Does Bitcoin Need Global Liquidity to Reach $100,000?

The Federal Reserve instituted a 50-point rate cut, promising liquidity conditions for Bitcoin's price hike. However, risks abound in this drastic reduction, and crypto profits are not guaranteed.

Global money supply is likely to increase, but this may not equate to Bitcoin revenues.

Depreciation, Liquidity and Bitcoin

The Federal Reserve has decided on a 50-point rate cut, and bitcoin prices are soaring. Given these and broader market trends, many in the community expect a Bitcoin bull market.

However, price reductions alone cannot guarantee such favorable market conditions; Other factors are also important. The key to understanding all this is global liquidity.

At first glance, Bitcoin's price over the past few weeks seems tentative, slow, and indecisive. But on closer inspection, it's getting closer than ever. Raoul Pal, CEO and founder of Global Macro Investor, noted that this correlation was “close, very close” throughout 2024.

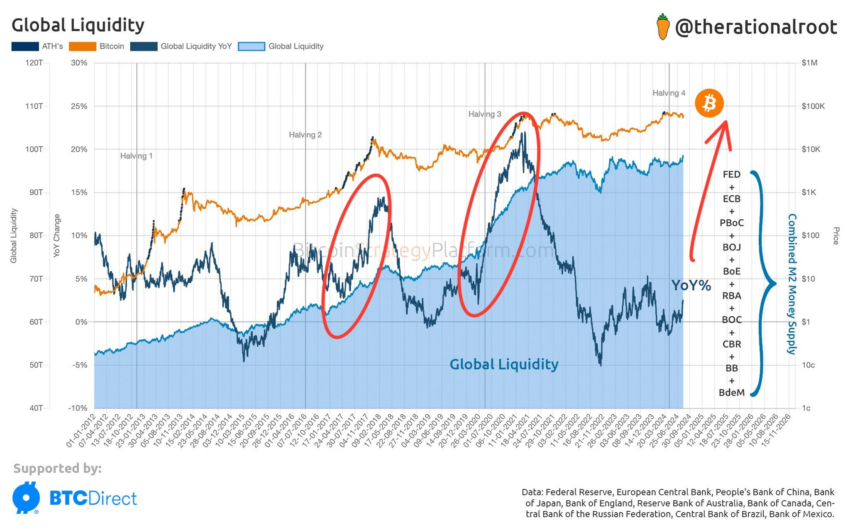

Compared to previous years' data on Global Liquidity (L2) and Bitcoin price, this year's closeness is remarkable.

Adrian Fritz, head of research at 21Shares, explained the relationship between the cut and liquidity in an exclusive interview with BeCrypto.

“The upcoming Fed rate cut may cause short-term Bitcoin price volatility. However, the size of the cut will play a critical role in shaping market reaction. A more aggressive 50 bps cut may provide short-term liquidity relief,” he added, with clear benefits for Bitcoin. He said.

A “more aggressive” reduction has taken place, and Bitcoin has already responded in kind. The dollar is the world's reserve currency, and a U.S. devaluation has positive effects on liquidity and market risks. Crypto provides invaluable liquidity to global markets, and this dynamic has only increased.

Quinten Francois, co-founder of WeRate, sees a trend towards increased liquidity, and Bitcoin will certainly benefit. Sounds easy, right?

Read more: Half a story of Bitcoin: Everything you need to know

Risks in the stock market

Horizen Labs CEO Rob Viglione discussed these dynamics with BeInCrypto. Like Fritz, he also expected a 25-point rate cut:

“Major price movements are rare as a 25 basis point cut is largely expected, but the direction of travel could be positive in the short term as investors move to volatile assets. Low interest rates support risk assets like Bitcoin as investors continue to seek higher returns outside of traditional investments.” It will continue, Viglione explained.

However, both underestimated the extent of these reductions. In the 25-point scenario, major price spikes have been rare, but cuts are more severe, Viglione said.

In other words, the market can be prepared for a big speed. There are also risks that could stand between Bitcoin and a bigger point.

“A 50-point decline could raise concerns about deeper economic challenges or a looming recession, which could lead to price declines. This is especially true given Bitcoin's recent failure to pass the $60,000 mark and September's historically weak performance for both Bitcoin and the broader markets.” It's important,” concludes Fritz.

Thankfully, Bitcoin has already broken $60,000. Bitcoin is perhaps wrongly seen as a risky asset, and lowering interest rates will benefit them. For now, it all seems reasonable to expect a price hike, provided investor confidence remains high. No one can predict the future, but we may see $100,000 worth of bitcoins sooner than we think.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.