Does Gold Record Want to Kill Bitcoin in Retail?

This week, but this week, but the golden area causes lines, but gold. From Singapore to Sydney, even Vietnam, and even from sunrise to sunrise, many are arriving in their killing.

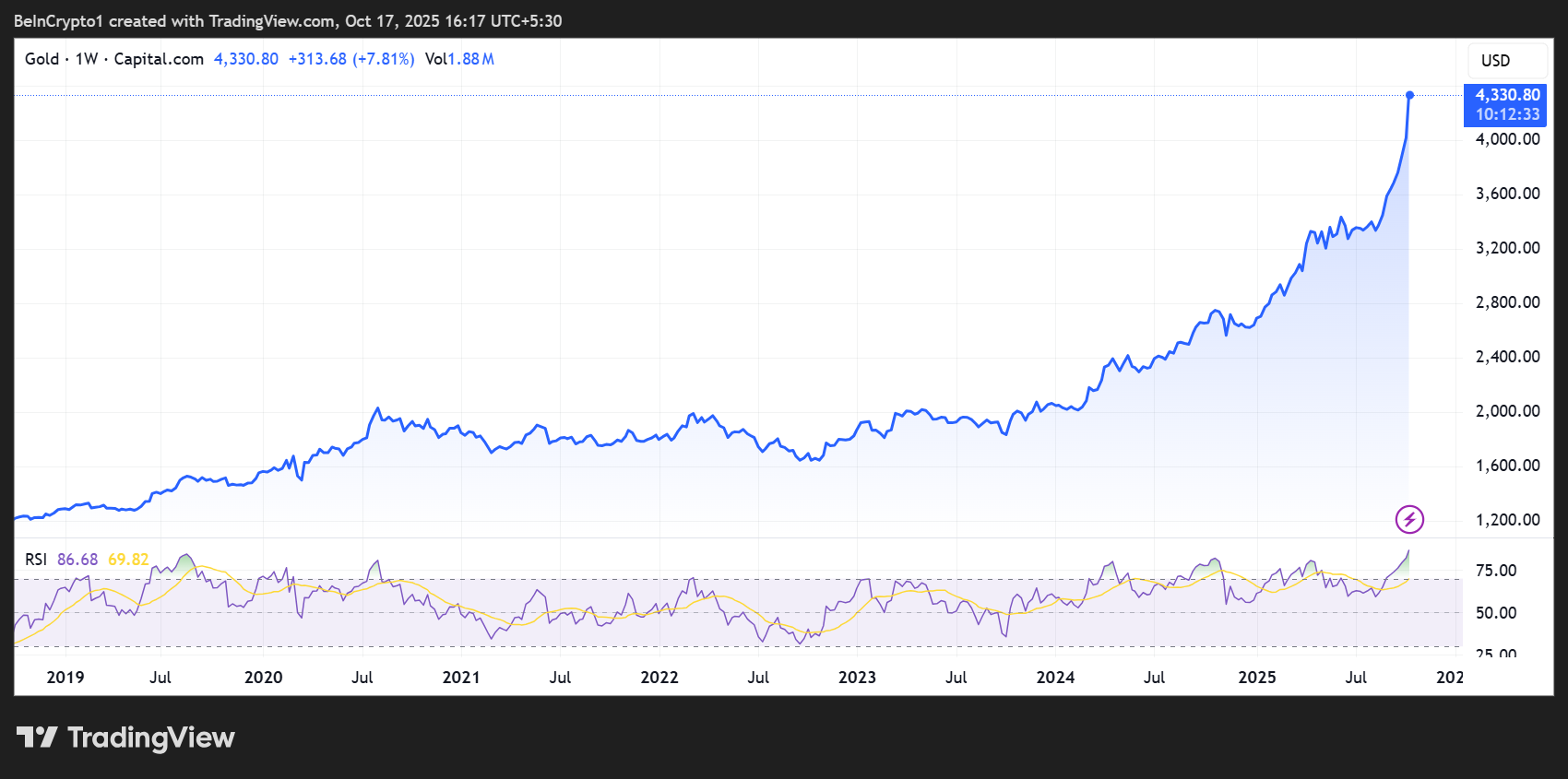

As bullion prices hit record highs and gold's total market capitalization surpasses $30 trillion, investors appear caught in a frenzy that analysts say could mark the asset's “macro top.” Meanwhile, Bitcoin fans are asking the same question: Is retail the next drive to digital gold?

Sponsored Sponsored

Gold Rush International: Retail Spot Papers' Entry Market Emipot

The reproduction was seen in a viral video from CulloPore after Blogostar, where customers raised their heads hours before the opening.

In other parts of the world, the scene is getting worse. The pictures from Sydney show the same lines outside of Sydney as they show the same lines outside of ABC. Some of these needs are reduced to silver, as the interest is distributed to special age brackets.

A Sydney said, “It's not just gold, there were a lot of young people over 2 hours old. A lot of people were a lot of young people in their 20s. A lot of young people were a lot of young people in their 20s.

In Vietnam, supporters have reported that people are protected from gold to buy gold. They announced that some gold shops in the country should not be sold.

Retail fears (missing fears) are forcing “sales seekers” to sell “missing” in some of the best gold systems in Vietnam.

Sponsored Sponsored

This “herd mentality” extends beyond Australia and Vietnam when people give it several hours. According to Janberg, Japan's top gold retailer says it can't keep up with demand.

“We're holding fast to solidify a stable supply for customers,” Bloomberg said.

The acquisition spree comes just months after Florida passed a golden rule. Governor Ron Wittens has repealed the bill to allow the initial payment of the statutory and sales tax on gold and silver coins starting in 2026.

However, as the FMO meets the ceiling, analysts call for caution. As retail psychology rarely changes, some may be caught when they leave.

Income metrics “soon become lines for people selling,” he wrote.

Sponsored Sponsored

Symbols of Pretoria and “top of the wind”

Market panic people are alarming about the mania. The merchant Lin called “Longevity in the teeth” “Peter's picnic [is] Insane growth rates and people are infected with buying disabled gold.

“I'm thinking, I'm thinking, I'm thinking,” he warned.

Other analysts say that when people freeze to buy physical gold when it is in the most expensive form to sell, they form signs of a great high.

As of this writing, gold is starting at $4,330, the highest rate in the entire period, the highest rate in the entire period.

Sponsored Sponsored

“What does this retail fruit look like?

Analysts are waiting for Bitcoin's ride

The movement of the metal parabolic comes when the market cap of gold cannot exceed 30.154 trillion dollars, making it the first asset in history to do so. However, according to many analysts, the disgrace of retail gold can turn into a mystery.

“The gold has now reached the epicurean level. We will see the bulls running in the 2nd part before the 29th, and then the bulls will run after the ash period.

At the same time, another popular analysis, Gilley started a new ride to digital gold.

However, such trends are indicative of the direction in the near future, and the macro uncertainty associated with President Trump can see the gold boom for a longer period of time, even for 2-5 years.