Do you rotate the feed rate cut reload frequency?

In the year The CRESPTo market crash that started on October 10 turned into one of the worst rallies in the history of digital assets. The $19 billion in bond purchases has cut thousands of billions of jobs out of the stock market.

According to the entire Crypto liquidity chart data, most of the losses come from long traders who are engaged in spreading and mistaking the wrong risks. The whole week from October 10 billion to October 10 billion will drink, and from October 10 to October 17.

In the year If it touches above $103,600 while it is at $3,600, XPN drops to $2.20. The greatness of the crash is that after earning more than 500 million dollars in youth, they have an income of more than 18 million dollars.

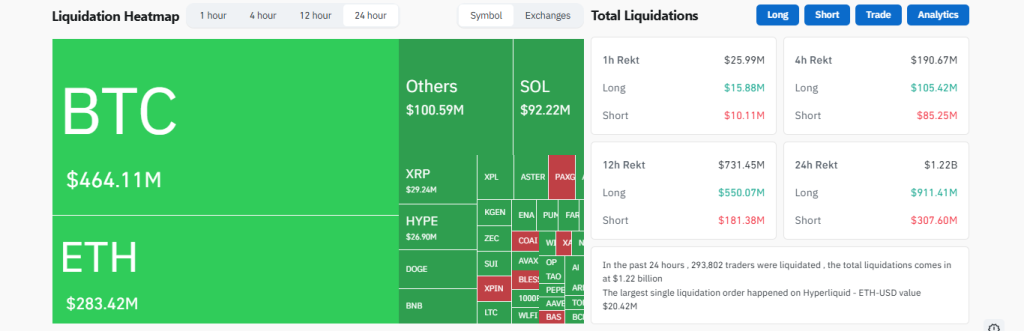

October 17 liquidation will add more than 1.21 billion dollars to the great

The pain does not end with the first tendons on October 10th. In October 2025, the Crypto market crashed for a full week longer, and today's Cressath market liquidation shows that market conditions are worsening while volatility is severe.

In the new record, however, on October 17, $1.21 billion of the positions were obtained, and the most volatile designations flowed since the date of the designation. More than 294,000 traders have highlighted how the feeling of the fruit is left, which has been summed up in 244,000 times.

Similarly, more digging was the first attempt to recover, but from October 14 – 14. As a result, short-term recovery attempts in the market are again overseeing excursions.

On the 14th, about 700 million dollars were destroyed. on the 15th, more than 450 million more; On the 16th day, approximately $730 million was lost. On the 17th, the supremacy of clay has returned to full force, the market still shows determination. In the year On October 17, the largest single liquidation occurred in the year of 20.42 million dollars.

Why has the resistance market taken over the competition today?

Several Crespto market crashes combined to create this storm. First, the global trade tensions exposed by reading a sharp cellolot around the international markets from the threat of 100% tariffs by President Trump.

Second, the ongoing shutdown of the United States has increased investment anxiety, Bitcoin Etf has shown that the risk of entry into the period institution is too risky.

The result is a highly competitive environment, where traders prefer cash and stable assets as they rotate. This is the reason why the price of gold (XUAU / ASD) is confused today. By setting the situation, excess ocean and cash margin creates a domino effect between exchanges, creating volatility.

Key technical steps and what comes next

From a technical point of view, it is the first topic that the weak hands and the market has run away from, and this phenomenon is currently a high frequency in the entire blue chip cryptos, which are more possible points if they succeed.

Bitcoin is now pushing the extension to $95,000 and will continue to break through the next psychological test. In the year 2005 models over $3,550 A.M.

Looking ahead, traders will be primarily driven by the federal record meeting in 2018. If the “CME Feduatch tool” on October 29th, the “EME Feduatch tool” will block the possibility of “EME FERT”. Such activity may be needed to inject much-needed liquidity into the market and provide a short-term recovery. Until then, the market will remain more volatile.

Trust with the agreement

In the year From 2017 To ensure accuracy, transparency and reliability, each article is known in fact. Our review guidelines ensure unedited reviews when indicated by exchanges, platforms or tools. We strive to provide up-to-date information on everything Crypto and Countchant, from origins to industries.

Investment responsibility

All opinions and insights shared represent the market conditions of the author. Please do your own research before making any investment decisions. However, the author or publication is not responsible for your financial choices.

Sponsored and advertisements

Sponsored content and affiliate links may appear on our site. Ads are clearly marked, and our editorial content is completely independent from our advertising partners.