Due to the uncertainty of the market, the cost of the Bitcoin ETF reached 1.13 billion dollars

Over the past seven trading days, spot bitcoin (BTC) exchange-traded funds (ETFs) have seen massive inflows of around $1.13 billion.

This development has raised concerns among investors and traders about Bitcoin's stability and future direction.

Behind the Spot Bitcoin ETF Exit: Changes in Market Sentiment and Volatility

According to Soso Value data, the spot Bitcoin ETF recorded outflows from June 13 to June 24. Greyscale Bitcoin Trust (GBTC) and Fidelity Wise Origin Bitcoin Fund (FBTC) were the largest contributors to these significant outflows, with $90 million and $35 million in outflows since June 24.

Read more: What is a Bitcoin ETF?

The crypto research firm 10x Research highlights that the current ETF sell-off is in stark contrast to the bullish buying seen in February and March, the perception that Bitcoin was driving institutional adoption. In today's market, bearish sentiment reflects ETF selling, as institutions are likely to exit the market, strongly influencing market confidence and trading behavior.

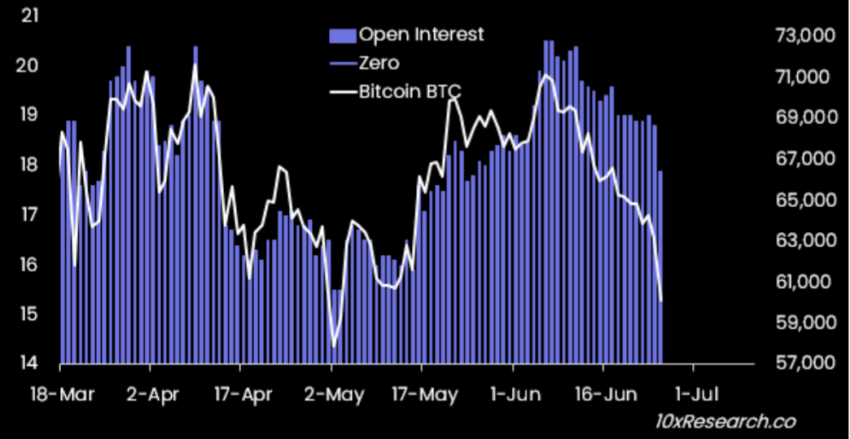

This shift is evident in the performance of many multi-strategy hedge funds. Previously short on Bitcoin ETFs and Chicago Mercantile Exchange (CME) Bitcoin futures, these funds are now unwinding their positions. This decision was reflected in the decline in interest in Bitcoin CME futures, which is in line with the sell-off of Bitcoin spot ETFs.

In addition, speculative trading in futures, led by institutional buying by ETFs, widened the volume of funds. The institutions adopted a delta-neutral strategy, buying ETFs and selling futures to lock in yield.

Arbitrage funds account for 30-40% of the $14.2 billion Bitcoin ETF's revenue, using a delta-neutral strategy of buying bitcoin in the past and selling the future. Current market conditions reflect a broader shift in institutional behavior and market sentiment, prompting a re-evaluation of this strategy.

Bitcoin ETF buyers flat out when the market price drops

Additionally, 10x Research has pointed to concerns about excessive bullishness regarding spot Ethereum ETFs, particularly weak Bitcoin ETF flows. This concern is compounded by the fact that the average Bitcoin ETF buyer is now flat, with an average entry price of $60,000-$61,000.

The continuous flow of these ETFs coincides with Bitcoin's current price movement. On June 24, the price of Bitcoin fell from $64,076 to $59,495, a decrease of approximately 7 percent. According to 10x Research, several factors contributed to this selloff, including Mt Gox distributions, German government sales, Bitcoin miners, EFF and OG wallets.

“Estimately, this will add up to $16-18 billion, which is the same as the year-to-date Bitcoin ETF revenues,” Markus Thielen from 10x Research pointed out.

10x Research has also identified several sell signals for Bitcoin. These signals include price range indicators that predict significant volatility and declines. These factors suggest that a deeper decline may occur before a rebound from lower levels.

However, 10x Research notes that Bitcoin is currently deeply oversold. Additionally, the Greed and Fear Index is one of the lowest levels, which often indicates market bottoms. This situation raises the sentiment of crypto influencers, which prompts them to recommend buying a dip.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Despite the high inflows from spot Bitcoin ETFs and the current BTC price situation, many institutional investors still show bullishness towards the cryptocurrency. Earlier this week, corporations such as MicroStrategy and Japanese company Metaplanet announced significant purchases of Bitcoin. There was also an increase in Bitcoin volume in Hong Kong spot Bitcoin ETFs, from 3,842 BTC on June 21 to 3,911 on June 24.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.