Dollar Index Reaches Dangerous Levels, Is Bitcoin Set To Rise?

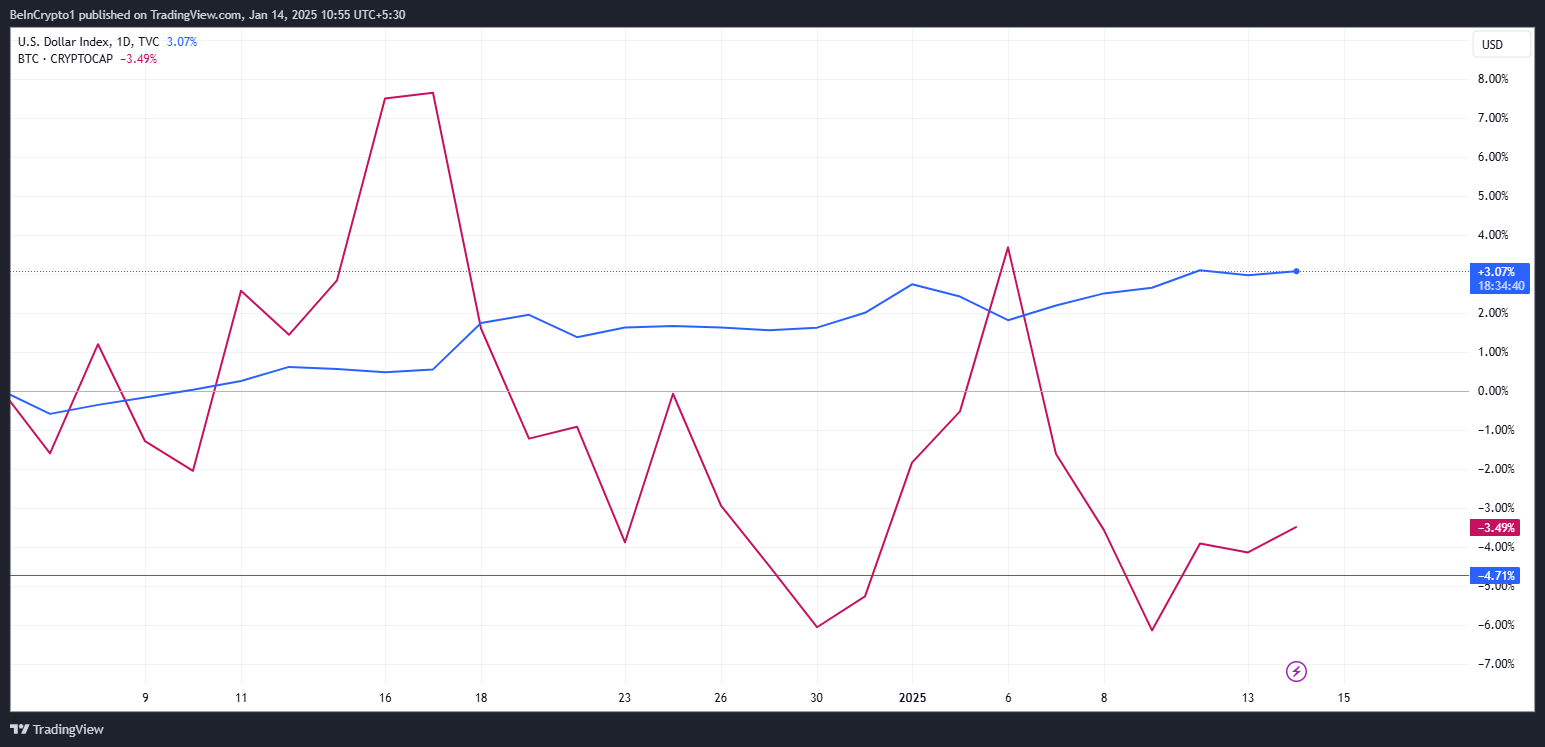

Bitcoin (BTC) fans will be closely watching the pioneer crypto's next move as the US dollar index (DXY) soared to a 26-month high of 110.

Historically, Bitcoin's performance has shown an inverse correlation with the DXY, leading to speculation that a critical period may be on the horizon for the digital asset.

Crypto experts sound the alarm when DXY rises to 110

Renowned crypto educator Quintin Francois discussed the historical significance of the DXY levels in a recent post. He also predicted that when DXY goes down, Bitcoin will go up, which will happen in 2025.

“Last time DXY was this high, BTC was at $20,000. Something big is happening,” he said.

The comments reflect excitement in the crypto community that the DXY rally will pave the way for Bitcoin to rally. Elsewhere, HZ, a crypto researcher, warned of broader risks associated with rising DXY.

“DXY is dangerous at 110. A few more points rise, and markets fall. A rising dollar will cause a global credit crunch, kill cash flows, erode earnings and crush emerging markets. If you are overwhelmed, you are standing at a trap door,” HZ warned.

Adding to the discussion, Financial analysis platform Barchart HaigIn the year He noted that hedge funds had the most pressure on the US dollar since the start of 2019. This sentiment reflects demand for the dollar as a safe haven amid ongoing global economic uncertainty.

Bitcoin and risk assets face key challenges

Meanwhile, market research firm Capital Hungry pointed out that the DXY's rise was partly driven by tariff fears. He also highlighted the importance of upcoming economic data for market direction.

“If we see lower PPI on Tuesday or neutral CPI on Wednesday, short-term internal highs in DXY, US stocks and risk assets could hold a bid,” Capital Hungry predicted.

This creates favorable conditions for Bitcoin to hold above $94,000 and rise to $99,000 in a short period of time. However, a higher-than-expected DXY could devalue this scenario, sending Bitcoin prices lower.

DXY's moves have significant implications beyond cryptocurrency. A stronger dollar could hurt emerging markets and global financial flows, potentially triggering an economic slowdown. On the flip side, any signs of easing in the DXY could provide relief to risk assets, including Bitcoin.

In August, the DXY hit its 2024 low in conjunction with Bitcoin's short rally. This reinforced the inverse relationship between the two properties. If the dollar index recovers from its current highs, analysts believe Bitcoin could make a renewed move higher.

The optimism of the crypto market is further bolstered by institutional developments. Capital Hunger highlighted BlackRock's newly launched BTC ETF (Exchange Traded Fund), which could significantly affect the direction of Bitcoin. The rise of traditional financial firms like BlackRock is seen as a major validation of Bitcoin's legitimacy and potential for mainstream adoption.

However, the crypto market remains at a crossroads, with Bitcoin's next major move likely to hinge on the direction of the DXY.

While the dollar index currently puts downward pressure on riskier assets, a reversal could pave the way for a rally in Bitcoin.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.