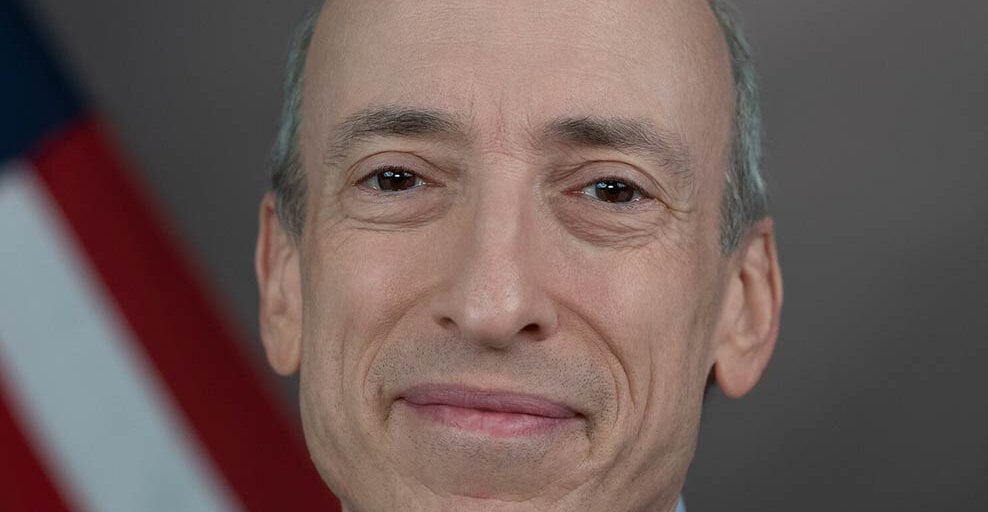

Don’t ‘AI Wash’ Investment Sites: SEC Chairman Gary Gensler

1 year ago Benito Santiago

Gary Gensler, chairman of the United States Securities and Exchange Commission, has again warned about artificial intelligence and how its rapid progress could affect financial markets.

“One shouldn't greenwash, and one shouldn't whitewash AI — I don't know how else to say it,” he said Wednesday at Messenger's “Balanced Innovation and Regulation” AI event in Washington, D.C. “If you're raising money from the public, offering and selling securities, you must come under the securities laws and provide full, fair and true information, and investors can decide.”

Greenwashing refers to making exaggerated or false claims about environmental, social and governance practices to make a project more attractive, also known as ESG. The SEC has previously warned that greenwashing could distract investors from realistic risks, rewards and asset prices.

Gensler says the hype around AI is turning the technology into a similar distraction.

“We are concerned about rigging and manipulating the markets on this macro issue,” he continued. I think it needs a lot of discussion around the world, not just financial regulators here.

Although generative AI can mimic human speech and writing style with surprising sophistication, he insists that there is a human behind the machine who has to answer for financial crimes committed by chatbots.

“I would say fraud is fraud, and if someone is using a model, they are defrauding the public; That person – as a matter of fact – can hear from us,” said Gensler. “Artificial intelligence as we now know it is still human in doubt.”

He even joked that human involvement may not always be possible.

“I don't know when we've reached the days of Sarah Connor,” he said, referring to the iconic character played by Linda Hamilton in the Terminator film franchise. But there are people who are putting in that AI model and putting in what are called hyperparameters, so there are still people who are responsible for that AI.

Gensler zeroed in on the risks of using AI in finance, pointing out that they could include personal biases and conflicts of interest in the training data for developers. Gensler warned that a lack of diversity in decision-making could lead to market instability and highlighted the dangers of relying on uniform or centralized data sets.

“If you have large segments of the market based on one data set, credit data,” Gensler said. “The damage could take us off the cliff.”

Although AI developers and significant investments in the space continue to grow, Gensler said that the number of AI models has been reduced to three main players, and we will see a fragmented data over time.

“This generally happens early in technology,” Gensler said. “So we end up with the three core foundations or models that everybody trusts because of the economics of the network… It's the AI supply chain.

“If you don't think about it, if you're a fintech startup, a community bank, a small asset manager, you can't build big models, you have to rely on somebody else's model,” he added. .

In September, Gensler added his name to the list of government officials who are concerned about the negative effects of generative AI, especially focusing on artificial intelligence created by AI. Gensler, who testified before the Senate Banking Committee, warned that deep falsification of AI poses a threat to financial markets, citing the SEC chairman's attempt to deregulate the US stock market as an example of deep falsification of AI.

“I think we have good laws, but these new technologies challenge those laws,” Gensler said. “If you're using AI and you're deep in the market, that's a real risk for the markets.”

Edited by Ryan Ozawa.sd