. Too many L1s lead to fragmentation, liquidity issues and increased competition, which can stifle innovation.

The way forward: L1 or L2?

The blockchain industry faces a critical decision: should the focus shift from launching new L1 blockchains to refining existing L2 solutions? Both approaches have their merits, and it is clear that no single solution will address all proliferation risks.

O'Holleran argues that the market naturally filters out weak L1 chains leaving only those that provide real value. On the other hand, Wayne believes that new L1 blockchains are necessary for innovation, while Katz sees L2 solutions as a way to streamline the ecosystem.

Read more: Layer-2 Crypto Projects for 2024: Top Picks

Ultimately, the way forward depends on how developers and users balance the need for innovation and the need for a more scalable and workable blockchain ecosystem. Through L1 or L2 solutions, the goal is the same: to build a blockchain infrastructure that can support the needs of the growing digital economy.

Disclaimer

Following Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is committed to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its employees. Readers should independently verify information and consult with a professional before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.